779 Cheyenne Dr Auburn, PA 17922

Estimated Value: $375,659 - $407,000

3

Beds

3

Baths

1,664

Sq Ft

$233/Sq Ft

Est. Value

About This Home

This home is located at 779 Cheyenne Dr, Auburn, PA 17922 and is currently estimated at $387,415, approximately $232 per square foot. 779 Cheyenne Dr is a home located in Schuylkill County with nearby schools including Schuylkill Haven Elementary Center, Schuylkill Haven Middle School, and Schuylkill Haven Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 20, 2021

Sold by

Kelly Bryan D and Kelly Cara A

Bought by

Kelly Bryan D and Kelly Cara A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$169,009

Outstanding Balance

$150,815

Interest Rate

2.7%

Mortgage Type

FHA

Estimated Equity

$236,600

Purchase Details

Closed on

Nov 23, 2016

Sold by

Line Barron and Line Jaymie

Bought by

Kelly Bryan D and Turolis Cara A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$181,623

Interest Rate

3.25%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 20, 2012

Sold by

Miller Justin M

Bought by

Line Jaymie and Line Barron

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$142,373

Interest Rate

3.62%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 9, 2012

Sold by

Miller Justin M and Miller Justin Michael

Bought by

Miller Justin M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kelly Bryan D | -- | None Available | |

| Kelly Bryan D | $185,000 | None Available | |

| Line Jaymie | $145,000 | None Available | |

| Miller Justin M | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kelly Bryan D | $169,009 | |

| Closed | Kelly Bryan D | $181,623 | |

| Previous Owner | Line Jaymie | $142,373 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,901 | $73,120 | $12,500 | $60,620 |

| 2024 | $4,488 | $73,120 | $12,500 | $60,620 |

| 2023 | $4,499 | $73,120 | $12,500 | $60,620 |

| 2022 | $4,350 | $73,120 | $12,500 | $60,620 |

| 2021 | $4,394 | $73,120 | $12,500 | $60,620 |

| 2020 | $4,394 | $73,120 | $12,500 | $60,620 |

| 2018 | $4,333 | $73,120 | $12,500 | $60,620 |

| 2017 | $4,155 | $73,120 | $12,500 | $60,620 |

| 2015 | -- | $73,120 | $12,500 | $60,620 |

| 2011 | -- | $3,265 | $0 | $0 |

Source: Public Records

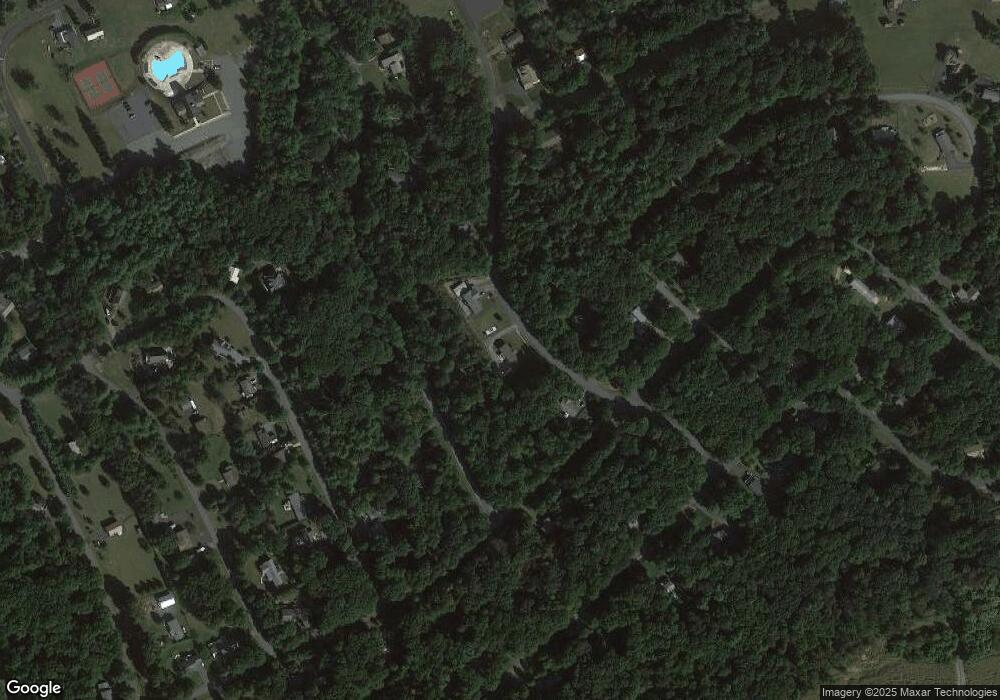

Map

Nearby Homes

- 2505 Wagonwheel Dr

- 2380 Cheyenne Dr

- 776 Cheyenne Dr

- 0 Cherokee Dr

- 2464 Papoose Dr

- 28 S Oak Ln

- 0 S Oak Ln

- 2522 Papoose Dr

- 595 Wynonah Dr

- 383 Tomahawk Dr

- 1462 Wynonah Dr

- 1949 Wynonah Dr

- 711 Stallion Dr

- 1482 Bearcat Cove

- 1494 Wynonah Dr

- 913 Wynonah Dr

- 906 Wynonah Dr

- 900 Wynonah Dr

- 287 Hogan Dr

- 288 Hogan Dr

- 779 Cheyenne Dr

- 787 Cherokee Dr

- 781 Cheyenne Dr

- 2381 Cheyenne Dr

- 777 Cheyenne Dr

- 777 Cheyenne Dr

- 2385 Cheyenne Dr

- 777 Cheyenne Dr

- 2560 Wagonwheel Dr

- 2387 Wagonwheel Dr

- 503 Cherokee Dr

- 782 Cheyenne Dr

- 2388 Crow Foot Dr

- 2513 Wagonwheel Dr

- 501 Cherokee Dr

- 2392 Crow Foot Dr

- 780 Cheyenne Dr

- 775 Cheyenne Dr

- 506 Cherokee Dr

- 2510 Wagonwheel Dr