7675 N Walters Rd Fremont, IN 46737

Estimated Value: $630,000 - $866,000

5

Beds

4

Baths

5,160

Sq Ft

$143/Sq Ft

Est. Value

About This Home

This home is located at 7675 N Walters Rd, Fremont, IN 46737 and is currently estimated at $736,429, approximately $142 per square foot. 7675 N Walters Rd is a home located in Steuben County with nearby schools including Fremont Elementary School, Fremont Middle School, and Fremont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 18, 2011

Sold by

Southern Michigan Bank & Trust

Bought by

Erman Richard M and Erman Carol J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$272,000

Outstanding Balance

$185,946

Interest Rate

4.76%

Mortgage Type

New Conventional

Estimated Equity

$550,483

Purchase Details

Closed on

Oct 22, 2009

Sold by

Lewis R L Sheriff Of Stueben Coun

Bought by

Southern Michigan Bank & Trust Sou

Purchase Details

Closed on

Jul 18, 2007

Sold by

Mccue Daniel J and Mccue Donna R

Bought by

Leckner Michael S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$55,550

Interest Rate

6.73%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Erman Richard M | -- | None Available | |

| Southern Michigan Bank & Trust Sou | $50,000 | Bird Svendndsen Brothers Sch | |

| Leckner Michael S | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Erman Richard M | $272,000 | |

| Previous Owner | Leckner Michael S | $55,550 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,083 | $484,600 | $81,700 | $402,900 |

| 2023 | $2,041 | $467,000 | $76,400 | $390,600 |

| 2022 | $2,225 | $425,800 | $64,700 | $361,100 |

| 2021 | $1,949 | $376,100 | $57,000 | $319,100 |

| 2020 | $2,044 | $369,700 | $56,000 | $313,700 |

| 2019 | $1,897 | $339,700 | $56,000 | $283,700 |

| 2018 | $1,502 | $274,000 | $35,500 | $238,500 |

| 2017 | $1,314 | $242,800 | $35,500 | $207,300 |

| 2016 | $1,083 | $223,900 | $21,300 | $202,600 |

| 2014 | $1,053 | $249,000 | $49,500 | $199,500 |

| 2013 | $1,053 | $255,000 | $49,500 | $205,500 |

Source: Public Records

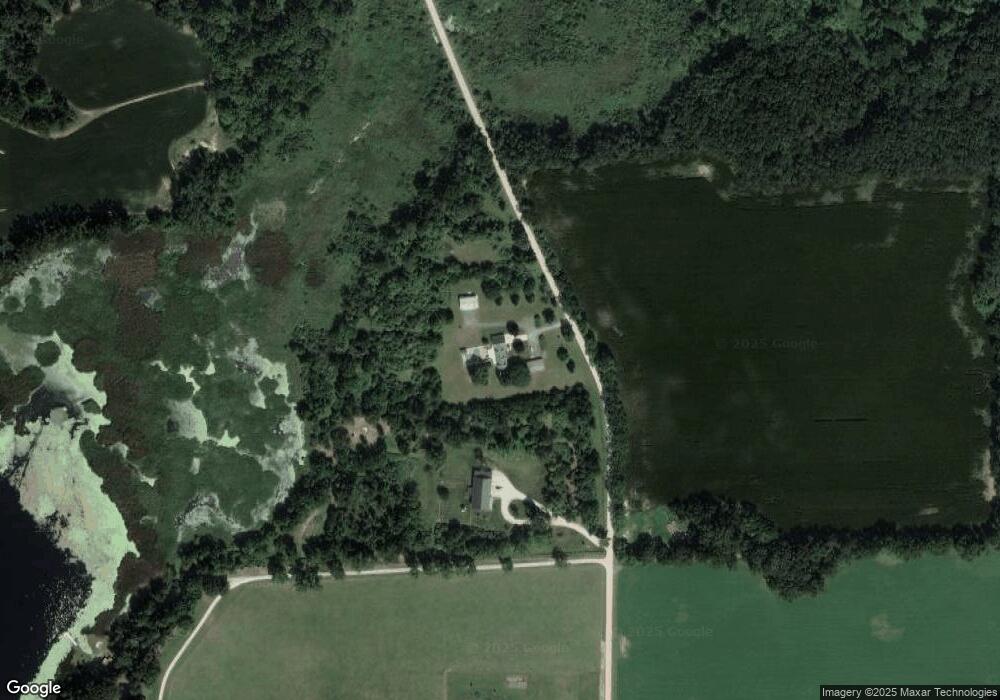

Map

Nearby Homes

- 815 Cherry Hill Ct

- 1000 Nicholas Trail

- 1001 Nicholas Trail

- 3217 E 700 N

- 406 Prairie Ln

- 7050 N van Guilder Rd

- 913 W Cora Ln

- 00 N 300 Rd E

- 6405 N 300 E

- 6540 N van Guilder Rd

- 603 W Follett Ln

- 380 Schaeffer Ct Fish Lake

- 50 Janedale Dr

- TBD Evans Dr

- 1000 W Toledo St

- 00 W Toledo St

- 115 355 Ln

- 919 Nature Ln

- 200 Michael St

- 916 Nature Ln