77 Greenleaf Dr Eagle Point, OR 97524

Estimated Value: $550,324 - $669,000

3

Beds

4

Baths

2,080

Sq Ft

$298/Sq Ft

Est. Value

About This Home

This home is located at 77 Greenleaf Dr, Eagle Point, OR 97524 and is currently estimated at $619,775, approximately $297 per square foot. 77 Greenleaf Dr is a home located in Jackson County with nearby schools including Eagle Point Middle School, White Mountain Middle School, and Eagle Point High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 23, 2006

Sold by

Simpson Scott D and Simpson Debbie J

Bought by

Andersen Marvin J and Andersen Michelle K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$381,600

Outstanding Balance

$213,000

Interest Rate

6.25%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$406,775

Purchase Details

Closed on

Mar 15, 1999

Sold by

Carl James

Bought by

Simpson Scott D and Simpson Debbie J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$105,200

Interest Rate

6.73%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Andersen Marvin J | $477,000 | Ticor Title | |

| Simpson Scott D | $70,500 | Crater Title Insurance |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Andersen Marvin J | $381,600 | |

| Previous Owner | Simpson Scott D | $105,200 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $2,828 | $257,321 | -- | -- |

| 2025 | $2,498 | $268,815 | $77,645 | $191,170 |

| 2024 | $2,498 | $220,469 | $75,489 | $144,980 |

| 2023 | $2,413 | $214,174 | $73,404 | $140,770 |

| 2022 | $2,352 | $214,174 | $73,404 | $140,770 |

| 2021 | $2,285 | $208,059 | $71,389 | $136,670 |

| 2020 | $2,482 | $202,124 | $69,424 | $132,700 |

| 2019 | $2,455 | $190,766 | $65,666 | $125,100 |

| 2018 | $2,402 | $185,333 | $63,873 | $121,460 |

| 2017 | $2,347 | $185,333 | $63,873 | $121,460 |

| 2016 | $2,289 | $174,938 | $60,428 | $114,510 |

| 2015 | $2,213 | $174,938 | $60,428 | $114,510 |

| 2014 | $2,151 | $165,134 | $57,184 | $107,950 |

Source: Public Records

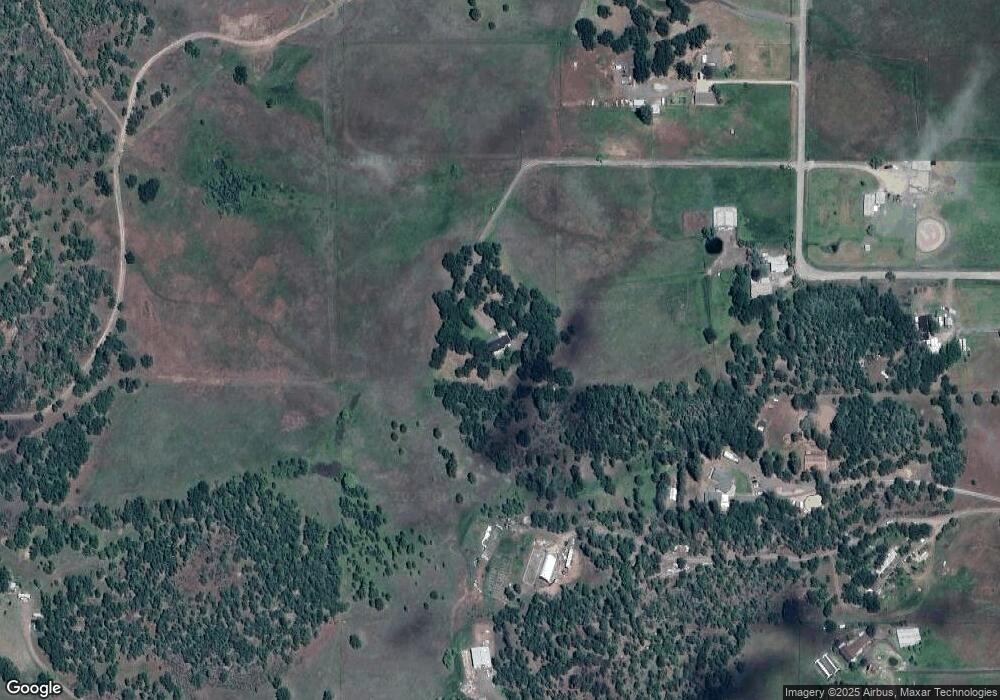

Map

Nearby Homes

- 0 Rogue River Dr Unit 220215041

- 506 Greenleaf Dr

- 0 Greenleaf Dr Unit 526832725

- 2900 Rogue River Dr

- 198 Flamingo Dr

- 510 Chateau Dr

- 0 Winnetka Rd

- 3399 Dodge Rd

- 110 Mcdonalds Way

- 17150 Antioch Rd

- 21 Brophy Way Unit 17

- 0 Antioch Rd Unit TL 407

- 0 Antioch Rd Unit TL 406

- 20055 Highway 62 Unit 49

- 363 Kitty Dr

- 13334 Modoc Rd

- 20140 Highway 62

- 20455 Highway 62

- 1305 Butte Falls Hwy

- 218 Long Branch Rd

- 1945 Rogue River Dr

- 11 Greenleaf Dr

- 115 Greenleaf Dr

- 155 Greenleaf Dr

- 108 Greenleaf Dr

- 1897 Rogue River Dr

- 1747 Rogue River Dr

- 1829 Rogue River Dr

- 421 Greenleaf Dr

- 0 Rogue River Dr Unit 100269102

- 0 Rogue River Dr Unit 100080407

- 0 Rogue River Dr Unit 100994842

- 0 Rogue River Dr Unit 100980282

- 0 Rogue River Dr Unit 100972025

- 0 Rogue River Dr Unit 100230401

- 0 Rogue River Dr Unit 100992538

- 0 Rogue River Dr Unit 100995284

- 0 Rogue River Dr Unit 100983985

- 0 Rogue River Dr Unit 100983411

- 0 Rogue River Dr Unit 100981516