7925 Aspect Way Las Vegas, NV 89149

Painted Desert NeighborhoodEstimated Value: $641,611 - $750,000

3

Beds

2

Baths

2,268

Sq Ft

$299/Sq Ft

Est. Value

About This Home

This home is located at 7925 Aspect Way, Las Vegas, NV 89149 and is currently estimated at $677,903, approximately $298 per square foot. 7925 Aspect Way is a home located in Clark County with nearby schools including Dean Lamar Allen Elementary School, Justice Myron E Leavitt Middle School, and Centennial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 27, 2007

Sold by

Shrum Durel B and Shrum Cheryl

Bought by

Hubert James

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$436,500

Outstanding Balance

$263,773

Interest Rate

6.23%

Mortgage Type

Unknown

Estimated Equity

$414,130

Purchase Details

Closed on

Nov 3, 2005

Sold by

Paetsch Edward H and Paetsch Adelaide G

Bought by

Shrum Durel B and Shrum Cheryl

Purchase Details

Closed on

Jun 19, 1996

Sold by

Mello Joe and Mello Judy

Bought by

Paetsch Edward H and Paetsch Adelaide G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,800

Interest Rate

5.62%

Purchase Details

Closed on

Sep 21, 1995

Sold by

Mello Joe

Bought by

Mello Joe and Mello Judy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,000

Interest Rate

7.97%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hubert James | $485,000 | Fidelity National Title | |

| Shrum Durel B | $495,000 | First Amer Title Co Of Nv | |

| Paetsch Edward H | $220,000 | Stewart Title | |

| Mello Joe | -- | Stewart Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hubert James | $436,500 | |

| Previous Owner | Paetsch Edward H | $175,800 | |

| Previous Owner | Mello Joe | $110,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,561 | $157,535 | $49,350 | $108,185 |

| 2024 | $3,458 | $157,535 | $49,350 | $108,185 |

| 2023 | $2,822 | $151,761 | $49,000 | $102,761 |

| 2022 | $3,357 | $132,814 | $38,500 | $94,314 |

| 2021 | $3,260 | $128,570 | $38,500 | $90,070 |

| 2020 | $3,162 | $124,484 | $35,000 | $89,484 |

| 2019 | $3,070 | $120,874 | $32,550 | $88,324 |

| 2018 | $2,980 | $115,246 | $29,750 | $85,496 |

| 2017 | $3,593 | $109,452 | $22,750 | $86,702 |

| 2016 | $2,822 | $103,744 | $22,400 | $81,344 |

| 2015 | $2,816 | $92,169 | $16,800 | $75,369 |

| 2014 | $2,734 | $82,812 | $12,250 | $70,562 |

Source: Public Records

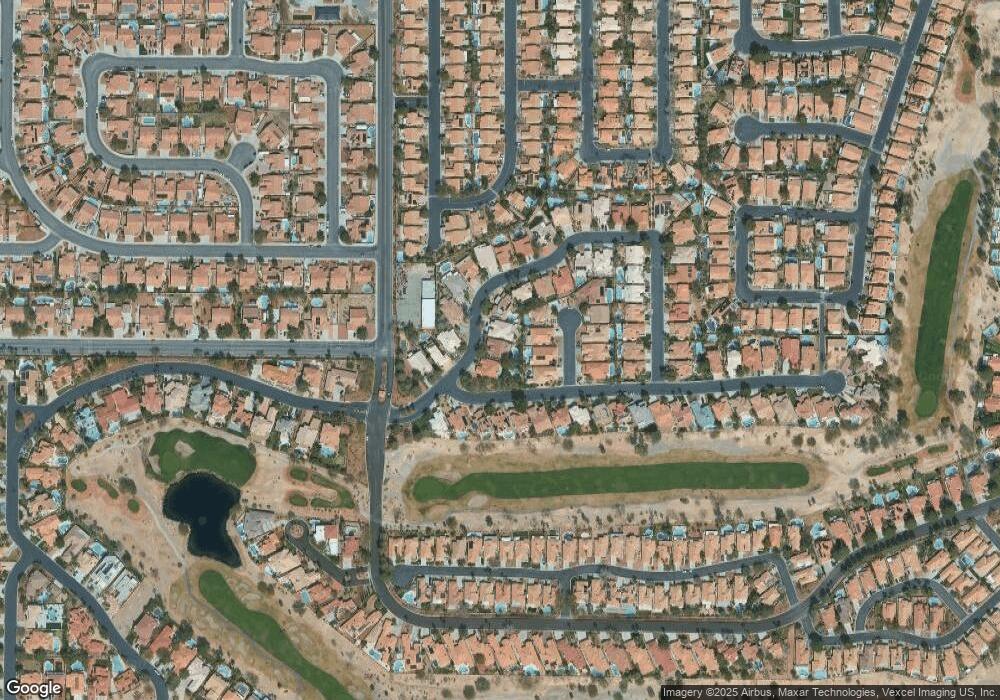

Map

Nearby Homes

- 5436 Desert Valley Dr

- 7920 Ben Hogan Dr

- 7932 Ben Hogan Dr

- 8016 Golfers Oasis Dr

- 7848 Ben Hogan Dr

- 7832 Ben Hogan Dr

- 5525 Desert Valley Dr

- 7912 Painted Rock Ln

- 8032 Wispy Sage Way

- 5381 Waving Sage Dr

- 8104 Wispy Sage Way

- 5613 Burdel St

- 5416 Irish Spring St

- 7709 Tinted Mesa Ct

- 5704 Burdel St

- 7652 Painted Dunes Dr

- 7629 Valley Green Dr Unit 101

- 7733 Kasmere Falls Dr

- 7632 Rolling View Dr Unit 202

- 5721 Whale Rock St

- 7921 Aspect Way

- 7929 Aspect Way

- 5405 Alabaster Ct

- 7917 Aspect Way

- 5409 Alabaster Ct

- 5401 Alabaster Ct

- 5413 Alabaster Ct

- 7928 Aspect Way

- 7909 Aspect Way

- 7924 Aspect Way

- 7932 Aspect Way

- 7925 Astral Ave

- 7921 Astral Ave

- 7905 Aspect Way

- 7929 Astral Ave

- 7917 Astral Ave

- 7933 Astral Ave

- 7936 Aspect Way Unit none

- 7936 Aspect Way

- 7916 Aspect Way