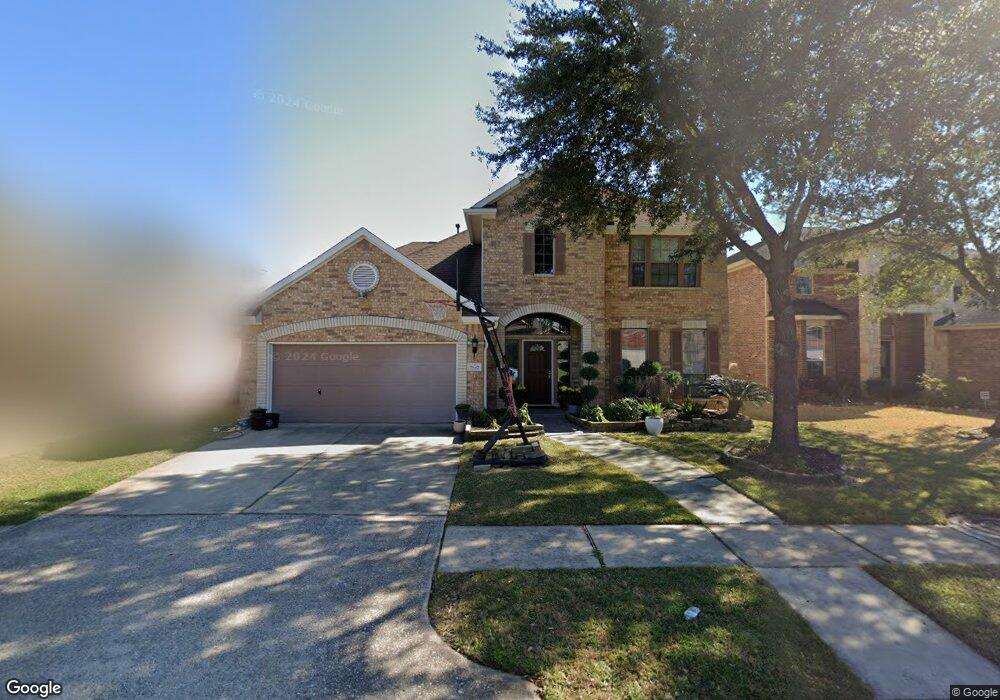

7842 Crystal Moon Dr Houston, TX 77040

North Houston NeighborhoodEstimated Value: $350,000 - $365,000

4

Beds

3

Baths

2,416

Sq Ft

$148/Sq Ft

Est. Value

About This Home

This home is located at 7842 Crystal Moon Dr, Houston, TX 77040 and is currently estimated at $357,576, approximately $148 per square foot. 7842 Crystal Moon Dr is a home located in Harris County with nearby schools including Reed Elementary School, Dean Middle School, and Jersey Village High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 18, 2005

Sold by

Darling Homes Of Houston Ltd

Bought by

Pham Hang Thi and Nguyen Loc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$147,192

Outstanding Balance

$78,436

Interest Rate

5.69%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$279,140

Purchase Details

Closed on

Jun 5, 2005

Sold by

Sowell Interests Terrace Lp

Bought by

Darling Homes Of Houston Ltd

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$153,000

Interest Rate

5.79%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pham Hang Thi | -- | Stewart Title Houston | |

| Darling Homes Of Houston Ltd | -- | Stewart Title Co Houston |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Pham Hang Thi | $147,192 | |

| Previous Owner | Darling Homes Of Houston Ltd | $153,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,402 | $354,508 | $54,480 | $300,028 |

| 2024 | $6,402 | $378,315 | $54,480 | $323,835 |

| 2023 | $6,402 | $366,683 | $54,480 | $312,203 |

| 2022 | $7,901 | $341,852 | $49,644 | $292,208 |

| 2021 | $7,562 | $265,233 | $49,644 | $215,589 |

| 2020 | $7,449 | $253,865 | $35,460 | $218,405 |

| 2019 | $7,081 | $233,243 | $32,881 | $200,362 |

| 2018 | $2,327 | $233,243 | $32,881 | $200,362 |

| 2017 | $7,242 | $233,243 | $32,881 | $200,362 |

| 2016 | $6,584 | $219,827 | $32,881 | $186,946 |

| 2015 | $4,912 | $214,889 | $32,881 | $182,008 |

| 2014 | $4,912 | $179,564 | $32,881 | $146,683 |

Source: Public Records

Map

Nearby Homes

- 8115 Oahu Ct

- 8315 Whisper Point Dr

- 8202 Terrace Brook Dr

- 8403 Cienna Dr

- 8315 Terrace Brook Dr

- 7823 Redlands Dr

- 8006 Summer Trail Dr

- 7926 Westington Ln

- 7915 Corrian Park Cir

- 8418 Westnut Ln

- 10515 Ince Ln

- 8331 Westbank Ave

- 7706 Cloverlake Ct

- 7802 Percussion Place

- 8126 Ivan Reid Dr

- 8715 Andante Dr

- 8111 Ivan Reid Dr

- 6508 Redcliff Rd

- 8131 Debbie Gay Dr

- 7727 Log Hollow Dr

- 7838 Crystal Moon Dr

- 7834 Crystal Moon Dr

- 7847 Redland Woods Dr

- 7851 Redland Woods Dr

- 7843 Redland Woods Dr

- 7903 Crystal Moon Dr

- 7903 Redland Woods Dr

- 7839 Redland Woods Dr

- 7906 Crystal Moon Dr

- 7830 Crystal Moon Dr

- 7843 Crystal Moon Dr

- 7847 Crystal Moon Dr

- 7839 Crystal Moon Dr

- 7907 Redland Woods Dr

- 7835 Redland Woods Dr

- 7835 Crystal Moon Dr

- 7910 Crystal Moon Dr

- 7826 Crystal Moon Dr

- 7907 Crystal Moon Dr

- 7831 Redland Woods Dr