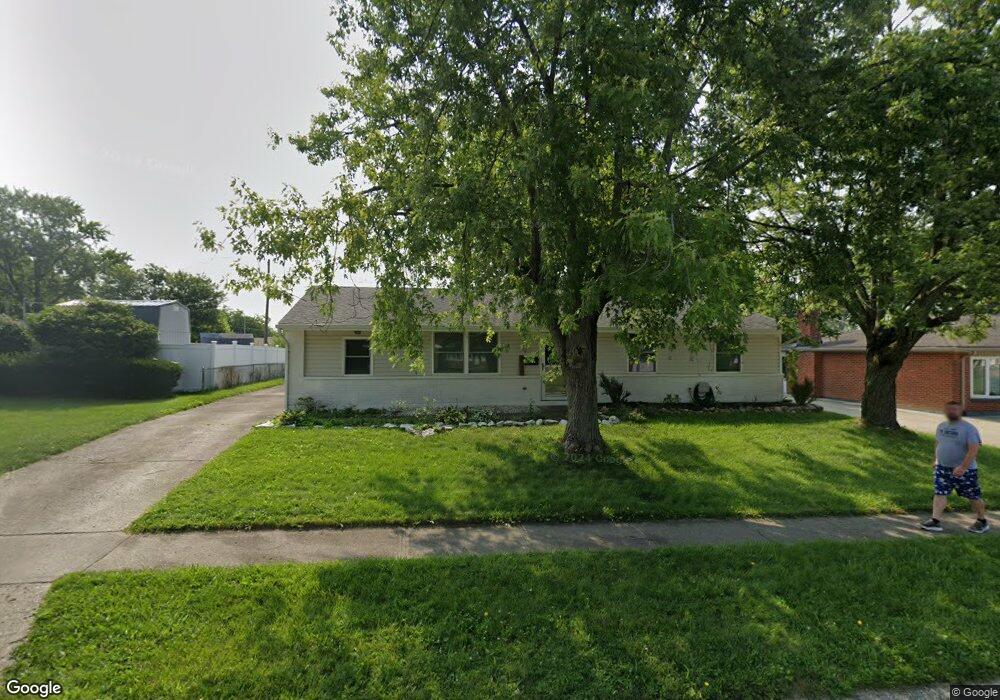

7730 Rothfield Dr Dayton, OH 45424

Estimated Value: $218,000 - $246,000

3

Beds

2

Baths

1,750

Sq Ft

$131/Sq Ft

Est. Value

About This Home

This home is located at 7730 Rothfield Dr, Dayton, OH 45424 and is currently estimated at $228,486, approximately $130 per square foot. 7730 Rothfield Dr is a home located in Montgomery County with nearby schools including Wayne High School and Huber Heights Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 28, 2017

Sold by

Miller David A and Miller Bernice A

Bought by

Santus Michael J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$107,079

Outstanding Balance

$91,383

Interest Rate

4.75%

Mortgage Type

FHA

Estimated Equity

$137,103

Purchase Details

Closed on

Apr 9, 2004

Sold by

Turner Daniel A and Turner Amy M

Bought by

Miller David A and Miller Bernice A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,600

Interest Rate

5.48%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 14, 2001

Sold by

Turner Clifton D and Turner Lorraine E

Bought by

Turner Ii Daniel A and Turner Amy M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$98,861

Interest Rate

6.87%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Santus Michael J | $109,100 | Springdale Title Llc | |

| Miller David A | $102,000 | -- | |

| Turner Ii Daniel A | $99,700 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Santus Michael J | $107,079 | |

| Previous Owner | Miller David A | $81,600 | |

| Previous Owner | Turner Ii Daniel A | $98,861 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,968 | $57,630 | $10,150 | $47,480 |

| 2023 | $2,968 | $57,630 | $10,150 | $47,480 |

| 2022 | $2,594 | $39,700 | $7,000 | $32,700 |

| 2021 | $2,632 | $39,700 | $7,000 | $32,700 |

| 2020 | $2,634 | $39,700 | $7,000 | $32,700 |

| 2019 | $2,483 | $33,060 | $7,000 | $26,060 |

| 2018 | $2,491 | $33,060 | $7,000 | $26,060 |

| 2017 | $2,474 | $33,060 | $7,000 | $26,060 |

| 2016 | $2,348 | $30,560 | $7,000 | $23,560 |

| 2015 | $2,318 | $30,560 | $7,000 | $23,560 |

| 2014 | $2,318 | $30,560 | $7,000 | $23,560 |

| 2012 | -- | $32,460 | $8,750 | $23,710 |

Source: Public Records

Map

Nearby Homes

- 6681 Spokane Dr

- 6701 Springport Way

- 7866 Harshmanville Rd

- 7854 Harshmanville Rd

- 7741 Shalamar Dr

- 6605 Highbury Rd

- 7371 Damascus Dr

- 7833 Harshmanville Rd

- 6447 Highbury Rd

- 7660 Stonecrest Dr

- 7611 Shepherdess Dr

- 8282 Briar Ridge Ct

- 6601 Grovehill Dr

- 6811 Highbury Rd

- 7011 Safari Dr

- 6150 Taylorsville Rd

- 6960 Serene Place

- 7150 Harshmanville Rd

- 7211 Stonehurst Dr

- 7221 Serpentine Dr

- 7720 Rothfield Dr

- 7750 Rothfield Dr

- 7729 Stonesboro Dr

- 7719 Stonesboro Dr

- 7710 Rothfield Dr

- 7770 Rothfield Dr

- 7731 Rothfield Dr

- 7721 Rothfield Dr

- 7741 Rothfield Dr

- 7711 Stonesboro Dr

- 7711 Rothfield Dr

- 7751 Rothfield Dr

- 7700 Rothfield Dr

- 7680 Stancrest Dr

- 7761 Rothfield Dr

- 7771 Rothfield Dr

- 7740 Remmick Ln

- 7750 Remmick Ln

- 7740 Stonesboro Dr

- 7701 Rothfield Dr