7736 Main St Olmsted Falls, OH 44138

Estimated Value: $201,000 - $265,000

2

Beds

2

Baths

1,008

Sq Ft

$236/Sq Ft

Est. Value

About This Home

This home is located at 7736 Main St, Olmsted Falls, OH 44138 and is currently estimated at $237,850, approximately $235 per square foot. 7736 Main St is a home located in Cuyahoga County with nearby schools including Falls-Lenox Primary Elementary School, Olmsted Falls Intermediate Building, and Olmsted Falls Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 23, 2003

Sold by

Santoro Louis E

Bought by

Campbell Santoro Kelly D

Current Estimated Value

Purchase Details

Closed on

May 18, 1993

Sold by

Wagner Richard E

Bought by

Dandrea Michelle

Purchase Details

Closed on

Aug 7, 1987

Sold by

Halstead Gary and Halstead Suzanne

Bought by

Wagner Richard E

Purchase Details

Closed on

Sep 8, 1981

Sold by

Brodt Gary A

Bought by

Halstead Gary and Halstead Suzanne

Purchase Details

Closed on

Jan 1, 1975

Bought by

Brodt Gary A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Campbell Santoro Kelly D | -- | Millennium Title Agency Ltd | |

| Dandrea Michelle | $98,000 | -- | |

| Wagner Richard E | $73,000 | -- | |

| Halstead Gary | $58,000 | -- | |

| Brodt Gary A | -- | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,173 | $84,175 | $18,550 | $65,625 |

| 2023 | $5,363 | $58,700 | $19,010 | $39,690 |

| 2022 | $5,446 | $58,700 | $19,010 | $39,690 |

| 2021 | $4,837 | $58,700 | $19,010 | $39,690 |

| 2020 | $4,388 | $46,940 | $15,190 | $31,750 |

| 2019 | $3,902 | $134,100 | $43,400 | $90,700 |

| 2018 | $3,899 | $46,940 | $15,190 | $31,750 |

| 2017 | $3,891 | $43,300 | $14,560 | $28,740 |

| 2016 | $3,872 | $43,300 | $14,560 | $28,740 |

| 2015 | $3,849 | $43,300 | $14,560 | $28,740 |

| 2014 | $3,849 | $40,080 | $13,480 | $26,600 |

Source: Public Records

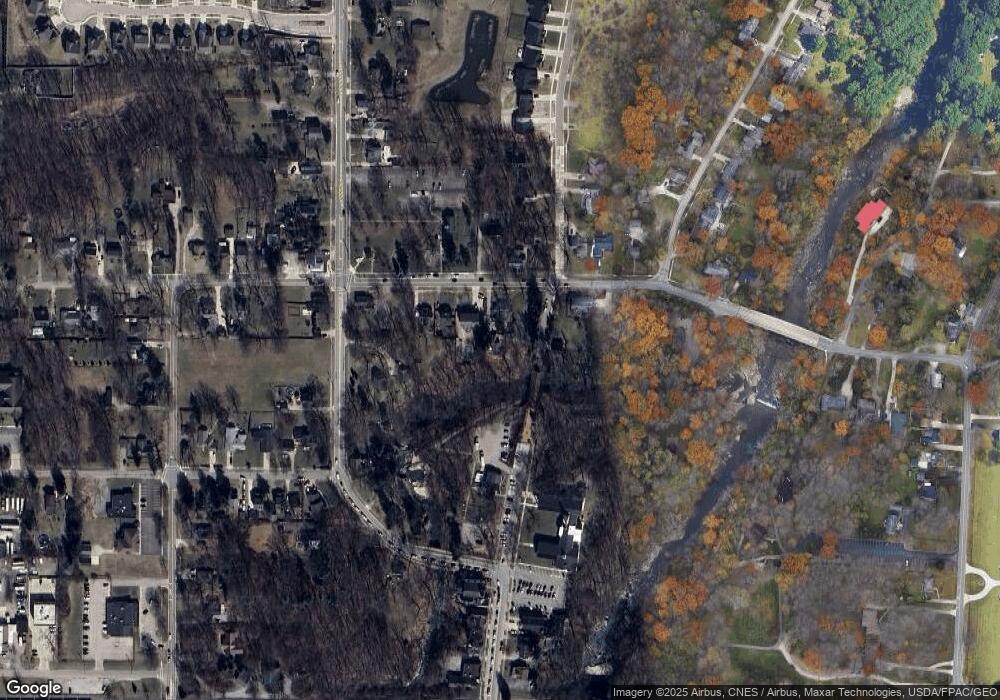

Map

Nearby Homes

- V/L Columbia Rd

- 281-12-024 River Rd

- 7593 Columbia Rd

- 281-12-007 River Rd

- 0

- 8241 Lewis Rd

- 5 Hawthorn Dr

- 0 River Rd Unit 5169658

- 121 Slippery Rock Ln

- 12 Maple Dr

- 11 Brookins Dr

- 1 Tympani Trail

- 3 Tympani Trail

- L 38 S Smokestack Trail

- 16 Van Ess Dr

- Anderson Plan at Smokestack Trails

- Bramante Ranch Plan at Smokestack Trails

- Hudson Plan at Smokestack Trails

- Columbia Plan at Smokestack Trails

- Lehigh Plan at Smokestack Trails

Your Personal Tour Guide

Ask me questions while you tour the home.