7733 East Point Dr Unit 57733 Findlay, OH 45840

Estimated Value: $279,113 - $294,000

2

Beds

2

Baths

1,733

Sq Ft

$166/Sq Ft

Est. Value

About This Home

This home is located at 7733 East Point Dr Unit 57733, Findlay, OH 45840 and is currently estimated at $288,028, approximately $166 per square foot. 7733 East Point Dr Unit 57733 is a home located in Hancock County with nearby schools including Van Buren Elementary School, Van Buren Middle School, and Van Buren High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 25, 2022

Sold by

Verhoff Tammy L

Bought by

Eugene W Verhoff And Tammy L Verhoff Revocabl

Current Estimated Value

Purchase Details

Closed on

Aug 17, 2021

Sold by

Kah Sharon K

Bought by

Verhuff Tammy

Purchase Details

Closed on

Aug 16, 2017

Sold by

Kah Sharyn K and Kah Kurt P

Bought by

Kah Sharyn K

Purchase Details

Closed on

May 7, 2015

Sold by

Wolford Bradley L and Wolford Susan D

Bought by

Kah Kurt P and Kah Sharyn K

Purchase Details

Closed on

Nov 5, 2004

Sold by

Acadia Point Development Inc

Bought by

Wolford Bradley L and Wolford Susan D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$85,000

Interest Rate

5.81%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Eugene W Verhoff And Tammy L Verhoff Revocabl | -- | -- | |

| Verhuff Tammy | $230,000 | Legacy Title | |

| Kah Sharyn K | -- | None Available | |

| Kah Kurt P | $185,000 | Mid Am Title | |

| Wolford Bradley L | $181,133 | Hancock Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wolford Bradley L | $85,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,283 | $71,040 | $3,680 | $67,360 |

| 2023 | $2,272 | $71,040 | $3,680 | $67,360 |

| 2022 | $2,273 | $71,040 | $3,680 | $67,360 |

| 2021 | $1,959 | $59,070 | $2,800 | $56,270 |

| 2020 | $1,957 | $59,070 | $2,800 | $56,270 |

| 2019 | $2,026 | $59,070 | $2,800 | $56,270 |

| 2018 | $1,910 | $54,900 | $2,800 | $52,100 |

| 2017 | $1,916 | $54,900 | $2,800 | $52,100 |

| 2016 | $1,869 | $54,900 | $2,800 | $52,100 |

| 2015 | $1,729 | $49,930 | $2,800 | $47,130 |

| 2014 | $1,686 | $49,930 | $2,800 | $47,130 |

| 2012 | $2,005 | $54,590 | $2,800 | $51,790 |

Source: Public Records

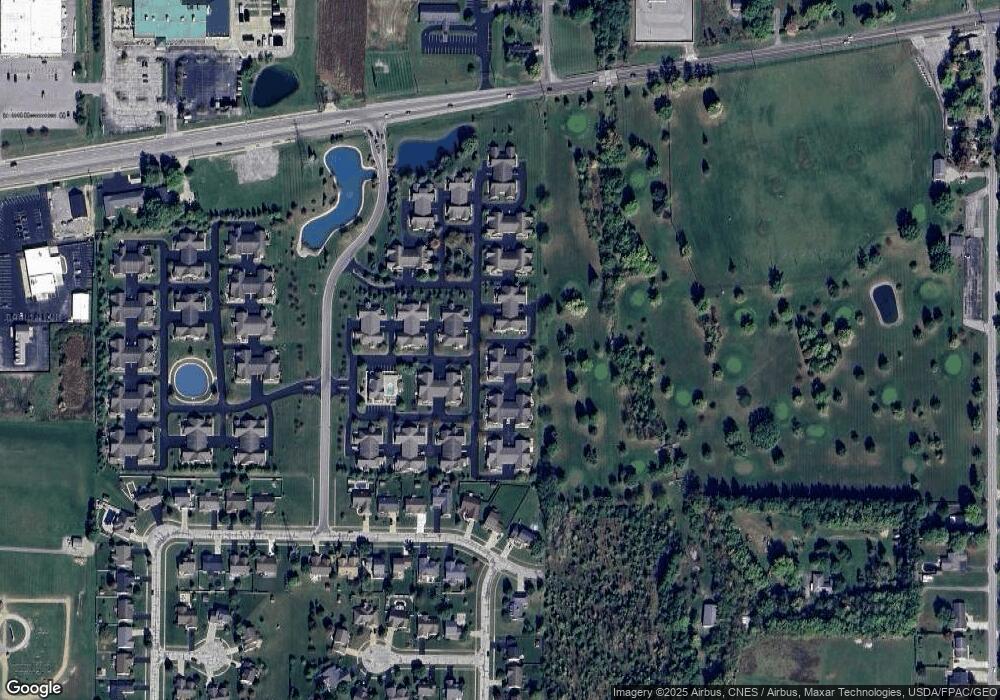

Map

Nearby Homes

- 15329 E Us Route 224

- 0 E Us Route 224

- 7712 E Watermark Dr

- 7507 Township Road 212

- 0 Meadowview Dr

- 665 Meadowview Dr

- 8419 E Woodland Trail

- 0 Hickory Ln Unit 6133896

- 0 Hickory Ln Unit 1 307878

- 0 Hickory Ln Unit 20252999

- 8457 Lakewood Dr

- 15680 Thornwood Dr

- 15711 Mahogany Trail

- 8405 Indian Lake Dr

- 16169 Forest Ln

- 6908 Township Road 212

- 8478 Indian Lake Dr

- 845 Fox Run Rd

- 456 Strathaven Dr

- 801 Fox Run Rd

- 7733 E Point Dr

- 7735 East Point Dr Unit 57735

- 15394 N Point Dr

- 7737 E Point Dr

- 7729 East Point Dr Unit 47729

- 7729 East Point Dr

- 7730 East Point Dr Unit 37730

- 7730 E Point Dr

- 7739 East Point Dr

- 7739 E Point Dr

- 15388 N Point Dr

- 7743 East Point Dr Unit 67743

- 7726 East Point Dr

- 7737 East Point Dr Unit 57737

- 15397 North Point Dr

- 7745 East Point Dr

- 7727 E Point Dr

- 15394 North Point Dr Unit 15394

- 7725 East Point Dr

- 7725 E Point Dr