8015 Hignite Ct Unit 21 Anderson, OH 45255

Estimated Value: $444,000 - $489,000

Studio

--

Bath

1,688

Sq Ft

$279/Sq Ft

Est. Value

About This Home

This home is located at 8015 Hignite Ct Unit 21, Anderson, OH 45255 and is currently estimated at $471,306, approximately $279 per square foot. 8015 Hignite Ct Unit 21 is a home located in Hamilton County with nearby schools including Ayer Elementary School, Nagel Middle School, and Anderson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 7, 2025

Sold by

Ashford Homes Llc

Bought by

Waldmann Daniel E and Mcguire Hailey R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$344,000

Outstanding Balance

$340,230

Interest Rate

6.13%

Mortgage Type

New Conventional

Estimated Equity

$131,076

Purchase Details

Closed on

Jan 4, 2023

Sold by

Meierjohan Building Group Llc

Bought by

Ashford Homes Llc

Purchase Details

Closed on

Nov 3, 2022

Sold by

Gregal Gam Anderson Llc

Bought by

Ashford Homes Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Interest Rate

6.95%

Purchase Details

Closed on

Oct 12, 2022

Sold by

Gregel-Gam Anderson Llc

Bought by

Ashford Homes Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Interest Rate

6.95%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Waldmann Daniel E | $430,000 | None Listed On Document | |

| Waldmann Daniel E | $430,000 | None Listed On Document | |

| Ashford Homes Llc | $100,000 | -- | |

| Ashford Homes Llc | $100,000 | -- | |

| Ashford Homes Llc | $100,000 | -- | |

| Ashford Homes Llc | $100,000 | None Listed On Document |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Waldmann Daniel E | $344,000 | |

| Previous Owner | Ashford Homes Llc | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,425 | $147,606 | $35,000 | $112,606 |

| 2024 | $9,345 | $147,606 | $35,000 | $112,606 |

| 2023 | $2,079 | $35,000 | $35,000 | $0 |

| 2022 | $1,052 | $15,750 | $15,750 | $0 |

| 2021 | $1,046 | $15,750 | $15,750 | $0 |

| 2020 | $3,246 | $49,438 | $49,438 | $0 |

| 2019 | $3,177 | $0 | $0 | $0 |

| 2018 | $0 | $0 | $0 | $0 |

Source: Public Records

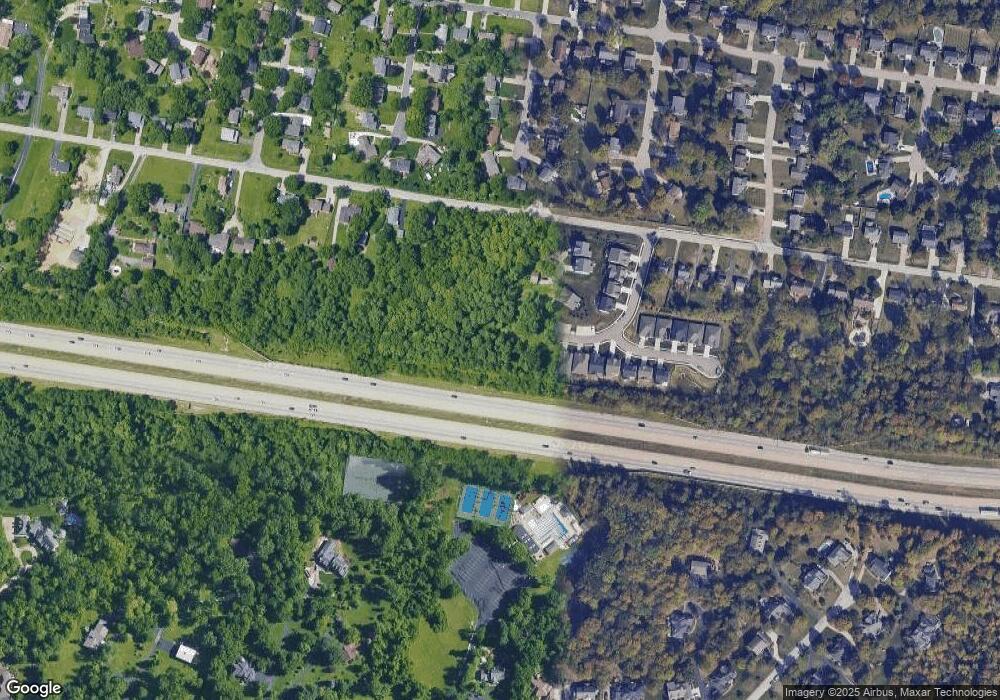

Map

Nearby Homes

- 8016 Hignite Ct

- 7988 Woodruff Rd

- 684 Balbriggan Ct

- 7978 Nagel Village Dr

- 881 Asbury Rd

- 8119 Witts Meadow Ln

- 559 Asbury Rd

- 849 Shawnee Trace Ct

- 792 Farmsworth Ct

- 7754 Forest Rd

- 8303 Tidewater Ct

- 807 Nordyke Rd

- 1094 Pamela Rd

- 8512 Prilla Ln

- 488 Madeira Ct

- 136 Coldstream Villa Dr

- 1357 Oak Ct

- 1363 Oak Ct

- 1400 Sigma Cir

- 3904 Columbard Ln

- 8019 Hignite Ct Unit 20

- 630 Sandker Ln

- 8004 Hignite Ct

- 8008 Hignite Ct

- 634 Sandker Ln

- 634 Sandker Ln Unit 18

- 620 Sandker Ln

- 8020 Hignite Ct

- 638 Sandker Ln

- 616 Sandker Ln

- 642 Sandker Ln Unit EW16

- 617 Sandker Ln

- 612 Sandker Ln

- 646 Sandker Ln

- 17 Sandker Ln

- 8109 Woodruff Rd

- 613 Sandker Ln

- 613 Sandker Ln Unit 33

- 608 Sandker Ln

- 657 Sandker Ln Unit 4