7883 S 442 Rd Locust Grove, OK 74352

Estimated Value: $193,000 - $319,000

3

Beds

3

Baths

1,955

Sq Ft

$135/Sq Ft

Est. Value

About This Home

This home is located at 7883 S 442 Rd, Locust Grove, OK 74352 and is currently estimated at $263,907, approximately $134 per square foot. 7883 S 442 Rd is a home located in Mayes County with nearby schools including Locust Grove Early Lrning Center, Locust Grove Upper Elementary School, and Locust Grove Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 5, 2025

Sold by

Brown Dana

Bought by

Brown Dana and Brown Meagan

Current Estimated Value

Purchase Details

Closed on

Nov 17, 2008

Sold by

Saffell W Clay and Saffell Stacy D

Bought by

Brown Ed and Brown Dana

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$51,952

Interest Rate

8.25%

Mortgage Type

Unknown

Purchase Details

Closed on

Aug 1, 2008

Sold by

Arnold Stanley and Arnold Juanita

Bought by

Saffell W Clay and Saffell Stacy D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$66,500

Interest Rate

6.4%

Mortgage Type

Unknown

Purchase Details

Closed on

May 14, 1997

Sold by

Wilcox Dennis

Bought by

Qualls Daniel

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brown Dana | -- | None Listed On Document | |

| Brown Ed | $70,000 | None Available | |

| Saffell W Clay | $42,500 | None Available | |

| Qualls Daniel | $80,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Brown Ed | $51,952 | |

| Previous Owner | Saffell W Clay | $66,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $715 | $8,953 | $2,918 | $6,035 |

| 2024 | $715 | $8,692 | $2,833 | $5,859 |

| 2023 | $715 | $8,440 | $2,815 | $5,625 |

| 2022 | $649 | $8,194 | $2,800 | $5,394 |

| 2021 | $641 | $7,955 | $2,800 | $5,155 |

| 2020 | $735 | $8,857 | $3,780 | $5,077 |

| 2019 | $795 | $9,491 | $1,595 | $7,896 |

| 2018 | $811 | $9,491 | $1,595 | $7,896 |

| 2017 | $811 | $9,491 | $1,595 | $7,896 |

| 2016 | $792 | $9,491 | $1,595 | $7,896 |

| 2015 | $710 | $8,371 | $1,595 | $6,776 |

| 2014 | $694 | $8,204 | $1,428 | $6,776 |

Source: Public Records

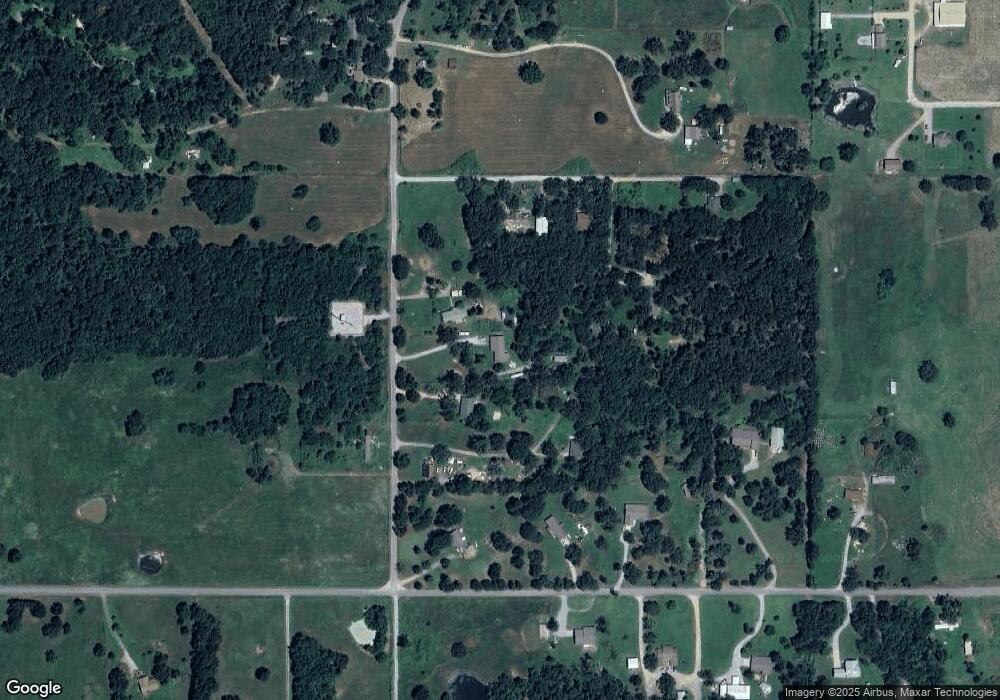

Map

Nearby Homes

- 6959 E 561 Rd

- 0 Hwy 82 S Unit 2503331

- 815 S Cherokee St

- 715 S Cherokee St

- 608 S Cherokee St

- 6164 E 578

- 9212 S 443 Rd

- 0 443 Unit 2440616

- 00 Hill St

- TBD SE 575

- 57 Joe Koelsch Dr

- 301 S Water St

- 8604 S County Road 4468

- 10171 U S Highway 412

- 212 N Mayes St

- 415 N Broadway

- 1 W Ross St

- 310 W Harrison

- 000 Earl Smith Rd

- 0 Peach St