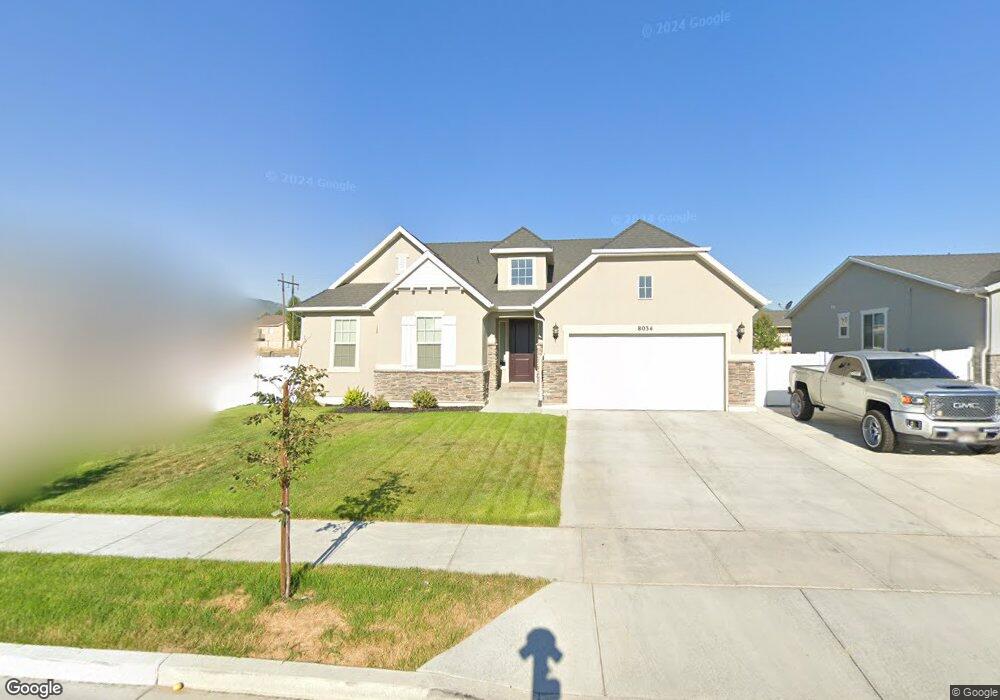

8034 S 6910 W West Jordan, UT 84081

Jordan Hills NeighborhoodEstimated Value: $558,000 - $641,000

3

Beds

2

Baths

3,792

Sq Ft

$158/Sq Ft

Est. Value

About This Home

This home is located at 8034 S 6910 W, West Jordan, UT 84081 and is currently estimated at $601,018, approximately $158 per square foot. 8034 S 6910 W is a home located in Salt Lake County with nearby schools including Oakcrest Elementary School, Sunset Ridge Middle School, and Copper Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 18, 2020

Sold by

Ivory Homes Ltd

Bought by

Crawford Alicia and Crawford Tyler

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$384,161

Outstanding Balance

$340,420

Interest Rate

3.3%

Mortgage Type

New Conventional

Estimated Equity

$260,598

Purchase Details

Closed on

Dec 26, 2019

Sold by

Ivory Homes Ltd

Bought by

Ruiz Virginia and Mendoza Manuel Salvador Ruiz

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$385,510

Interest Rate

3.7%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 31, 2019

Sold by

Ivory Development Llc

Bought by

Ivory Homes Ltd

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Crawford Alicia | -- | Cottonwood Title | |

| Ruiz Virginia | -- | Cottonwood Title | |

| Ivory Homes Ltd | -- | Cottonwood Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Crawford Alicia | $384,161 | |

| Previous Owner | Ruiz Virginia | $385,510 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,818 | $569,500 | $153,900 | $415,600 |

| 2024 | $2,818 | $542,200 | $149,400 | $392,800 |

| 2023 | $2,853 | $517,300 | $143,600 | $373,700 |

| 2022 | $2,973 | $530,300 | $140,800 | $389,500 |

| 2021 | $2,490 | $404,300 | $110,900 | $293,400 |

| 2020 | $2,432 | $370,700 | $123,200 | $247,500 |

| 2019 | $1,499 | $123,200 | $123,200 | $0 |

| 2018 | $0 | $0 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 7011 W Saw Timber Way

- 7919 S Ares Ct

- 6784 W 8070 S

- 7009 W 7895 S

- 7953 S 7110 W

- 7069 W Cottage Point Dr

- 8009 S Hayden Park St

- 7092 W Jayson Bend Dr

- 7143 W 8130 S

- 6819 Pomona Ct

- Witzel Plan at The Sycamores

- Beatrix Plan at The Sycamores

- Sweetwater Plan at The Sycamores

- Princeton Plan at The Sycamores

- Dakota Plan at The Sycamores

- Dashell Plan at The Sycamores

- Roosevelt Plan at The Sycamores

- Wasatch Plan at The Sycamores

- 7169 Moorepark Place

- 7171 W 8170 S

- 8042 S 6910 W

- 8022 S 6910 W

- 8014 S 6910 W

- 8046 S 6910 W

- 8037 S 6910 W

- 8043 S 6910 W

- 8023 S 6910 W

- 8052 S 6910 W

- 8049 S 6910 W

- 8007 6910 W

- 8002 S 6910 W

- 8019 Madison Nan West Jordan

- 8019 S Madison Nan Dr

- 8019 Madison Nan Dr

- 8027 Madison Nan Dr

- 8027 S Madison Nan Dr

- 8013 Madison Nan Dr

- 8013 S Madison Nan Dr

- 8033 S Madison Nan Dr

- 8033 Madison Nan Dr