8121 Parsons Pass Unit 91 New Albany, OH 43054

Estimated Value: $627,000 - $657,000

4

Beds

3

Baths

2,600

Sq Ft

$245/Sq Ft

Est. Value

About This Home

This home is located at 8121 Parsons Pass Unit 91, New Albany, OH 43054 and is currently estimated at $637,375, approximately $245 per square foot. 8121 Parsons Pass Unit 91 is a home located in Franklin County with nearby schools including New Albany Primary School, New Albany Intermediate School, and New Albany Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 13, 2019

Sold by

Kommineni Sashi Kiran and Bondalapati Swapna

Bought by

Dixon Jonathan Allen and Dixon Grace Partridge

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$324,800

Interest Rate

3.6%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 17, 2014

Sold by

Rush Miles D and Rush Erin C

Bought by

Kommineni Sashi Kiran and Bondalapati Swapna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$264,000

Interest Rate

3.37%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Dec 3, 2010

Sold by

M/I Homes Of Central Ohio Llc

Bought by

Rush Miles D and Rush Erin C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$254,139

Interest Rate

4.4%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dixon Jonathan Allen | $406,000 | Kingdom Title Soluions | |

| Kommineni Sashi Kiran | $330,000 | Stewart Title | |

| Rush Miles D | $260,800 | Transohio |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Dixon Jonathan Allen | $324,800 | |

| Previous Owner | Kommineni Sashi Kiran | $264,000 | |

| Previous Owner | Rush Miles D | $254,139 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $11,276 | $181,240 | $38,510 | $142,730 |

| 2023 | $10,675 | $181,240 | $38,510 | $142,730 |

| 2022 | $10,770 | $139,170 | $32,210 | $106,960 |

| 2021 | $10,364 | $139,170 | $32,210 | $106,960 |

| 2020 | $10,284 | $138,750 | $32,210 | $106,540 |

| 2019 | $9,816 | $120,660 | $28,010 | $92,650 |

| 2018 | $9,449 | $120,660 | $28,010 | $92,650 |

| 2017 | $9,491 | $120,660 | $28,010 | $92,650 |

| 2016 | $9,182 | $104,030 | $21,640 | $82,390 |

| 2015 | $8,784 | $104,030 | $21,640 | $82,390 |

| 2014 | $8,625 | $104,030 | $21,640 | $82,390 |

| 2013 | $371 | $3,955 | $3,955 | $0 |

Source: Public Records

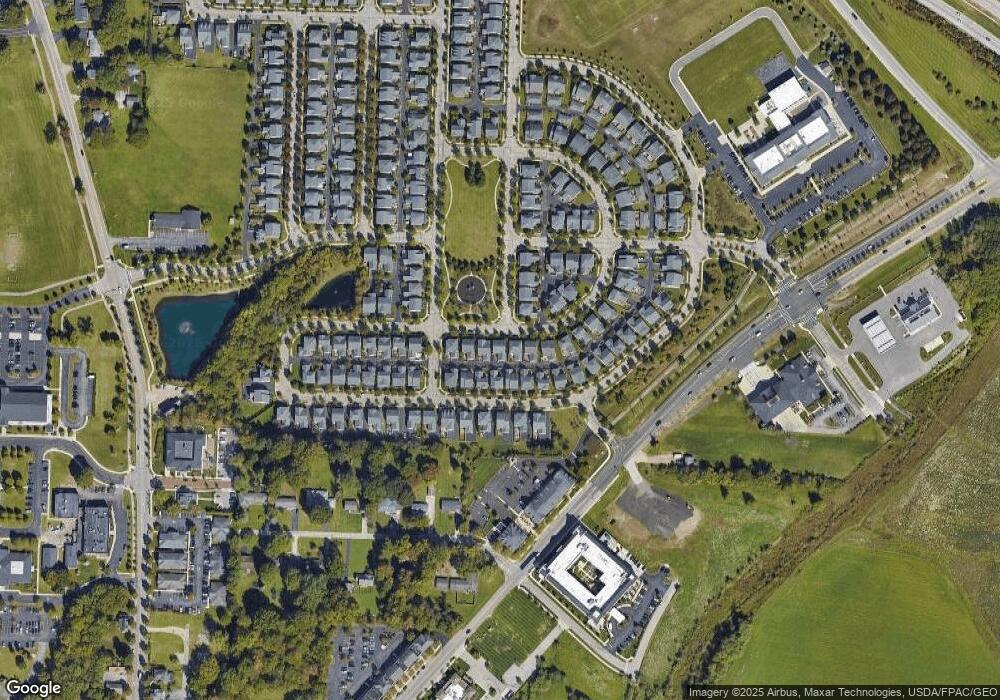

Map

Nearby Homes

- 8127 Griswold Dr

- 8175 Parsons Pass

- 6869 Cedar Brook Place

- 6500 Cedar Glen Ct

- 8309 Marwithe Place

- 105 Keswick Dr

- 115 Keswick Dr

- 5510 Steele Ct

- 5950 Johnstown Rd

- 10087 Johnstown Rd

- 5945 Johnstown Rd

- 4945 Yantis Dr

- 7485 Central College Rd

- 5685 Jersey Dr

- 5692 Sugarwood Dr

- 7075 Maynard Place

- 7072 Maynard Place E

- 6964 Aster Dr

- 6935 Kindler Dr

- 0 Johnstown Rd

- 8121 Parsons Pass

- 8115 Parsons Pass

- 8127 Parsons Pass

- 8133 Parsons Pass

- 8109 Parsons Pass

- 8116 Griswold Dr

- 8122 Griswold Dr

- 8128 Griswold Dr

- 8104 Griswold Dr

- 4968 Butterworth Green Dr

- 8103 Parsons Pass

- 8134 Griswold Dr

- 8098 Griswold Dr

- 4974 Butterworth Green Dr

- 8145 Parsons Pass

- 8140 Griswold Dr

- 8140 Griswold Dr Unit 33SC

- 8115 Griswold Dr

- 8109 Griswold Dr

- 8144 Parsons Pass