7755 Circle University Park, FL 34201

Estimated Value: $264,000 - $298,000

3

Beds

3

Baths

1,388

Sq Ft

$202/Sq Ft

Est. Value

About This Home

This home is located at 7755 Circle, University Park, FL 34201 and is currently estimated at $280,203, approximately $201 per square foot. 7755 Circle is a home located in Manatee County with nearby schools including Robert Willis Elementary School, Braden River Middle School, and Braden River High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 2, 2022

Sold by

Farouk Elnaas

Bought by

Rahwma Salwa

Current Estimated Value

Purchase Details

Closed on

Mar 6, 2020

Sold by

Willig John A and Willig Linda Stamm

Bought by

Elnaas Farouk

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$191,900

Interest Rate

3.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 12, 2006

Sold by

Dukette Robert and Dukette Sandy

Bought by

Willig John A and Willig Linda Stamm

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$199,000

Interest Rate

6.29%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 23, 2004

Sold by

Carolina Landings Inc

Bought by

Dukette Robert and Dukette Sandy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,654

Interest Rate

5.78%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rahwma Salwa | $186,000 | Berlin Patten Ebling Pllc | |

| Elnaas Farouk | $202,000 | Attorney | |

| Willig John A | $249,000 | Attorney | |

| Dukette Robert | $197,100 | Barnes Walker Title Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Elnaas Farouk | $191,900 | |

| Previous Owner | Willig John A | $199,000 | |

| Previous Owner | Dukette Robert | $157,654 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,270 | $255,000 | -- | $255,000 |

| 2024 | $4,270 | $276,250 | -- | $276,250 |

| 2023 | $4,219 | $267,750 | $0 | $267,750 |

| 2022 | $3,071 | $210,000 | $0 | $210,000 |

| 2021 | $2,567 | $159,000 | $0 | $159,000 |

| 2020 | $2,557 | $151,000 | $0 | $151,000 |

| 2019 | $2,562 | $151,000 | $0 | $151,000 |

| 2018 | $2,466 | $151,000 | $0 | $0 |

| 2017 | $2,210 | $146,500 | $0 | $0 |

| 2016 | $2,071 | $134,600 | $0 | $0 |

| 2015 | $1,712 | $123,500 | $0 | $0 |

| 2014 | $1,712 | $102,041 | $0 | $0 |

| 2013 | $1,509 | $84,507 | $1 | $84,506 |

Source: Public Records

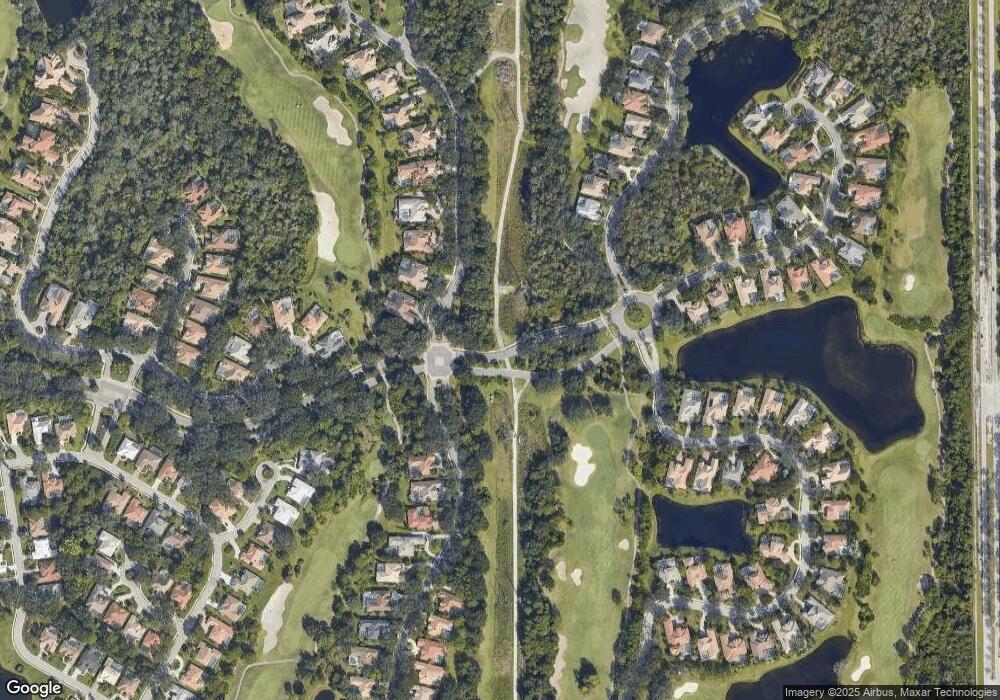

Map

Nearby Homes

- 7685 Plantation Cir Unit B

- 7596 Plantation Cir

- 7696 Plantation Cir Unit 7696

- 7560 Plantation Cir

- 7593 Plantation Cir Unit 7593

- 7580 Plantation Cir Unit 7580

- 8005 Warwick Gardens Ln

- 8073 Tybee Ct Unit 8073

- 8035 St Simons St Unit 8035

- 7914 Edmonston Cir

- 7804 Edmonston Cir

- 8105 Warwick Gardens Ln

- 7906 Ashley Cir Unit 4

- 8230 72nd St E Unit 133

- 8122 Spring Marsh Dr

- 7815 Ashley Cir

- 8324 72nd Ln E

- 8307 Planters Knoll Terrace

- 8125 Collingwood Ct

- 7276 83rd Dr E

- 7779 Circle

- 7731 Circle

- 7743 Circle

- 7753 Circle

- 7750 Plantation Cir Unit C

- 7750 Plantation Cir

- 7748 Plantation Cir

- 7752 Plantation Cir Unit 7752

- 7746 Plantation Cir Unit 7746

- 7744 Plantation Cir Unit 7744

- 7754 Plantation Cir

- 7758 Plantation Cir

- 7742 Plantation Cir

- 7792 Plantation Cir

- 7756 Plantation Cir

- 7756 Plantation Cir Unit 7756

- 7790 Plantation Cir Unit 7790

- 7796 Plantation Cir

- 7794 Plantation Cir

- 7794 Plantation Cir