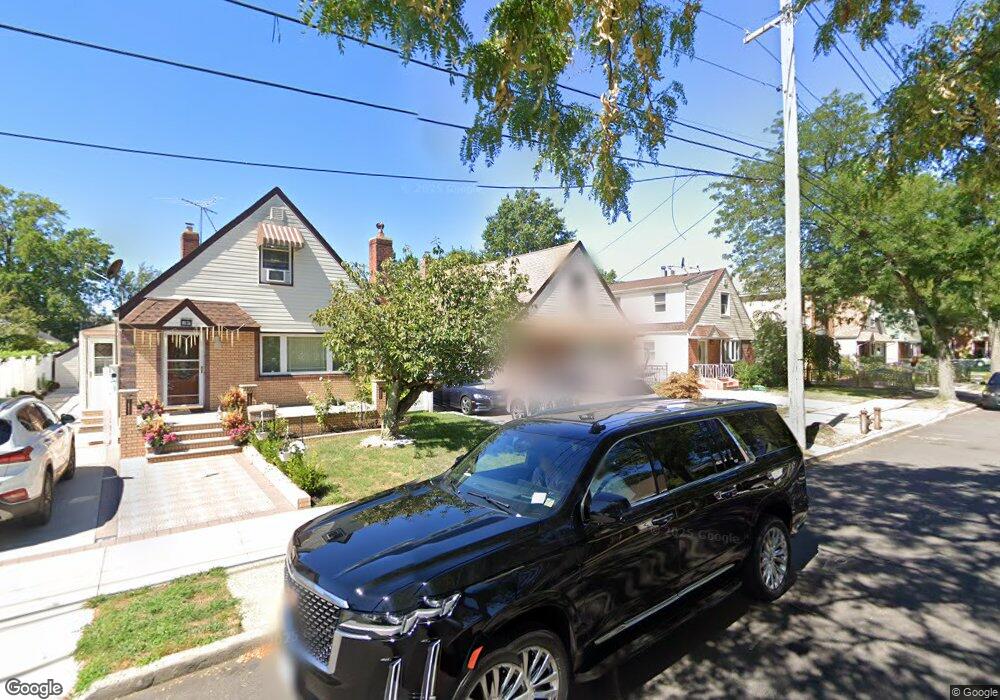

8020 268th St Glen Oaks, NY 11004

Estimated Value: $871,997 - $939,000

--

Bed

--

Bath

1,500

Sq Ft

$599/Sq Ft

Est. Value

About This Home

This home is located at 8020 268th St, Glen Oaks, NY 11004 and is currently estimated at $898,249, approximately $598 per square foot. 8020 268th St is a home located in Queens County with nearby schools including P.S.115Q James J Ambrose School, Fremont/Hay Elementary School, and Irwin Altman Middle School 172.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 19, 2022

Sold by

Khela Harinder S and Khela Pargat Singh

Bought by

Khela Harinder S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,482

Outstanding Balance

$371,110

Interest Rate

3.69%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$527,139

Purchase Details

Closed on

Dec 8, 2008

Sold by

Sharon Schager Trustee and Shiela A Hajari Trustee

Bought by

Khela Harinder S and Khela Pargat Singh

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$384,000

Interest Rate

6.27%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 3, 2003

Sold by

Keiser Mary and Keiser William Thomas

Bought by

Keiser William Thomas

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Khela Harinder S | -- | -- | |

| Khela Harinder S | -- | -- | |

| Khela Harinder S | -- | -- | |

| Khela Harinder S | $480,000 | -- | |

| Khela Harinder S | $480,000 | -- | |

| Keiser William Thomas | -- | -- | |

| Keiser William Thomas | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Khela Harinder S | $400,482 | |

| Closed | Khela Harinder S | $400,482 | |

| Closed | Khela Harinder S | $384,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,528 | $41,213 | $14,685 | $26,528 |

| 2024 | $7,809 | $38,880 | $14,033 | $24,847 |

| 2023 | $7,528 | $38,880 | $13,559 | $25,321 |

| 2022 | $7,355 | $44,940 | $16,740 | $28,200 |

| 2021 | $7,304 | $42,420 | $16,740 | $25,680 |

| 2020 | $6,974 | $39,000 | $16,740 | $22,260 |

| 2019 | $6,485 | $42,180 | $16,740 | $25,440 |

| 2018 | $6,307 | $32,400 | $11,679 | $20,721 |

| 2017 | $6,203 | $31,900 | $15,240 | $16,660 |

| 2016 | $5,707 | $31,900 | $15,240 | $16,660 |

| 2015 | $3,410 | $28,620 | $18,445 | $10,175 |

| 2014 | $3,410 | $27,000 | $18,600 | $8,400 |

Source: Public Records

Map

Nearby Homes

- 80-59 268th St

- 80-64 266th St

- 79-12 268th St

- 8168 Langdale St Unit 263A

- 81-25 265th St

- 81-49 268th St Unit 290B

- 81-51 Langdale St Unit 207A

- 268-03 82nd Ave Unit 286A

- 78-37 267th St

- 78-30 270th St

- 7836 271st St

- 78-36 271st St

- 82-25 268th St Unit 175B

- 8224 Langdale St Unit 138B

- 81-56 264th St

- 1683 Stewart Ave

- 78-07 264th St

- 8143 262nd St

- 82-65 268th St Unit 2nd Floor

- 80-18 261st St