7B John Paul Jones Dr Monroe, NJ 08831

Estimated Value: $403,000 - $478,960

3

Beds

2

Baths

1,404

Sq Ft

$324/Sq Ft

Est. Value

About This Home

This home is located at 7B John Paul Jones Dr, Monroe, NJ 08831 and is currently estimated at $455,490, approximately $324 per square foot. 7B John Paul Jones Dr is a home located in Mercer County with nearby schools including Oak Tree Elementary School, Monroe Township Middle School, and Monroe Township High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 1, 2023

Sold by

Falitz Sharon D

Bought by

Ciccarelli Suzanne

Current Estimated Value

Purchase Details

Closed on

Oct 12, 2021

Sold by

D & B Design Contracting Llc

Bought by

Falitz Sharon

Purchase Details

Closed on

May 10, 2021

Sold by

Sison Lydia and Sison Joel

Bought by

D & B Design Contracting Llc

Purchase Details

Closed on

Jun 9, 2010

Sold by

Cavallo Alice

Bought by

Sison Lydia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$147,907

Interest Rate

4.39%

Mortgage Type

FHA

Purchase Details

Closed on

Dec 17, 2008

Sold by

Cavallo Alice and Cavallo Albert

Bought by

Cavallo Alice

Purchase Details

Closed on

Nov 29, 2005

Sold by

Horen Sue Alix

Bought by

Cavallo Albert and Cavallo Alice

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ciccarelli Suzanne | $440,000 | River Edge Title | |

| Ciccarelli Suzanne | $440,000 | River Edge Title | |

| Falitz Sharon | $360,000 | First American Title Ins Co | |

| Falitz Sharon | $360,000 | First American Title | |

| D & B Design Contracting Llc | $220,000 | Chicago Title Company Llc | |

| Sison Lydia | $149,900 | None Available | |

| Cavallo Alice | -- | None Available | |

| Cavallo Albert | $238,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sison Lydia | $147,907 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,056 | $144,300 | $50,000 | $94,300 |

| 2024 | $3,915 | $144,300 | $50,000 | $94,300 |

| 2023 | $3,915 | $144,300 | $50,000 | $94,300 |

| 2022 | $3,848 | $144,300 | $50,000 | $94,300 |

| 2021 | $3,375 | $127,300 | $50,000 | $77,300 |

| 2020 | $3,384 | $127,300 | $50,000 | $77,300 |

| 2019 | $3,307 | $127,300 | $50,000 | $77,300 |

| 2018 | $3,282 | $127,300 | $50,000 | $77,300 |

| 2017 | $3,231 | $127,300 | $50,000 | $77,300 |

| 2016 | $3,183 | $127,300 | $50,000 | $77,300 |

| 2015 | $3,106 | $127,300 | $50,000 | $77,300 |

| 2014 | $3,002 | $127,300 | $50,000 | $77,300 |

Source: Public Records

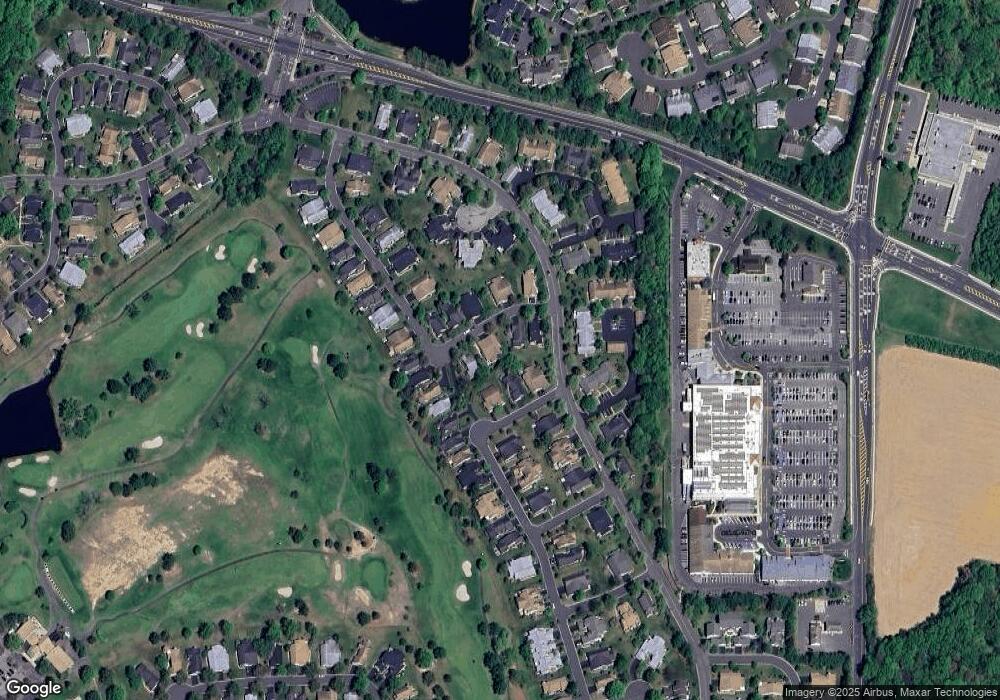

Map

Nearby Homes

- 8 John Paul Jones Dr

- 153 Concordia Cir Unit d

- 19 Wellington Place

- 18 Kingston Ct

- 9 Melborn Dr Unit 9B

- 5 Chadwick Ln Unit C

- 43 Winthrop Rd

- 43 Winthrop Rd Unit C

- 15 Betsy Ross Dr Unit B

- 1 Rothwell Dr

- 14 Dorchester Dr

- 20C Dorchester Dr

- 20 Dorchester Dr

- 19 Rutland Ln

- 22 Chandler Ct

- 3 Rutland Ln

- 123 Concordia Cir Unit G

- 29B Hillsborough Dr

- 140 Prospect Plains Rd

- 1 Phillip Ct

- 7B John Paul Jones Dr

- 7B John Paul Jones Dr Unit B

- 7A John Paul Jones Dr

- 14 John Paul Jones Dr Unit B

- 3 John Paul Jones Dr

- 7 John Paul Jones Dr

- 7 John Paul Jones Dr Unit B

- 9 John Paul Jones Dr

- 21 John Paul Jones Dr Unit A

- 10 John Paul Jones Dr

- 6 John Paul Jones Dr

- 6 John Paul Jones Dr Unit B

- 8B John Paul Jones Dr

- 4 Daniel Webster Ave

- 1 John Paul Jones Dr

- 6B John Paul Jones Dr

- 12 John Paul Jones Dr

- 170 Concordia Cir

- 170 Concordia Cir Unit A

- 6A Daniel Webster Ave