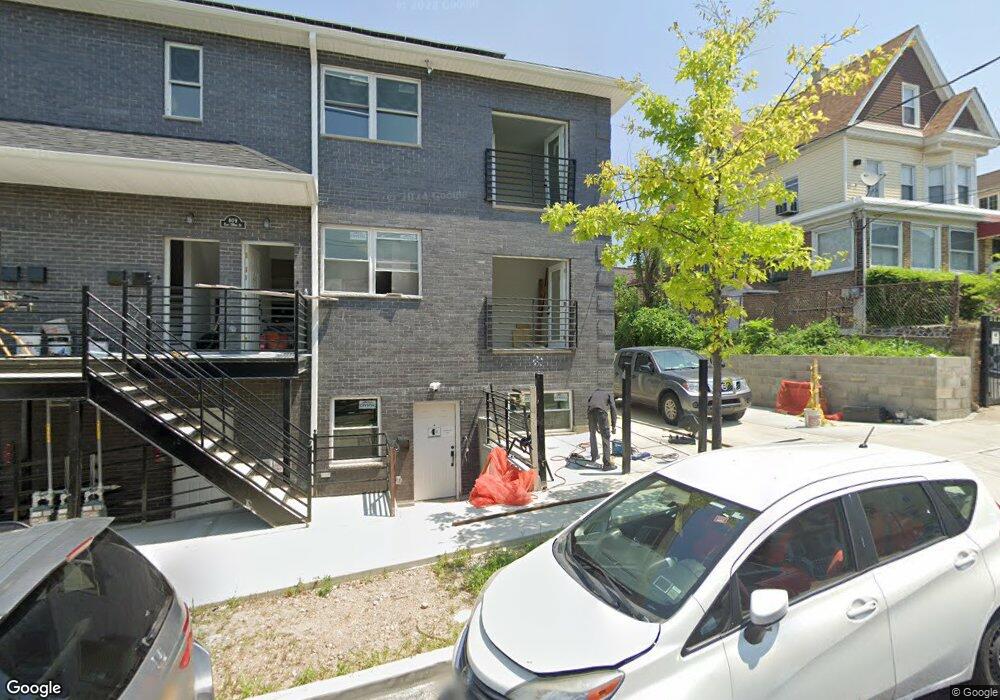

809 E 218th St Bronx, NY 10467

Williamsbridge NeighborhoodEstimated Value: $1,015,000 - $1,216,000

12

Beds

6

Baths

3,771

Sq Ft

$292/Sq Ft

Est. Value

About This Home

This home is located at 809 E 218th St, Bronx, NY 10467 and is currently estimated at $1,100,900, approximately $291 per square foot. 809 E 218th St is a home located in Bronx County with nearby schools including P.S. 78 Anne Hutchinson, North Bronx School of Empowerment, and Our Lady of Grace School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 17, 2024

Sold by

3750 Barnes Development Llc

Bought by

809 E 218 Llc

Current Estimated Value

Purchase Details

Closed on

Jan 7, 2019

Sold by

Greater New York Corporation Of Seventh- and Adventists

Bought by

3750 Barnes Development Llc

Purchase Details

Closed on

Jan 8, 2016

Sold by

Sagi Inc

Bought by

Greater New York Corporation Of

Purchase Details

Closed on

May 4, 2011

Sold by

Top Dvlp Inc

Bought by

Sagi Inc

Purchase Details

Closed on

Oct 23, 2006

Sold by

Russell Cornelia

Bought by

Top Dvlp Inc

Purchase Details

Closed on

Mar 23, 1999

Sold by

Russell Alfred and Russell Cornelia

Bought by

Russell Cornelia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,000

Interest Rate

7.22%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| 809 E 218 Llc | $972,575 | -- | |

| 3750 Barnes Development Llc | $425,000 | -- | |

| 3750 Barnes Development Llc | $425,000 | -- | |

| Greater New York Corporation Of | $397,500 | -- | |

| Greater New York Corporation Of | $397,500 | -- | |

| Sagi Inc | $825,626 | -- | |

| Sagi Inc | $825,626 | -- | |

| Top Dvlp Inc | $705,000 | -- | |

| Top Dvlp Inc | $705,000 | -- | |

| Russell Cornelia | -- | Stewart Title Insurance Co | |

| Russell Cornelia | -- | Stewart Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Russell Cornelia | $145,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,495 | $54,540 | $14,015 | $40,525 |

| 2024 | $10,495 | $52,255 | $13,255 | $39,000 |

| 2023 | $2,540 | $12,505 | $12,505 | $0 |

| 2022 | $2,103 | $13,800 | $13,800 | $0 |

| 2021 | $0 | $27,540 | $27,540 | $0 |

| 2020 | $4,666 | $23,940 | $23,940 | $0 |

| 2019 | $4,205 | $20,820 | $20,820 | $0 |

| 2018 | $4,000 | $19,620 | $19,620 | $0 |

| 2017 | $4,709 | $23,100 | $23,100 | $0 |

| 2016 | $4,615 | $23,085 | $23,085 | $0 |

| 2015 | $2,949 | $24,268 | $24,268 | $0 |

| 2014 | $2,949 | $22,896 | $22,896 | $0 |

Source: Public Records

Map

Nearby Homes

- 3763 Barnes Ave

- 3724 Barnes Ave

- 740 E 218th St

- 762 E 221st St

- 804 E 221st St

- 826 E 216th St

- 724 E 216th St Unit 5C

- 724 E 216th St Unit 2C

- 836 E 221st St

- 759 E 221st St

- 3717 Bronxwood Ave

- 831 E 221st St

- 835 E 221st St

- 3766 Bronxwood Ave

- 849 E 221st St

- 822 E 215th St

- 3800 Bronxwood Ave

- 686 E 220th St

- 855 E 215th St

- 3722 Bronxwood Ave

- 3750 Barnes Ave

- 3756 Barnes Ave

- 803 E 218th St

- 813 E 218th St

- 3758 Barnes Ave

- 3758 Barnes Ave Unit 2

- 3758 Barnes Ave Unit 4

- 3760 Barnes Ave

- 815 E 218th St

- 815 E 218th St Unit 2

- 815 E 218th St Unit 4

- 819 E 218th St

- 819 E 218th St Unit 3R

- 819 E 218th St Unit 2

- 819 E 218th St Unit 4

- 3762 Barnes Ave

- 3764 Barnes Ave

- 0 E 218th St Unit 3310337

- 3766 Barnes Ave

- 808 E 218th St