7918 Cardinal Landing Ln Cypress, TX 77433

Estimated Value: $261,953 - $305,000

3

Beds

2

Baths

1,675

Sq Ft

$169/Sq Ft

Est. Value

About This Home

This home is located at 7918 Cardinal Landing Ln, Cypress, TX 77433 and is currently estimated at $283,738, approximately $169 per square foot. 7918 Cardinal Landing Ln is a home located in Harris County with nearby schools including Duryea Elementary School, Hopper Middle School, and Cypress Springs High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 14, 2023

Sold by

Freeman Christene Elizabeth

Bought by

James And Christene Freeman Living Trust

Current Estimated Value

Purchase Details

Closed on

Aug 31, 2011

Sold by

Taylor Morrison Of Texas Inc

Bought by

Crawford Christene E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$122,880

Interest Rate

4.53%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| James And Christene Freeman Living Trust | -- | None Listed On Document | |

| Crawford Christene E | -- | Advantage Title Of Fort Bend |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Crawford Christene E | $122,880 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $257,020 | $47,498 | $209,522 |

| 2024 | -- | $251,319 | $47,498 | $203,821 |

| 2023 | $5,517 | $294,211 | $51,728 | $242,483 |

| 2022 | $5,602 | $261,307 | $34,394 | $226,913 |

| 2021 | $5,314 | $197,551 | $34,394 | $163,157 |

| 2020 | $5,218 | $186,748 | $29,716 | $157,032 |

| 2019 | $5,054 | $175,432 | $23,113 | $152,319 |

| 2018 | $1,485 | $160,141 | $23,113 | $137,028 |

| 2017 | $4,718 | $160,141 | $23,113 | $137,028 |

| 2016 | $4,464 | $151,504 | $23,113 | $128,391 |

| 2015 | $3,155 | $151,504 | $23,113 | $128,391 |

| 2014 | $3,155 | $132,629 | $23,113 | $109,516 |

Source: Public Records

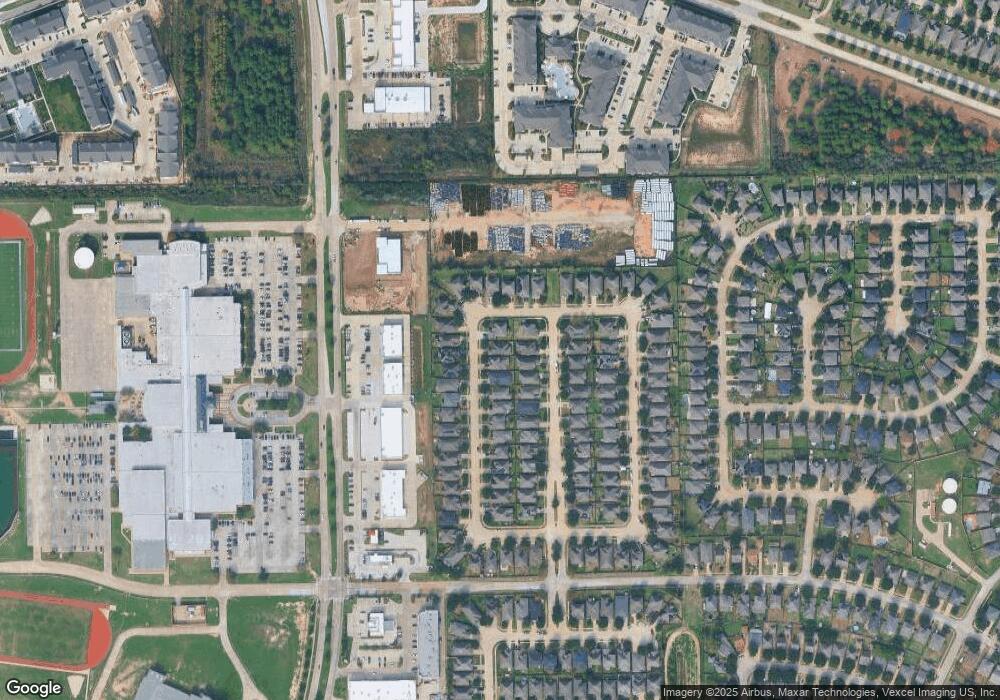

Map

Nearby Homes

- 7931 Raven Creek Ln

- 7714 Chatham Springs Ln

- 8103 Sedona Ridge Dr

- 7934 Ashland Springs Ln

- 19919 Caraway Ridge Dr

- 8226 Stratford Canyon Dr

- 19915 Sycamore Valley Dr

- 19802 Redwood Manor Ln

- 20607 Summer Retreat Ln

- 7447 Oakwood Canyon Dr

- 8303 Kerrington Glen Dr

- 19718 Redwood Manor Ln

- 7402 Bering Landing Dr

- 7343 Village Lake Dr

- 11114 Hindwing Trail

- 21311 Calico Aster Ct

- 19815 Stanton Lake Dr

- 20726 Ranch Mill Ln

- 7730 Sagemark Ridge Dr

- 8115 Heartbrook Field Ln

- 7914 Cardinal Landing Ln

- 7922 Cardinal Landing Ln

- 7919 Flowing Oak Ln

- 7915 Flowing Oak Ln

- 7923 Flowing Oak Ln

- 7911 Flowing Oak Ln

- 7906 Cardinal Landing Ln

- 7919 Cardinal Landing Ln

- 7923 Cardinal Landing Ln

- 7915 Cardinal Landing Ln

- 7927 Cardinal Landing Ln

- 7907 Flowing Oak Ln

- 7902 Cardinal Landing Ln

- 7911 Cardinal Landing Ln

- 20134 Harvest Landing Ln

- 20130 Harvest Landing Ln

- 7903 Flowing Oak Ln

- 20142 Harvest Landing Ln

- 7907 Cardinal Landing Ln

- 7931 Cardinal Landing Ln