8 Kittle St Williamstown, WV 26187

Estimated Value: $206,000 - $249,000

3

Beds

2

Baths

1,196

Sq Ft

$188/Sq Ft

Est. Value

About This Home

This home is located at 8 Kittle St, Williamstown, WV 26187 and is currently estimated at $225,103, approximately $188 per square foot. 8 Kittle St is a home located in Wood County with nearby schools including Williamstown Elementary School, Williamstown Middle/High School, and Jackson Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 22, 2019

Sold by

Gains Kayla M

Bought by

Stewart Snodgrass Brittany A and Snodgrass Eric B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,350

Outstanding Balance

$132,188

Interest Rate

4.2%

Mortgage Type

New Conventional

Estimated Equity

$92,915

Purchase Details

Closed on

May 20, 2013

Sold by

Givens Ralph E and Givens Phyllis J

Bought by

Gains Kayla M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,700

Interest Rate

3.45%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stewart Snodgrass Brittany A | $155,000 | Title First Agency Inc | |

| Gains Kayla M | -- | Attorneys Title Co Llc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stewart Snodgrass Brittany A | $150,350 | |

| Previous Owner | Gains Kayla M | $119,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,086 | $86,940 | $21,300 | $65,640 |

| 2023 | $1,034 | $81,660 | $19,980 | $61,680 |

| 2022 | $872 | $78,960 | $18,660 | $60,300 |

| 2021 | $851 | $76,680 | $18,660 | $58,020 |

| 2020 | $823 | $73,920 | $17,340 | $56,580 |

| 2019 | $833 | $72,420 | $17,340 | $55,080 |

| 2018 | $847 | $71,640 | $17,340 | $54,300 |

| 2017 | $827 | $69,540 | $17,340 | $52,200 |

| 2016 | $755 | $68,460 | $17,340 | $51,120 |

| 2015 | $734 | $66,480 | $16,680 | $49,800 |

| 2014 | $702 | $63,540 | $14,640 | $48,900 |

Source: Public Records

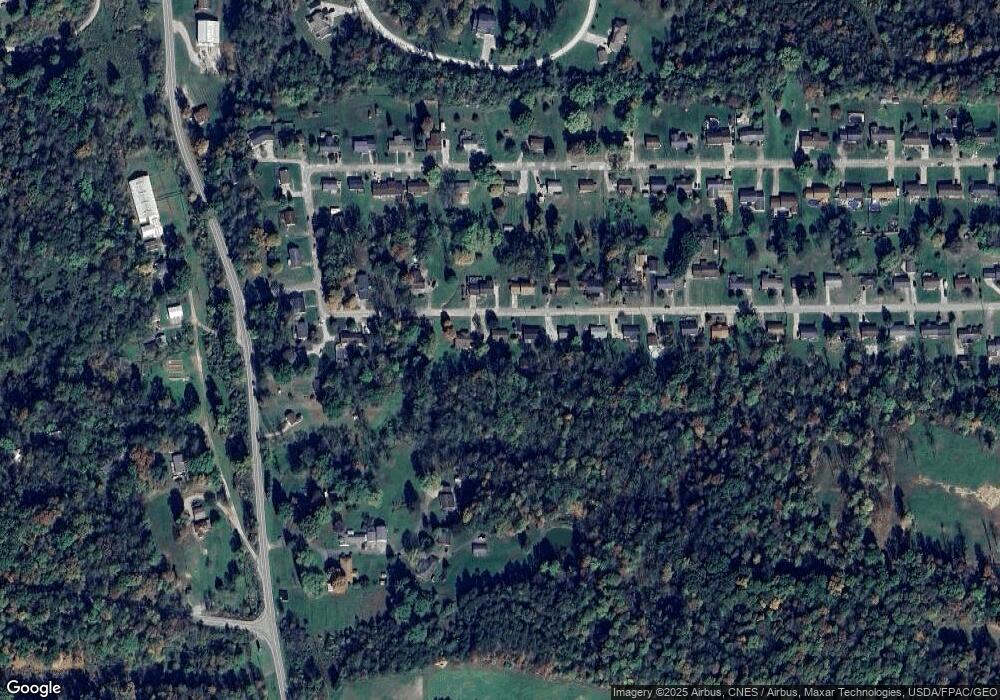

Map

Nearby Homes

- 111 Beckwith Ave

- 134 Nelson Hill Dr

- 13533 Emerson Ave

- 477 Burnt Hill Rd

- 2168 Meadowview Dr

- Lot 2 Happy Hollow Rd

- Tract 5 Happy Hollow Rd

- 328 Captain Ames Dr

- 5673 Old Saint Marys Pike

- 273 Captain Ames Dr

- 1641 Valley Mills Rd

- 11674 Emerson Ave

- 2361 Carpenter Run Rd

- 27345 State Route 7

- 1371 N Dry Run Rd

- 122 Buells Cir

- 133 Brant Dr

- 1003 Duncan Ln

- 0 Granada Dr

- 215 Valley Mills Rd