81-1015 Akakou Place Unit D1 Kealakekua, HI 96750

Estimated Value: $574,000 - $931,000

3

Beds

2

Baths

1,392

Sq Ft

$584/Sq Ft

Est. Value

About This Home

This home is located at 81-1015 Akakou Place Unit D1, Kealakekua, HI 96750 and is currently estimated at $813,411, approximately $584 per square foot. 81-1015 Akakou Place Unit D1 is a home located in Hawaii County with nearby schools including Konawaena Elementary School, Konawaena Middle School, and Konawaena High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 23, 2022

Sold by

Finlay Kevin Robert and Fu Ying

Bought by

Finlay Kevin Robert and Fu Ying

Current Estimated Value

Purchase Details

Closed on

Sep 8, 2021

Sold by

Huston Richard D and Huston Nancy J

Bought by

Finlay Kevin Robert

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

2.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 16, 2002

Sold by

Yates Randall W and Yates Joanna M

Bought by

Huston Richard D and Huston Nancy J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$189,000

Interest Rate

6.16%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 23, 2002

Sold by

Heis Henry J

Bought by

Yates Randall W and Yates Joanna M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$189,000

Interest Rate

6.16%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Finlay Kevin Robert | -- | None Listed On Document | |

| Finlay Kevin Robert | $692,000 | Fnt | |

| Huston Richard D | $239,000 | -- | |

| Yates Randall W | $1,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Finlay Kevin Robert | $200,000 | |

| Previous Owner | Huston Richard D | $189,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,753 | $638,300 | $220,800 | $417,500 |

| 2024 | $6,753 | $608,400 | $216,400 | $392,000 |

| 2023 | $6,415 | $577,900 | $213,200 | $364,700 |

| 2022 | $6,415 | $577,900 | $213,200 | $364,700 |

| 2021 | $1,263 | $381,800 | $99,600 | $282,200 |

| 2020 | $1,209 | $370,700 | $99,600 | $271,100 |

| 2019 | $1,156 | $359,900 | $99,600 | $260,300 |

| 2018 | $1,104 | $349,400 | $99,600 | $249,800 |

| 2017 | $1,054 | $339,200 | $99,600 | $239,600 |

| 2016 | $1,005 | $329,300 | $99,600 | $229,700 |

| 2015 | $754 | $319,700 | $99,600 | $220,100 |

| 2014 | $754 | $310,400 | $94,800 | $215,600 |

Source: Public Records

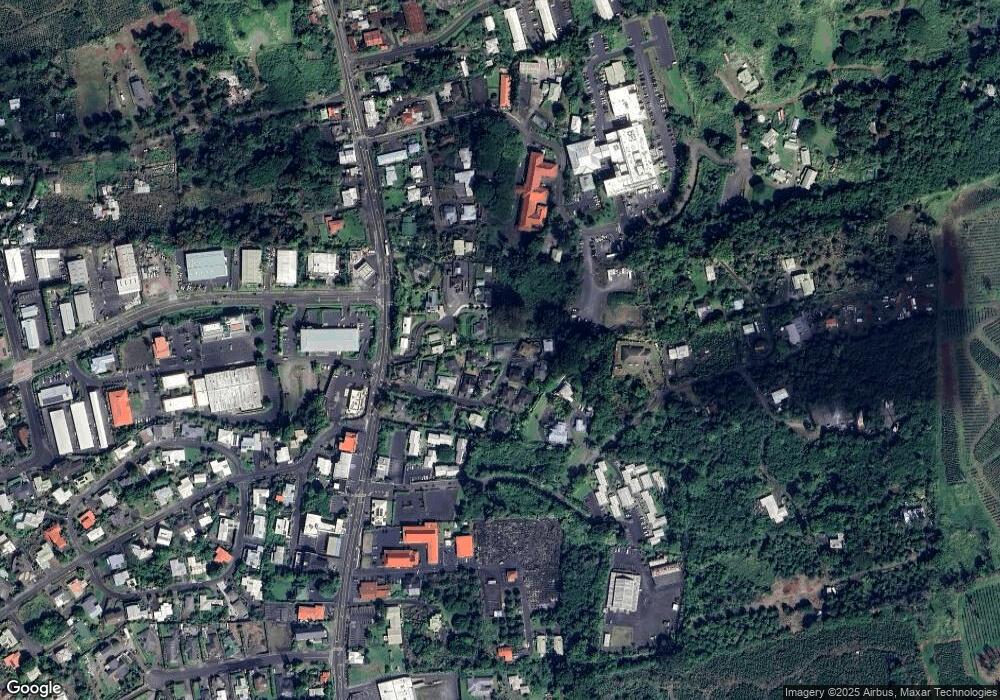

Map

Nearby Homes

- 81-6632 Alalani St

- 81-1031 Keopuka Mauka Rd

- 79-7403 Hawai?i Belt Rd

- 81-6357 Mamalahoa Hwy

- 81-6741 Kauaiki St

- 81-589 Kaiue St

- 81-580 Kaiue St

- 81-464 Piialii Way

- 81-6315 Hawaii Belt Rd

- 81-2026 Haku Nui Rd

- 81-6470 Laukapalala Way

- 81-543 Ala Makaili

- 81-594 Ala Makaili

- 81-476 Pue Way

- 81-528 Kaiue St

- 81-6624 Hiaaiono Place

- 81-467 Keehau St

- 81-6691 Pakaukani Place

- 81-460 Keehau St

- 81-6513 Laupai Way

- 81-1015 A Kakou Place Unit D1

- 81-1013 Akakou Place Unit D2

- 81-1023 Akakou Place Unit F1

- 81-1017 Akakou Place Unit E1

- 81-1017 A Kakou Place Unit E1

- 81-1011 Akakou Place Unit C2

- 81-1027 Akakou Place Unit G2

- 81-1027 A Kakou Place Unit G2

- 81-1009 Akakou Place Unit C1

- 81-1019 Akakou Place Unit E2

- 81-1019 A Kakou Place Unit E2

- 81-1007 Akakou Place Unit B2

- 81-1005 Akakou Place Unit B1

- 81-1021 Akakou Place Unit F2

- 81-1001 Akakou Place Unit A2

- 81-1021 A Kakou Place Unit F2

- 81-1003 Akakou Place Unit A1

- 81-6650 Hawaii Belt Rd

- 0 Ohe Place

- 81-1019 Ohe Place