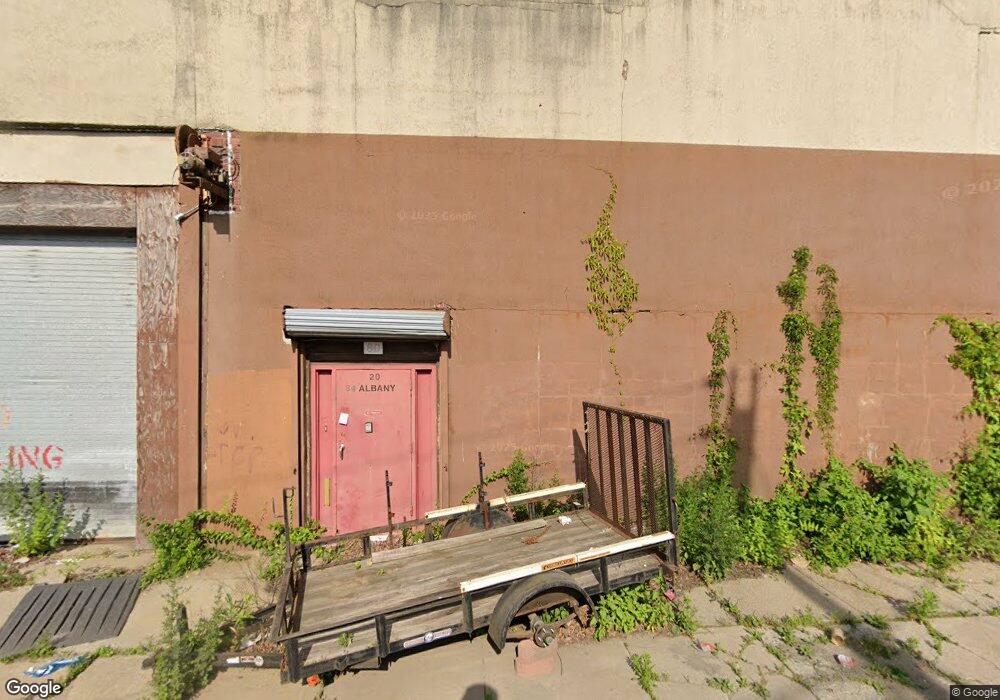

80 Albany Ave Freeport, NY 11520

Estimated Value: $1,212,806

--

Bed

--

Bath

20,160

Sq Ft

$60/Sq Ft

Est. Value

About This Home

This home is located at 80 Albany Ave, Freeport, NY 11520 and is currently priced at $1,212,806, approximately $60 per square foot. 80 Albany Ave is a home located in Nassau County with nearby schools including Columbus Avenue School, Caroline G. Atkinson Intermediate School, and John W Dodd Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 31, 2023

Sold by

Incorporated Village Of Freeport

Bought by

Gardens At Buffalo Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$12,250,000

Outstanding Balance

$11,898,814

Interest Rate

6.43%

Mortgage Type

Construction

Purchase Details

Closed on

Nov 12, 2020

Sold by

84 Albany Ave Realty Corp

Bought by

Incorporated Village Of Freeport

Purchase Details

Closed on

Jun 29, 2001

Sold by

Johar Inc

Bought by

84 Albany Ave Realty Corp

Purchase Details

Closed on

Dec 11, 1996

Sold by

Kugel & Goldstein Realty

Bought by

Johar Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gardens At Buffalo Llc | $17,500,000 | Fidelity National Ttl Ins Co | |

| Gardens At Buffalo Llc | $17,500,000 | Fidelity National Ttl Ins Co | |

| Gardens At Buffalo Llc | $17,500,000 | Fidelity National Ttl Ins Co | |

| Gardens At Buffalo Llc | $17,500,000 | Fidelity National Ttl Ins Co | |

| Incorporated Village Of Freeport | -- | First American Title | |

| Incorporated Village Of Freeport | -- | First American Title | |

| Incorporated Village Of Freeport | -- | First American Title | |

| 84 Albany Ave Realty Corp | $525,000 | Michael Kennedy | |

| 84 Albany Ave Realty Corp | $525,000 | Michael Kennedy | |

| Johar Inc | $290,000 | -- | |

| Johar Inc | $290,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gardens At Buffalo Llc | $12,250,000 | |

| Closed | Gardens At Buffalo Llc | $12,250,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $9,136 | $2,420 | $6,716 |

| 2024 | -- | $9,136 | $2,420 | $6,716 |

| 2023 | $0 | $9,136 | $2,420 | $6,716 |

| 2022 | $0 | $9,136 | $2,420 | $6,716 |

| 2021 | $4,736 | $8,627 | $2,420 | $6,207 |

| 2020 | $52,185 | $5,010 | $1,342 | $3,668 |

| 2019 | $5,139 | $5,010 | $1,342 | $3,668 |

| 2018 | $23,306 | $5,610 | $0 | $0 |

| 2017 | $20,813 | $5,610 | $1,186 | $4,424 |

| 2016 | $32,190 | $7,110 | $1,503 | $5,607 |

| 2015 | $4,525 | $7,110 | $1,503 | $5,607 |

| 2014 | $4,525 | $7,110 | $1,503 | $5,607 |

| 2013 | $4,674 | $7,110 | $1,503 | $5,607 |

Source: Public Records

Map

Nearby Homes

- 1690 Argyle Rd

- 6 Frederick Ave

- 1674 Birch Dr

- 1763 E Berkshire Rd

- 60 Bedell St

- 26 Rosedale Ave

- 78 Jesse St

- 70 S Main St Unit 307-PH

- 11 Mount Ave

- 96 N Columbus Ave

- 98 N Columbus Ave

- 158 Church St

- 18 Halsey St

- 182 Grand Ave

- 21 Stillwell Place

- 55 Southside Ave

- 268 Grand Ave

- 160 Bedford Ave

- 131 Gregory Ave

- 49 Princeton Place

- 6 Buffalo Ave

- 175 Mill Rd Unit 133

- 234 E Merrick Rd

- 63 Buffalo Ave

- 244 E Merrick Rd

- 60 Albany Ave

- 90 Albany Ave

- 98 Maple Place

- 96 Maple Place

- 17-21 E Merrick Rd

- 94 Albany Ave

- 99 Maple Place

- 96 Albany Ave

- 6 Troy Place

- 0 Mill Rd Unit 2979529

- 111 Albany Ave

- 90 Mill Rd

- 111 Liberty Ave

- 9 Niagara Ave

- 102 Buffalo Ave