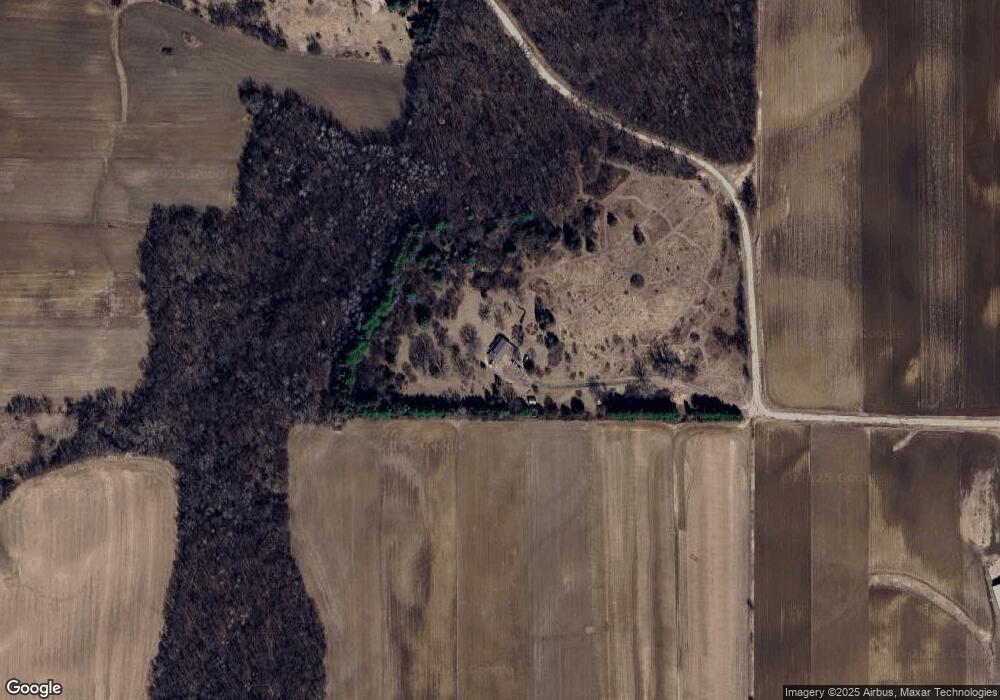

8055 Indian Trail Cross Plains, WI 53528

Estimated Value: $720,362 - $746,000

--

Bed

--

Bath

--

Sq Ft

23.08

Acres

About This Home

This home is located at 8055 Indian Trail, Cross Plains, WI 53528 and is currently estimated at $733,181. 8055 Indian Trail is a home located in Dane County with nearby schools including Wisconsin Heights Elementary School, Mazomanie Elementary School, and Wisconsin Heights Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 31, 2022

Sold by

Dega Stephanie J

Bought by

Dega Stephanie J and Hassler Chelsea E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$445,850

Outstanding Balance

$414,056

Interest Rate

3.56%

Mortgage Type

New Conventional

Estimated Equity

$319,125

Purchase Details

Closed on

Jan 29, 2021

Sold by

Indian Trail Farms Llc

Bought by

County Of Dane

Purchase Details

Closed on

Dec 27, 2012

Sold by

Dega Jeanette P

Bought by

Indian Trail Farms Llc

Purchase Details

Closed on

Jun 27, 2006

Sold by

Us Bank National Assn

Bought by

Dega Jeane P

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dega Stephanie J | -- | None Listed On Document | |

| Dega Stephanie J | $557,400 | None Listed On Document | |

| County Of Dane | $2,924,500 | None Available | |

| Indian Trail Farms Llc | -- | None Available | |

| Dega Jeane P | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dega Stephanie J | $445,850 | |

| Closed | Dega Stephanie J | $445,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $11,621 | $573,100 | $237,400 | $335,700 |

| 2023 | $9,434 | $573,100 | $237,400 | $335,700 |

| 2021 | $10,048 | $533,100 | $197,400 | $335,700 |

| 2020 | $9,524 | $533,000 | $197,300 | $335,700 |

| 2019 | $9,181 | $532,900 | $197,200 | $335,700 |

| 2018 | $9,393 | $533,000 | $197,300 | $335,700 |

| 2017 | $9,312 | $533,000 | $197,300 | $335,700 |

| 2016 | $9,244 | $533,000 | $197,300 | $335,700 |

| 2015 | $8,903 | $533,000 | $197,300 | $335,700 |

| 2014 | $8,608 | $533,000 | $197,300 | $335,700 |

| 2013 | $8,378 | $533,000 | $197,300 | $335,700 |

Source: Public Records

Map

Nearby Homes

- 5596 Enchanted Valley Rd

- 7985 County Highway K

- 5296 Ripp Rd

- 7256 Riles Rd

- 8012 Laufenberg Blvd

- 8008 Laufenberg Blvd

- 8004 Laufenberg Blvd

- 8002 Laufenberg Blvd

- 3701 Conrad Dr

- 3600 Angelus Way

- 3602 Angelus Way

- 3620 Angelus Way

- 3608 Angelus Way

- Lot 4 Hickory Run

- 4992 Sunrise Ridge Trail

- Lot 2 Lodi Springfield Rd

- Lot 1 Lodi Springfield Rd

- 301 King Arthurs Ct

- 6097 Jacoby Dr

- 3027 Acker St

- 5844 Enchanted Valley Rd

- 5840 Enchanted Valley Rd

- 8022 Martinsville Rd

- 7980 Dairy Ln

- 5845 Enchanted Valley Rd

- 5780 Enchanted Valley Rd

- 5987 Whippoorwill Rd

- 5756 High Rise Rd

- 5759 High Rise Rd

- 5989 Whippoorwill Rd

- 8092 Martinsville Rd

- 8112 Martinsville Rd

- 5712 Enchanted Valley Rd

- 8120 Martinsville Rd

- 5717 Enchanted Valley Rd

- 7906 George Rd

- 5684 Enchanted Valley Rd

- 8223 Cty K

- 5729 Whippoorwill Rd

- 6041 Whippoorwill Rd