8014 Timberlodge Trail Unit C12 Dayton, OH 45458

Estimated Value: $200,000 - $234,928

2

Beds

3

Baths

1,968

Sq Ft

$112/Sq Ft

Est. Value

About This Home

This home is located at 8014 Timberlodge Trail Unit C12, Dayton, OH 45458 and is currently estimated at $219,732, approximately $111 per square foot. 8014 Timberlodge Trail Unit C12 is a home located in Montgomery County with nearby schools including Primary Village South, Normandy Elementary School, and Hadley E Watts Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 19, 2019

Sold by

Rittenhouse Shaw Kristen L

Bought by

Riveroll Gregory R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$102,320

Outstanding Balance

$89,613

Interest Rate

3.7%

Mortgage Type

New Conventional

Estimated Equity

$130,119

Purchase Details

Closed on

Apr 20, 2018

Sold by

Dubya Housing Llc

Bought by

Rittenhouse Shaw Kristen L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$103,500

Interest Rate

4.44%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 18, 2006

Sold by

Wisecup Victor N

Bought by

Dubya Housing Llc

Purchase Details

Closed on

Aug 26, 2004

Sold by

Weaver Lisa K

Bought by

Wisecup Victor

Purchase Details

Closed on

Dec 5, 2001

Sold by

Kadzie Janice K and Kadzie Janice K

Bought by

Weaver Lisa K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,250

Interest Rate

6.68%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Riveroll Gregory R | $127,900 | Fidelity Lawyers Ttl Agcy Ll | |

| Rittenhouse Shaw Kristen L | $115,000 | Acs Title & Closing Services | |

| Dubya Housing Llc | -- | None Available | |

| Wisecup Victor | $116,500 | None Available | |

| Weaver Lisa K | $95,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Riveroll Gregory R | $102,320 | |

| Previous Owner | Rittenhouse Shaw Kristen L | $103,500 | |

| Previous Owner | Weaver Lisa K | $90,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,587 | $56,820 | $9,100 | $47,720 |

| 2023 | $3,587 | $56,820 | $9,100 | $47,720 |

| 2022 | $3,475 | $43,560 | $7,000 | $36,560 |

| 2021 | $3,485 | $43,560 | $7,000 | $36,560 |

| 2020 | $3,480 | $43,560 | $7,000 | $36,560 |

| 2019 | $3,359 | $37,570 | $7,000 | $30,570 |

| 2018 | $3,009 | $37,570 | $7,000 | $30,570 |

| 2017 | $2,980 | $37,570 | $7,000 | $30,570 |

| 2016 | $2,779 | $33,010 | $7,000 | $26,010 |

| 2015 | $2,738 | $33,010 | $7,000 | $26,010 |

| 2014 | $2,738 | $33,010 | $7,000 | $26,010 |

| 2012 | -- | $40,610 | $8,960 | $31,650 |

Source: Public Records

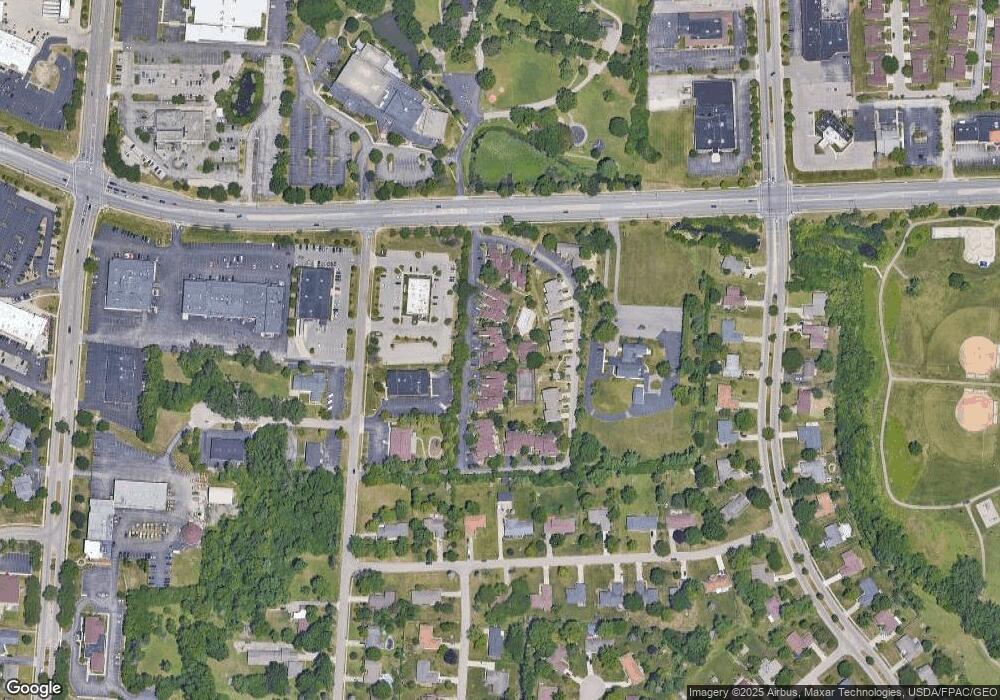

Map

Nearby Homes

- 8030 Paragon Rd

- 7607 Paragon Commons Cir Unit 97607

- 1070 Foxshire Place

- 8436 Mcewen Rd

- 7853 Betsy Ross Cir Unit 11

- 8517 Garnet Dr

- 8472 Mcewen Rd

- 8713 Washington Colony Dr Unit 311

- 1157 Timbertrail Ct Unit 12

- 755 Hidden Cir Unit 623

- 8738 Washington Colony Dr Unit 832

- 9211 Bottega - South Dr Unit 67

- 1241 Autumn Wind Ct

- 8768 Washington Colony Dr Unit 12

- 8477 Woodgrove Ct Unit 8

- 1124 Evergreen Park Ct Unit 221124

- 8749 Shadycreek Dr Unit 8751

- 8836 Washington Colony Dr Unit 16

- 8760 Shadycreek Dr Unit 8758

- 8869 Washington Colony Dr Unit 19

- 8016 Timberlodge Trail Unit C13

- 8012 Timberlodge Trail Unit C11

- 8010 Timberlodge Trail Unit C10

- 8022 Timberlodge Trail Unit D15

- 8006 Timberlodge Trail Unit B9

- 8004 Timberlodge Trail Unit B8

- 8002 Timberlodge Trail Unit B7

- 8018 Timberlodge Trail Unit C14

- 8000 Timberlodge Trail Unit B6

- 8026 Timberlodge Trail Unit D17

- 8030 Timberlodge Trail Unit D19

- 8028 Timberlodge Trail Unit D18

- 8024 Timberlodge Trail Unit D16

- 8082 Timberlodge Trail

- 8084 Timberlodge Trail

- 8086 Timberlodge Trail

- 8102 Timberlodge Trail Unit A1

- 8034 Timberlodge Trail Unit E20

- 8104 Timberlodge Trail Unit 2

- 8104 Timberlodge Trail Unit A2