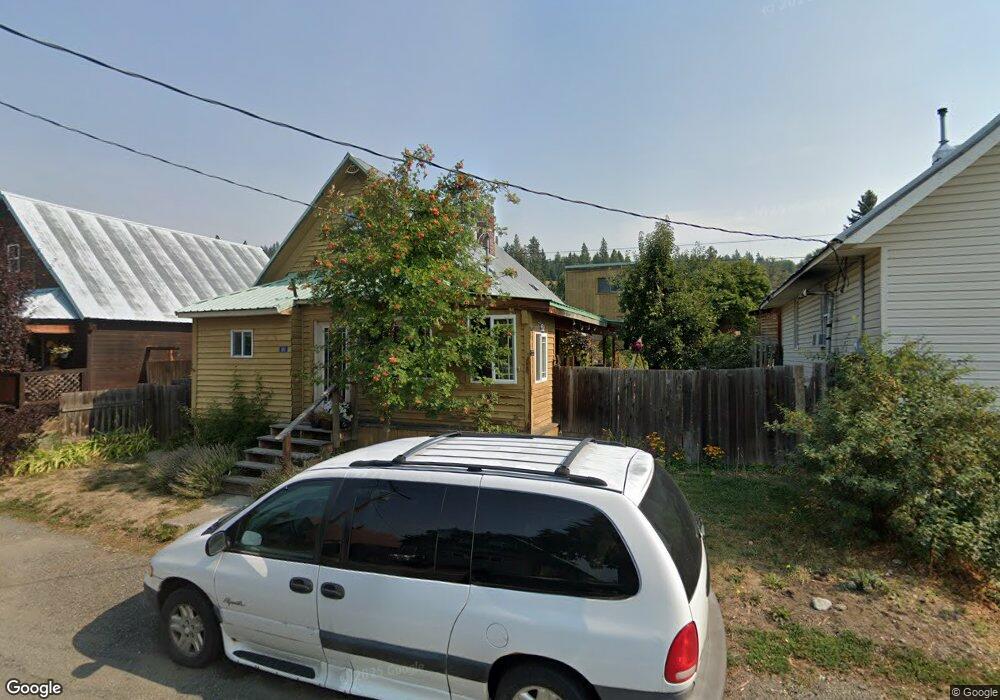

8041 State Route 903 Ronald, WA 98940

Estimated Value: $413,000 - $570,000

4

Beds

2

Baths

1,338

Sq Ft

$361/Sq Ft

Est. Value

About This Home

This home is located at 8041 State Route 903, Ronald, WA 98940 and is currently estimated at $483,294, approximately $361 per square foot. 8041 State Route 903 is a home located in Kittitas County with nearby schools including Cle Elum Roslyn Elementary School, Walter Strom Middle School, and Cle Elum Roslyn High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 17, 2019

Sold by

Flowers Christopher Thomas and Flowers Megan Kathleen

Bought by

Matz Dylan and Matz Morgan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$258,186

Outstanding Balance

$227,009

Interest Rate

4.1%

Mortgage Type

FHA

Estimated Equity

$256,285

Purchase Details

Closed on

Feb 2, 2017

Sold by

Foreclosure Investments Mountain Llc

Bought by

Flowers Christopher Thomas and Flowers Megan Kathleen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,225

Interest Rate

4.2%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 12, 2007

Sold by

Foreclosure Investments Mountain Llc

Bought by

Moody Brent A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Matz Dylan | $262,950 | Kittitas T&E Llc | |

| Flowers Christopher Thomas | $145,500 | None Available | |

| Moody Brent A | -- | Stwt Title | |

| Foreclosure Investments Mountain Llc | -- | Stwt Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Matz Dylan | $258,186 | |

| Previous Owner | Flowers Christopher Thomas | $138,225 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,149 | $391,650 | $72,000 | $319,650 |

| 2023 | $2,149 | $322,480 | $63,010 | $259,470 |

| 2022 | $1,726 | $252,160 | $39,000 | $213,160 |

| 2021 | $1,686 | $234,880 | $39,000 | $195,880 |

| 2019 | $1,186 | $155,810 | $18,000 | $137,810 |

| 2018 | $965 | $120,060 | $18,000 | $102,060 |

| 2017 | $965 | $120,060 | $18,000 | $102,060 |

| 2016 | $916 | $117,160 | $18,000 | $99,160 |

| 2015 | $944 | $117,160 | $18,000 | $99,160 |

| 2013 | -- | $113,840 | $18,000 | $95,840 |

Source: Public Records

Map

Nearby Homes

- 510 3rd St

- 280 Blue Agate Ln

- 51 Ronald Ridge Rd

- 391 Pacific Ave

- 470 Old Grove Trail

- 220 Old Grove Trail

- 150 Grand Fir Ln

- 34 Old Grove Trail

- 1 Red Sky Way

- 7 Red Sky Way

- 661 Pacific Ave W

- 0 XXX Mountain Ridge Rd

- 671 W Pacific Ave

- 2 Red Sky Way

- 0 Lot H R&r Heights Dr

- 3847 Swiftwater Dr

- 190 Indigo Ln

- 31 Kokanee Loop

- 121 Panorama Dr

- 1791 Wanawish Loop

- 8011 3rd St

- 8021 Washington 903

- 8040 State Road 903

- 7991 State Route 903

- 8050 State Route 903

- 8021 Sr 903

- 0 Washington 903

- 1 Washington 903

- 8000 Washington 903

- 8010 State Route 903

- 50 1st St

- 8071 State Route 903

- 8040 Washington 903

- 8040 3rd St

- 7990 Washington 903

- 8070 State Route 903

- 8051 State Route 903

- 31 Atlantic Ave E

- 90 1st St