7823 Calvert Ct Unit WW83 Dublin, OH 43016

Estimated Value: $779,000 - $991,000

4

Beds

4

Baths

3,235

Sq Ft

$265/Sq Ft

Est. Value

About This Home

This home is located at 7823 Calvert Ct Unit WW83, Dublin, OH 43016 and is currently estimated at $858,878, approximately $265 per square foot. 7823 Calvert Ct Unit WW83 is a home located in Franklin County with nearby schools including Albert Chapman Elementary School, Ann Simpson Davis Middle School, and Dublin Scioto High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 25, 2015

Sold by

Ferguson Mark R

Bought by

Dunn Ryan and Dunn Elise M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$383,404

Outstanding Balance

$297,697

Interest Rate

3.82%

Mortgage Type

New Conventional

Estimated Equity

$561,181

Purchase Details

Closed on

Mar 29, 2005

Sold by

Duffy Homes Inc

Bought by

Ferguson Mark R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$334,000

Interest Rate

4.62%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 17, 2004

Sold by

Wyandotte Woods Associates Llc

Bought by

Duffy Homes Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dunn Ryan | $479,300 | Landsel Title | |

| Ferguson Mark R | $534,000 | Title First | |

| Duffy Homes Inc | $88,000 | Title First |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dunn Ryan | $383,404 | |

| Previous Owner | Ferguson Mark R | $334,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $24,686 | $254,490 | $45,500 | $208,990 |

| 2023 | $16,305 | $254,485 | $45,500 | $208,985 |

| 2022 | $13,492 | $192,500 | $46,200 | $146,300 |

| 2021 | $13,525 | $192,500 | $46,200 | $146,300 |

| 2020 | $13,637 | $192,500 | $46,200 | $146,300 |

| 2019 | $14,797 | $184,730 | $42,000 | $142,730 |

| 2018 | $14,354 | $184,730 | $42,000 | $142,730 |

| 2017 | $13,076 | $184,730 | $42,000 | $142,730 |

| 2016 | $13,758 | $173,290 | $35,250 | $138,040 |

| 2015 | $13,847 | $173,290 | $35,250 | $138,040 |

| 2014 | $13,864 | $173,290 | $35,250 | $138,040 |

| 2013 | $6,718 | $165,025 | $33,565 | $131,460 |

Source: Public Records

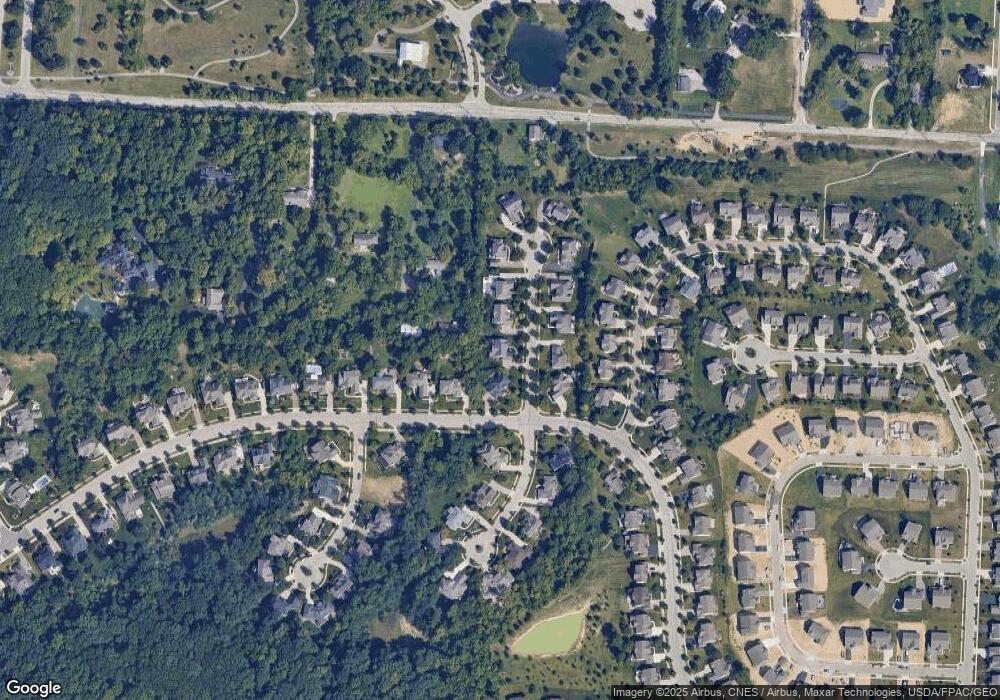

Map

Nearby Homes

- 8128 Conine Dr

- 4096 Wyandotte Woods Blvd

- 4329 Wyandotte Woods Blvd

- 7909 Melrue Ct

- 8151 Winchcombe Dr

- 3910 Summit View Rd

- 7841 Breen Cir

- 0 Arrowhead Rd

- 2734 Saltergate Dr Unit 2734

- 4650 Chatham Ct

- 4933 Emerald Lakes Blvd Unit 4903

- 2608 Sawmill Meadows Ave

- 2717 Summer Dr

- 7575 Riverside Dr

- 7746 Willowcove Ct

- 4844 Calloway Ct

- 7899 Sethwick Rd

- 2620 Cedar Lake Dr Unit 2620

- 8025 Inistork Dr

- 5175 Woodbridge Ave

- 7823 Calvert Ct

- 7831 Calvert Ct

- 7831 Calvert Ct Unit 84

- 7815 Calvert Ct

- 4240 Wyandotte Woods Blvd

- 4240 Wyandotte Woods Blvd Unit Lot 81

- 7824 Calvert Ct

- 7839 Calvert Ct

- 7839 Calvert Ct Unit L-85

- 7832 Calvert Ct

- 7832 Calvert Ct Unit L-91

- 7816 Calvert Ct

- 4248 Wyandotte Woods Blvd

- 7840 Calvert Ct

- 7840 Calvert Ct Unit 90

- 4231 Wyandotte Woods Blvd

- 7847 Calvert Ct

- 7847 Calvert Ct Unit WW86

- 7782 Kelly Dr

- 7790 Kelly Dr