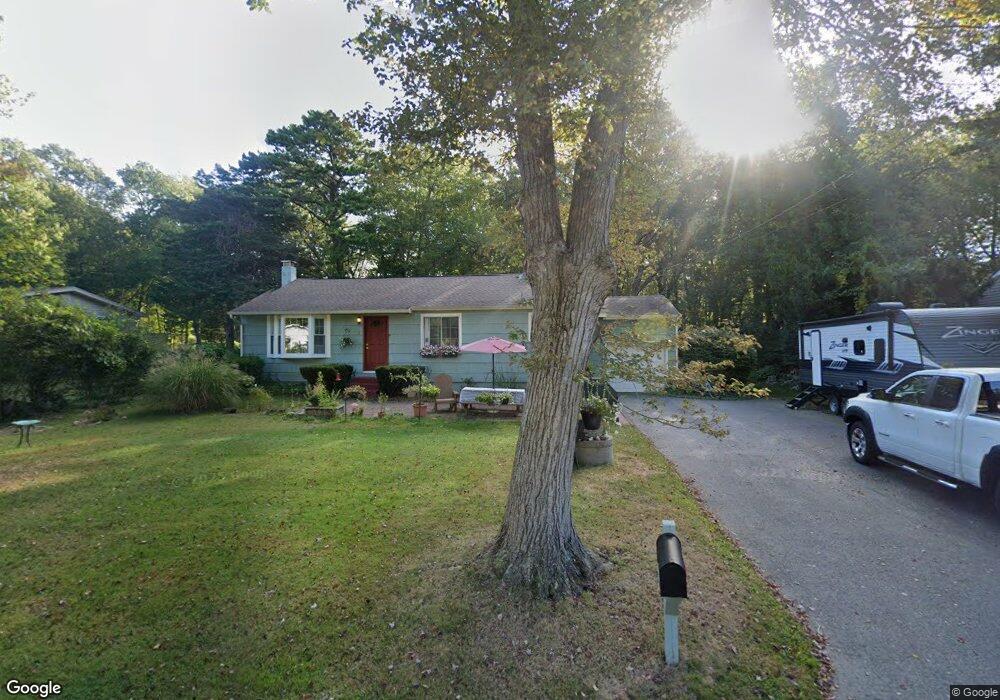

8 Stone Ct Gales Ferry, CT 06335

Estimated Value: $307,000 - $341,000

3

Beds

2

Baths

1,092

Sq Ft

$298/Sq Ft

Est. Value

About This Home

This home is located at 8 Stone Ct, Gales Ferry, CT 06335 and is currently estimated at $324,941, approximately $297 per square foot. 8 Stone Ct is a home located in New London County with nearby schools including Ledyard Middle School, Ledyard High School, and Academy Of St Therese.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 23, 2005

Sold by

Roudabush Kirk and Roudabush Natalie

Bought by

Mallory Andrew and Mallory Rhonda

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$228,375

Outstanding Balance

$119,686

Interest Rate

5.82%

Estimated Equity

$205,255

Purchase Details

Closed on

May 21, 2003

Sold by

Sargent Kenneth

Bought by

Roudabush Kirk and Roudabush Natalie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$155,000

Interest Rate

5.86%

Purchase Details

Closed on

Oct 15, 1991

Sold by

West Byron

Bought by

Sargeant Kenneth

Purchase Details

Closed on

Oct 1, 1987

Sold by

Miller Mary

Bought by

West Byron

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mallory Andrew | $225,000 | -- | |

| Roudabush Kirk | $155,000 | -- | |

| Sargeant Kenneth | $100,000 | -- | |

| West Byron | $115,200 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | West Byron | $228,375 | |

| Previous Owner | West Byron | $155,000 | |

| Previous Owner | West Byron | $95,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,098 | $137,270 | $44,730 | $92,540 |

| 2024 | $4,833 | $137,270 | $44,730 | $92,540 |

| 2023 | $4,744 | $137,270 | $44,730 | $92,540 |

| 2022 | $4,642 | $137,270 | $44,730 | $92,540 |

| 2021 | $4,596 | $136,780 | $44,730 | $92,050 |

| 2020 | $4,029 | $115,220 | $46,830 | $68,390 |

| 2019 | $4,040 | $115,220 | $46,830 | $68,390 |

| 2018 | $3,951 | $115,220 | $46,830 | $68,390 |

| 2017 | $3,749 | $115,220 | $46,830 | $68,390 |

| 2016 | $3,676 | $115,220 | $46,830 | $68,390 |

| 2015 | $3,503 | $115,220 | $46,830 | $68,390 |

| 2014 | $3,675 | $122,920 | $46,830 | $76,090 |

Source: Public Records

Map

Nearby Homes

- 10 Stone Ct

- 123A Whalehead Rd

- 7 Briarwood Ct

- 16 Marty's Way

- 18 Marty's Way

- 0 Clarks Falls Unit 24089817

- 39 Ash Dr Unit 9

- 11 Marty's Way

- 25 Marty's Way

- 2 Garden Ct

- 5 Bittersweet Dr

- 47 Norman Dr

- 16 Marlene Dr

- 5 Ledgewood Dr

- 145 Massapeag Side Rd

- 15 Drawbridge Rd

- 421 Kitemaug Rd

- 932 Long Cove Rd Unit TRLR 4

- 3 Holdsworth Rd

- 140 Route 12