7680 Tremayne Place Unit 113 McLean, VA 22102

Tysons Corner NeighborhoodEstimated Value: $366,000 - $386,000

2

Beds

2

Baths

1,150

Sq Ft

$328/Sq Ft

Est. Value

About This Home

This home is located at 7680 Tremayne Place Unit 113, McLean, VA 22102 and is currently estimated at $376,964, approximately $327 per square foot. 7680 Tremayne Place Unit 113 is a home located in Fairfax County with nearby schools including Westgate Elementary School, Kilmer Middle School, and Marshall High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 27, 2025

Sold by

Friend Ada Carolina

Bought by

Ada Carolina Friend Revocable Trust and Friend

Current Estimated Value

Purchase Details

Closed on

Aug 31, 2010

Sold by

Houti Amina E

Bought by

Worthington Ada C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

4.57%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 15, 1999

Sold by

Alejandro Diane B

Bought by

El-Houti Amina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,000

Interest Rate

7.8%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ada Carolina Friend Revocable Trust | -- | None Listed On Document | |

| Ada Carolina Friend Revocable Trust | -- | None Listed On Document | |

| Worthington Ada C | $250,000 | -- | |

| El-Houti Amina | $95,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Worthington Ada C | $200,000 | |

| Previous Owner | El-Houti Amina | $75,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,891 | $354,130 | $71,000 | $283,130 |

| 2024 | $3,891 | $321,940 | $64,000 | $257,940 |

| 2023 | $3,613 | $306,610 | $61,000 | $245,610 |

| 2022 | $3,519 | $294,820 | $59,000 | $235,820 |

| 2021 | $3,797 | $310,340 | $62,000 | $248,340 |

| 2020 | $3,828 | $310,340 | $62,000 | $248,340 |

| 2019 | $3,486 | $282,640 | $51,000 | $231,640 |

| 2018 | $2,941 | $255,780 | $51,000 | $204,780 |

| 2017 | $3,025 | $249,790 | $50,000 | $199,790 |

| 2016 | $3,182 | $263,300 | $53,000 | $210,300 |

| 2015 | $3,133 | $268,670 | $54,000 | $214,670 |

| 2014 | $3,063 | $265,540 | $53,000 | $212,540 |

Source: Public Records

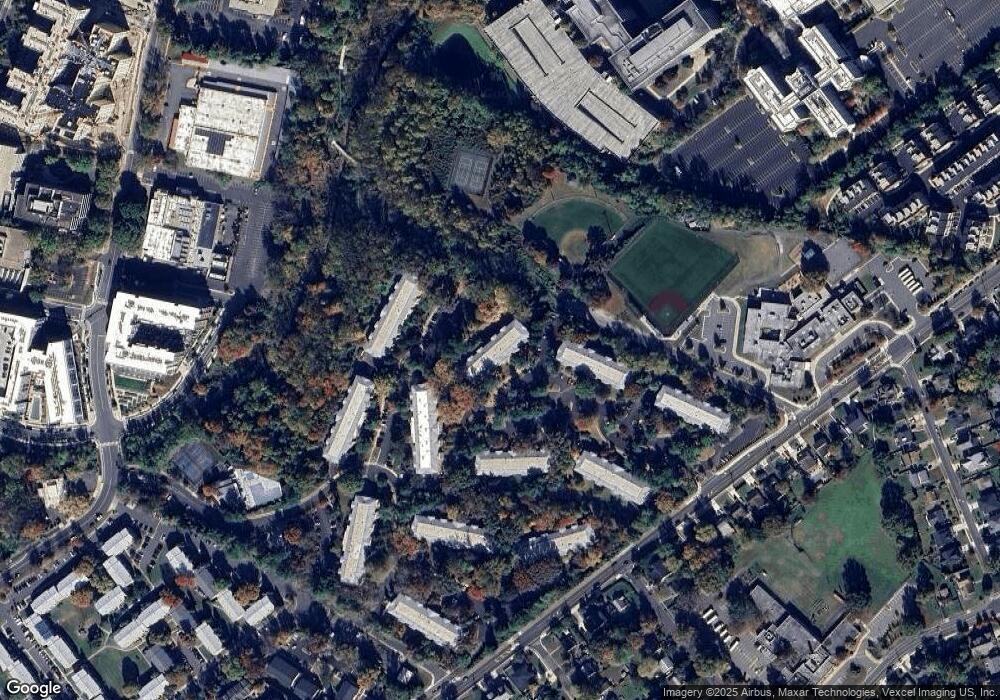

Map

Nearby Homes

- 7680 Tremayne Place Unit 308

- 7640 Tremayne Place Unit 202

- 7640 Provincial Dr Unit 214

- 7640 Provincial Dr Unit 204

- 7505 Magarity Rd

- 7585 Sawyer Farm Way Unit 904

- 7465 Backett Wood Terrace Unit 1215

- 7552 Sawyer Farm Way Unit 1405

- 1852 Griffith Rd

- 7509 Sawyer Farm Way Unit 2002

- 1800 Old Meadow Rd Unit 1121

- 1800 Old Meadow Rd Unit 1412

- 1800 Old Meadow Rd Unit 1415

- 1800 Old Meadow Rd Unit 1218

- 1800 Old Meadow Rd Unit 302

- 1800 Old Meadow Rd Unit 1215

- 1800 Old Meadow Rd Unit 1017

- 1800 Old Meadow Rd Unit 1204

- 1910 Cherri Dr

- 7703 Lunceford Ln

- 7680 Tremayne Place

- 7680 Tremayne Place Unit 309

- 7680 Tremayne Place Unit 110

- 7680 Tremayne Place Unit 311

- 7680 Tremayne Place Unit 310

- 7680 Tremayne Place Unit 211

- 7680 Tremayne Place Unit 305

- 7680 Tremayne Place Unit 103

- 7680 Tremayne Place Unit 304

- 7680 Tremayne Place Unit 313

- 7680 Tremayne Place Unit 201

- 7680 Tremayne Place Unit 101

- 7680 Tremayne Place Unit 210

- 7680 Tremayne Place Unit 112

- 7680 Tremayne Place Unit 111

- 7680 Tremayne Place Unit 312

- 7680 Tremayne Place Unit 108PS1

- 7680 Tremayne Place Unit 107

- 7680 Tremayne Place Unit 208

- 7680 Tremayne Place Unit 109