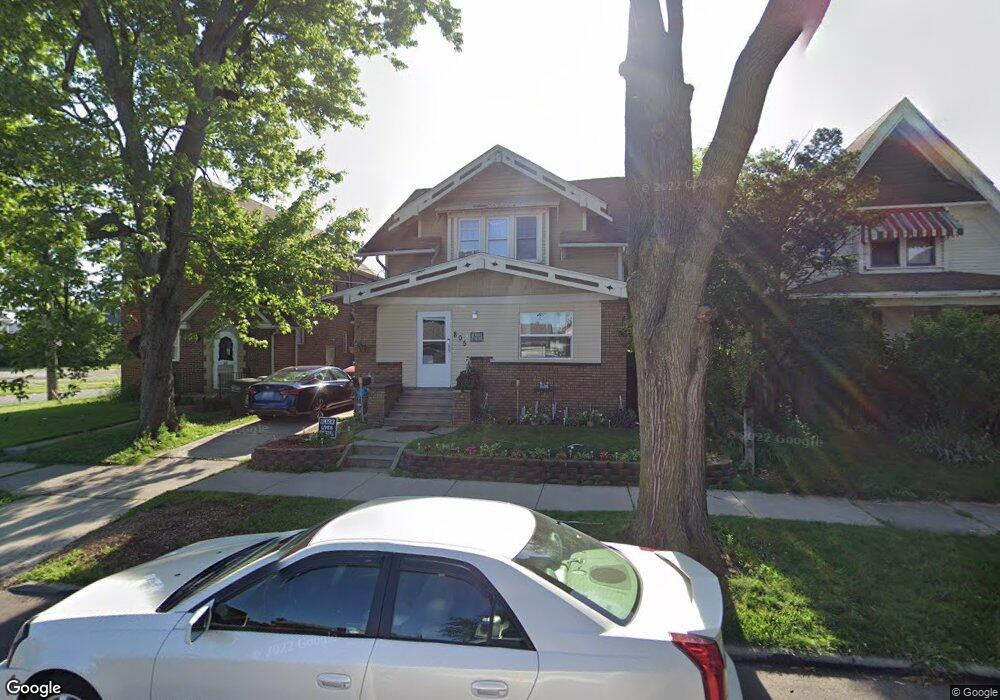

805 Euclid Ave Toledo, OH 43605

East Toledo NeighborhoodEstimated Value: $51,000 - $66,000

3

Beds

1

Bath

1,255

Sq Ft

$47/Sq Ft

Est. Value

About This Home

This home is located at 805 Euclid Ave, Toledo, OH 43605 and is currently estimated at $58,746, approximately $46 per square foot. 805 Euclid Ave is a home located in Lucas County with nearby schools including Navarre Elementary School, Waite High School, and Toledo Preparatory Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 25, 2017

Sold by

Northwwst Ohio Development Agency

Bought by

Deromano El Srandra

Current Estimated Value

Purchase Details

Closed on

Sep 28, 2011

Sold by

West Jerry and West Mary

Bought by

Northwest Ohio Development Agency

Purchase Details

Closed on

Jul 14, 2008

Sold by

West Jerry M and West Mary E

Bought by

West Jerry and West Mary

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$48,140

Interest Rate

6.15%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 28, 1995

Sold by

Marazon Joseph S

Bought by

West Jerry M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$38,088

Interest Rate

8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 2, 1993

Sold by

Marazon Daniel J and Marazon Lois M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Deromano El Srandra | -- | None Available | |

| Northwest Ohio Development Agency | -- | Attorney | |

| West Jerry | -- | Area Title Agency | |

| West Jerry M | $38,000 | -- | |

| -- | $29,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | West Jerry | $48,140 | |

| Previous Owner | West Jerry M | $38,088 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $995 | $14,490 | $3,990 | $10,500 |

| 2023 | $861 | $12,530 | $3,360 | $9,170 |

| 2022 | $865 | $12,530 | $3,360 | $9,170 |

| 2021 | $882 | $12,530 | $3,360 | $9,170 |

| 2020 | $948 | $11,900 | $3,640 | $8,260 |

| 2019 | $918 | $11,900 | $3,640 | $8,260 |

| 2018 | $946 | $11,900 | $3,640 | $8,260 |

| 2017 | $1,522 | $11,655 | $3,570 | $8,085 |

| 2016 | $973 | $33,300 | $10,200 | $23,100 |

| 2015 | $966 | $33,300 | $10,200 | $23,100 |

| 2014 | $1,130 | $11,660 | $3,570 | $8,090 |

| 2013 | $754 | $11,660 | $3,570 | $8,090 |

Source: Public Records

Map

Nearby Homes

- 627 Greenwood Ave

- 51 Garfield Place

- 826 Greenwood Ave

- 618 Euclid Ave

- 522 Saint Louis St

- 548 Saint Louis St

- 610 Parker Ave

- 457 Parker Ave

- 451 5th St

- 350 Parker Ave

- 1133 Nevada St

- 547 Church St

- 428 Potter St

- 1129 Mason St

- 1207 Nevada St

- 737-739 Forsythe St

- 1215 Greenwood Ave

- 427 Oak St

- 622 Church St

- 743 Forsythe St

- 809 Euclid Ave

- 803 Euclid Ave

- 817 Euclid Ave

- 819 Euclid Ave

- 810 Main St

- 642 Greenwood Ave

- 814 Main St

- 821 Euclid Ave

- 632 Greenwood Ave

- 818 Main St

- 827 Euclid Ave

- 816 Euclid Ave

- 630 Greenwood Ave

- 758 Euclid Ave

- 829 Euclid Ave

- 747 Euclid Ave

- 628 Greenwood Ave

- 752 Euclid Ave

- 633 Greenwood Ave

- 833 Euclid Ave