7771 Bristol Park Dr Unit 7771 Tinley Park, IL 60477

Central Tinley Park NeighborhoodEstimated Value: $257,458 - $293,000

2

Beds

2

Baths

1,500

Sq Ft

$178/Sq Ft

Est. Value

About This Home

This home is located at 7771 Bristol Park Dr Unit 7771, Tinley Park, IL 60477 and is currently estimated at $267,615, approximately $178 per square foot. 7771 Bristol Park Dr Unit 7771 is a home located in Cook County with nearby schools including Millennium Elementary School, Virgil I Grissom Middle School, and Victor J Andrew High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 15, 2018

Sold by

Zopf William J and Zopf Maureen

Bought by

Regan Kathleen A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,000

Outstanding Balance

$109,261

Interest Rate

4.62%

Mortgage Type

New Conventional

Estimated Equity

$158,354

Purchase Details

Closed on

Aug 31, 2016

Sold by

Zopf Maureen and Rosemary Farkas Trust

Bought by

Zopf William J and Zopf Maureen

Purchase Details

Closed on

May 2, 2005

Sold by

Farkas Rosemary

Bought by

Farkas Rosemary and The Rosemary Farkas Trust

Purchase Details

Closed on

Dec 8, 2004

Sold by

Hester Nancy K

Bought by

Farkas Rosemary

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,800

Interest Rate

5.78%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 27, 1998

Sold by

State Bank Of Countryside

Bought by

Hester Nancy K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$113,000

Interest Rate

7.05%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Regan Kathleen A | $168,000 | Fidelity National Title | |

| Zopf William J | -- | Attorney | |

| Farkas Rosemary | -- | -- | |

| Farkas Rosemary | $181,000 | Pntn | |

| Hester Nancy K | $141,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Regan Kathleen A | $126,000 | |

| Previous Owner | Farkas Rosemary | $144,800 | |

| Previous Owner | Hester Nancy K | $113,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,078 | $18,005 | $1,453 | $16,552 |

| 2023 | $4,665 | $18,005 | $1,453 | $16,552 |

| 2022 | $4,665 | $16,507 | $627 | $15,880 |

| 2021 | $4,546 | $16,506 | $626 | $15,880 |

| 2020 | $4,505 | $16,506 | $626 | $15,880 |

| 2019 | $3,220 | $13,357 | $569 | $12,788 |

| 2018 | $4,239 | $13,357 | $569 | $12,788 |

| 2017 | $4,126 | $13,357 | $569 | $12,788 |

| 2016 | $2,240 | $6,743 | $512 | $6,231 |

| 2015 | $2,216 | $6,743 | $512 | $6,231 |

| 2014 | $762 | $6,743 | $512 | $6,231 |

| 2013 | $2,564 | $12,997 | $512 | $12,485 |

Source: Public Records

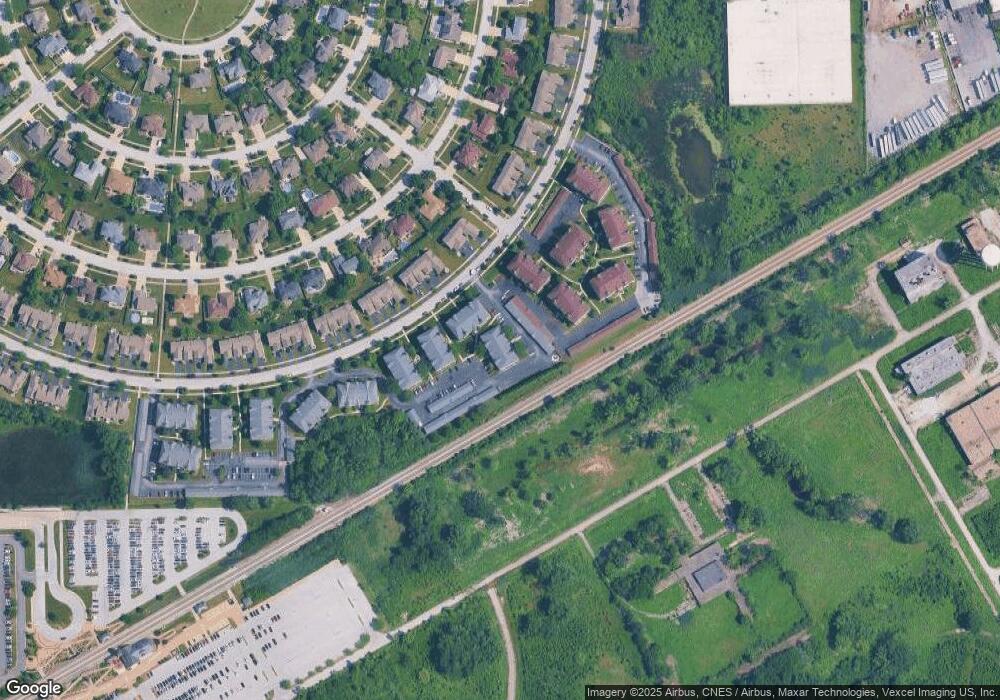

Map

Nearby Homes

- 7783 Bristol Park Dr Unit 1-SW

- 7841 Bristol Park Dr

- 7727 Bristol Park Dr

- 8036 Blarney Rd

- 7925 Belle Rive Ct

- 17800 Iroquois Trace

- 17908 Iroquois Trace

- 18001 S Harlem Ave

- 8030 Valley View Dr

- 18145 Harlem Ave

- 7278 173rd Place

- 17700 70th Ct

- 7912 172nd Place

- 7120 182nd St

- 18212 Glen Swilly Cir

- 17436 71st Ave

- 17116 Dooneen Ave

- 17377 71st Ave

- 8416 Stratford Dr Unit 8416

- 6839 179th St

- 7771 Bristol Park Dr Unit 1SW

- 7771 Bristol Park Dr Unit 2NE

- 7771 Bristol Park Dr Unit 3SW

- 7771 Bristol Park Dr Unit 7771

- 7771 Bristol Park Dr Unit 7771

- 7771 Bristol Park Dr Unit 7771

- 7771 Bristol Park Dr Unit 7771

- 7771 Bristol Park Dr Unit 7771

- 7771 Bristol Park Dr Unit 7771

- 7771 Bristol Park Dr Unit 7771

- 7771 Bristol Park Dr Unit 7771

- 7771 Bristol Park Dr Unit 7771

- 7771 Bristol Park Dr Unit 7771

- 7771 Bristol Park Dr Unit 7771

- 7771 Bristol Park Dr Unit 3NW

- 7771 Bristol Park Dr Unit 3SE

- 7771 Bristol Park Dr Unit 2SW

- 7771 Bristol Park Dr Unit 2SE

- 7775 Bristol Park Dr Unit 3NE

- 7775 Bristol Park Dr Unit 3SW