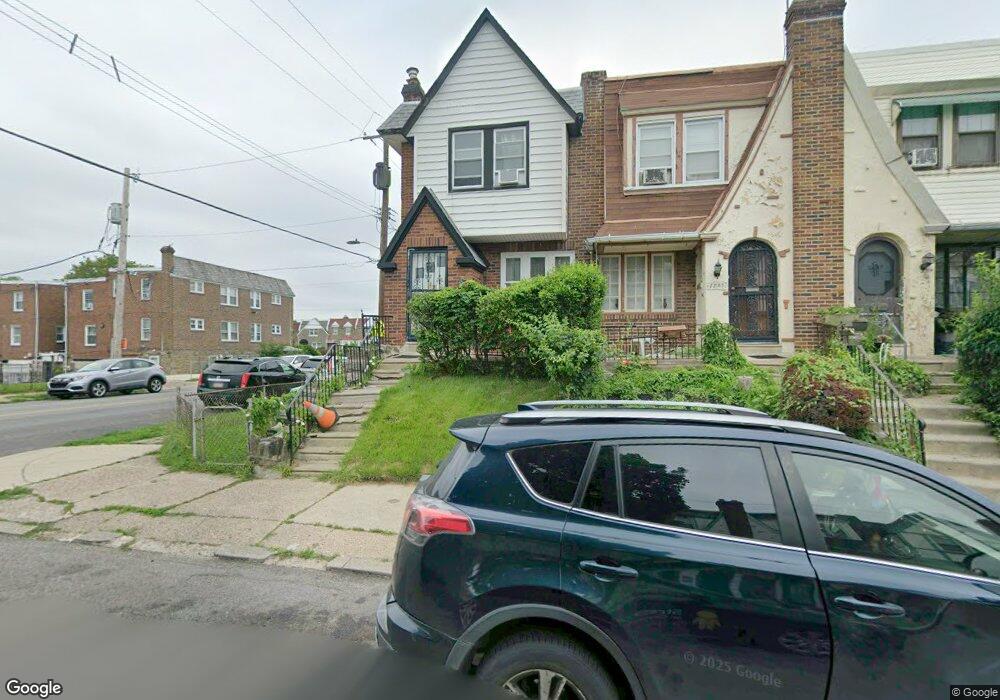

7855 Temple Rd Philadelphia, PA 19150

West Oak Lane NeighborhoodEstimated Value: $168,000 - $211,838

3

Beds

1

Bath

1,050

Sq Ft

$185/Sq Ft

Est. Value

About This Home

This home is located at 7855 Temple Rd, Philadelphia, PA 19150 and is currently estimated at $194,210, approximately $184 per square foot. 7855 Temple Rd is a home located in Philadelphia County with nearby schools including Franklin S Edmonds School, Martin Luther King High School, and St. Raymond Of Penafort Catholic School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 31, 2019

Sold by

Melton Theodora Dona and Melton Arnold T

Bought by

Hopkins Kylee

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,061

Outstanding Balance

$103,344

Interest Rate

5.75%

Mortgage Type

FHA

Estimated Equity

$90,866

Purchase Details

Closed on

Nov 28, 2005

Sold by

Rudden Thomas M and Rudden Guilit S

Bought by

Pierce Guy C and Jacquinto James M

Purchase Details

Closed on

Oct 14, 2002

Sold by

R & K Realty Enterprises Llc

Bought by

Rudden Thomas M and Rudden Guilit S

Purchase Details

Closed on

Sep 5, 2002

Sold by

Freedman Jeff and Will Of Beatrice Freedman

Bought by

R & K Realty Enterprises Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hopkins Kylee | $118,000 | Sovereign Search & Abstract | |

| Pierce Guy C | $68,000 | None Available | |

| Rudden Thomas M | $52,000 | -- | |

| R & K Realty Enterprises Llc | $33,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hopkins Kylee | $114,061 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,093 | $180,800 | $36,160 | $144,640 |

| 2024 | $2,093 | $180,800 | $36,160 | $144,640 |

| 2023 | $2,093 | $149,500 | $29,900 | $119,600 |

| 2022 | $1,400 | $149,500 | $29,900 | $119,600 |

| 2021 | $1,400 | $0 | $0 | $0 |

| 2020 | $1,400 | $0 | $0 | $0 |

| 2019 | $1,461 | $0 | $0 | $0 |

| 2018 | $0 | $0 | $0 | $0 |

| 2017 | $1,572 | $0 | $0 | $0 |

| 2016 | $1,557 | $0 | $0 | $0 |

| 2015 | $1,505 | $0 | $0 | $0 |

| 2014 | -- | $112,300 | $6,938 | $105,362 |

| 2012 | -- | $16,896 | $1,416 | $15,480 |

Source: Public Records

Map

Nearby Homes

- 7919 Michener Ave

- 7824 Fayette St

- 7945 Provident St

- 7849 Provident St

- 7837 Williams Ave

- 7837 Provident St

- 7734 Temple Rd

- 7729 Temple Rd

- 7968 Fayette St

- 7723 Temple Rd

- 7724 Fayette St

- 7712 Temple Rd

- 7827 Argus Rd

- 7945 Limekiln Pike

- 8016 Michener Ave

- 7925 Cedarbrook Ave

- 2467 79th Ave

- 2459 79th Ave

- 1312 E Sharpnack St

- 7638 Fayette St

- 7853 Temple Rd

- 7851 Temple Rd

- 7849 Temple Rd

- 7847 Temple Rd

- 7850 Michener Ave

- 7848 Michener Ave

- 7845 Temple Rd

- 7846 Michener Ave

- 83057 Michener Ave Unit D

- 7844 Michener Ave

- 7843 Temple Rd

- 7901 Temple Rd

- 7842 Michener Ave

- 7840 Michener Ave

- 7841 Temple Rd

- 7900 Michener Ave

- 7900 Michener Ave Unit 2

- 7900 Michener Ave Unit 1

- 7900 Michener Ave

- 7854 Temple Rd