7859 Malton Ln Unit 13F Columbus, OH 43085

Slate Hill NeighborhoodEstimated Value: $229,260 - $298,000

3

Beds

2

Baths

1,222

Sq Ft

$214/Sq Ft

Est. Value

About This Home

This home is located at 7859 Malton Ln Unit 13F, Columbus, OH 43085 and is currently estimated at $261,315, approximately $213 per square foot. 7859 Malton Ln Unit 13F is a home located in Franklin County with nearby schools including Slate Hill Elementary School, Worthingway Middle School, and Thomas Worthington High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 20, 2008

Sold by

Miller Judee M

Bought by

Schneider Derya A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$116,578

Outstanding Balance

$74,021

Interest Rate

5.93%

Mortgage Type

FHA

Estimated Equity

$187,294

Purchase Details

Closed on

Dec 21, 1994

Sold by

Traxler Ann M

Bought by

Thompson Michael N and Thompson Cynthia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$66,500

Interest Rate

9.19%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 2, 1990

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Schneider Derya A | $117,500 | Worthington | |

| Thompson Michael N | $70,000 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Schneider Derya A | $116,578 | |

| Previous Owner | Thompson Michael N | $66,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,825 | $62,300 | $14,350 | $47,950 |

| 2023 | $3,658 | $62,300 | $14,350 | $47,950 |

| 2022 | $3,387 | $45,780 | $5,460 | $40,320 |

| 2021 | $3,125 | $45,780 | $5,460 | $40,320 |

| 2020 | $3,010 | $45,780 | $5,460 | $40,320 |

| 2019 | $2,566 | $35,210 | $4,200 | $31,010 |

| 2018 | $2,151 | $35,210 | $4,200 | $31,010 |

| 2017 | $2,058 | $35,210 | $4,200 | $31,010 |

| 2016 | $1,817 | $25,590 | $4,170 | $21,420 |

| 2015 | $1,817 | $25,590 | $4,170 | $21,420 |

| 2014 | $1,817 | $25,590 | $4,170 | $21,420 |

| 2013 | $1,063 | $30,100 | $4,900 | $25,200 |

Source: Public Records

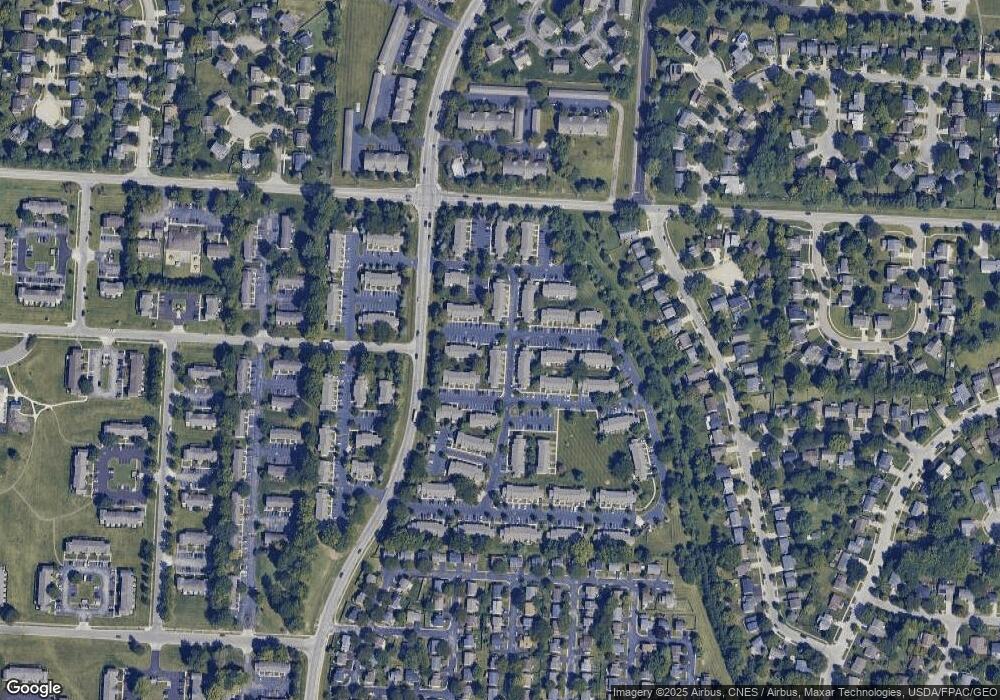

Map

Nearby Homes

- 874 Charnwood Ln Unit 5D

- 7850 Malton Ln Unit 14E

- 7685 Whitneyway Dr Unit 17

- 889 Pelham Ct

- 7697 Barkwood Dr Unit 1D

- 7634 Kelvinway Dr Unit 150

- 7981 Oakwind Ct

- 910 Annagladys Dr Unit G2

- 796 Timber Way Dr Unit 15B

- 7916 Sudeley Ct

- 696 Keys View Ct Unit 77

- 716 Alta View Ct Unit 33

- 737 Plant Dr Unit 2-C

- 580 Mawyer Dr Unit 132

- 1212 Tillicum Dr

- 1090 Landings Loop Unit 36

- 7852 Heathcock Ct

- 7415 Cayman Ln Unit 7415

- 1291 Worthington Creek Dr Unit 7

- 7416 Sancus Blvd

- 7857 Malton Ln

- 7855 Malton Ln

- 7855 Malton Ln Unit 13D

- 7853 Malton Ln Unit 13C

- 7858 Malton Ln Unit 14A

- 7851 Malton Ln Unit 13B

- 877 Charnwood Ln Unit 11A

- 875 Charnwood Ln Unit 11B

- 7856 Malton Ln Unit 14B

- 7854 Malton Ln

- 7854 Malton Ln Unit 14C

- 7849 Malton Ln Unit 13A

- 7852 Malton Ln

- 7852 Malton Ln Unit 14D

- 7873 Malton Ln Unit 6B

- 7871 Malton Ln Unit 6A

- 873 Charnwood Ln

- 876 Upholland Ln Unit 12F

- 7848 Malton Ln

- 7848 Malton Ln Unit 14F