8121 Timbertree Way West Chester, OH 45069

West Chester Township NeighborhoodEstimated Value: $193,000 - $254,000

2

Beds

2

Baths

1,824

Sq Ft

$126/Sq Ft

Est. Value

About This Home

This home is located at 8121 Timbertree Way, West Chester, OH 45069 and is currently estimated at $229,140, approximately $125 per square foot. 8121 Timbertree Way is a home located in Butler County with nearby schools including Freedom Elementary School, Lakota Ridge Junior School, and Lakota West High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 19, 2011

Sold by

Howell William L

Bought by

Oneill Flann and Oneill Rebecca Jo

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$34,425

Outstanding Balance

$3,258

Interest Rate

4.12%

Mortgage Type

VA

Estimated Equity

$225,882

Purchase Details

Closed on

Aug 5, 1999

Sold by

Likes Sandra K Tr

Bought by

Howell William L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,350

Interest Rate

7.59%

Purchase Details

Closed on

Dec 9, 1996

Sold by

Akers Sandra J

Bought by

Harwell Roy and Likes Sandra K

Purchase Details

Closed on

Dec 1, 1985

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Oneill Flann | $74,000 | Attorney | |

| Howell William L | $111,500 | -- | |

| Harwell Roy | $127,000 | -- | |

| -- | $70,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Oneill Flann | $34,425 | |

| Previous Owner | Howell William L | $100,350 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,271 | $64,300 | $8,750 | $55,550 |

| 2023 | $2,268 | $64,300 | $8,750 | $55,550 |

| 2022 | $2,289 | $48,990 | $8,750 | $40,240 |

| 2021 | $2,030 | $47,080 | $8,750 | $38,330 |

| 2020 | $2,078 | $47,080 | $8,750 | $38,330 |

| 2019 | $3,754 | $39,170 | $8,750 | $30,420 |

| 2018 | $1,732 | $39,170 | $8,750 | $30,420 |

| 2017 | $1,750 | $39,170 | $8,750 | $30,420 |

| 2016 | $1,680 | $36,030 | $8,750 | $27,280 |

| 2015 | $1,669 | $36,030 | $8,750 | $27,280 |

| 2014 | $2,004 | $36,030 | $8,750 | $27,280 |

| 2013 | $2,004 | $40,480 | $10,500 | $29,980 |

Source: Public Records

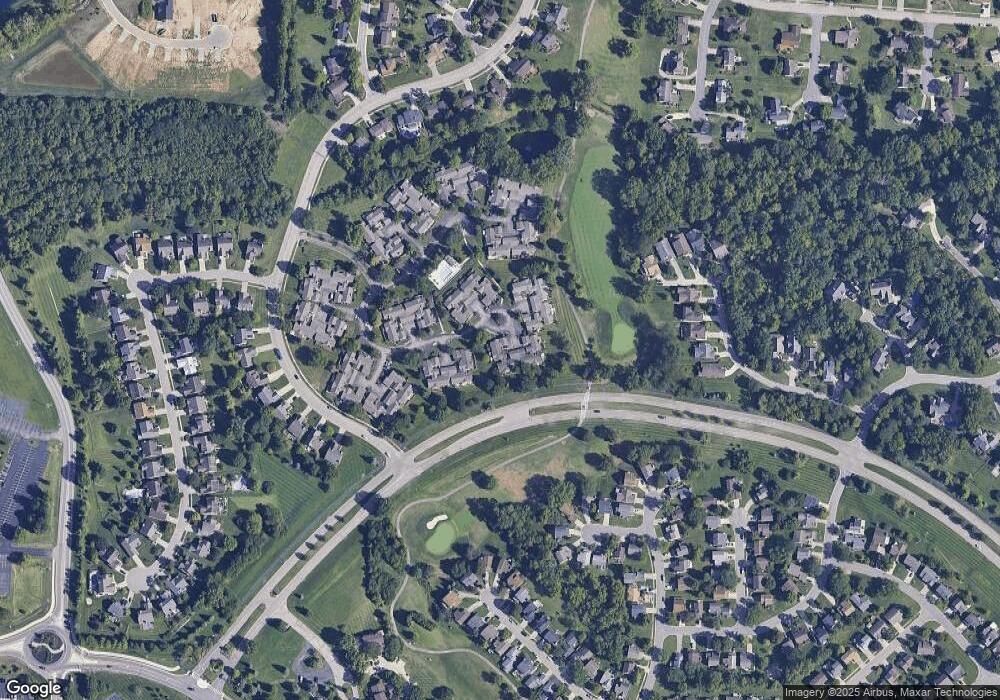

Map

Nearby Homes

- 8051 Timbertree Way Unit 4

- 5281 Woodcliff Ct

- 5299 Fieldstone Dr

- 8185 Pepperwood Dr

- 5271 Pros Dr

- 5356 Pros Dr

- 8392 Spring Valley Ct

- 9107 Park Place Cir

- Promenade Plus Plan at Bel Haven

- Promenade Plan at Bel Haven

- Portico Plus Plan at Bel Haven

- Provenance Plan at Bel Haven

- 8517 Breezewood Ct

- 9003 Galewind Way Unit 9003

- 8434 Woodreed Dr Unit 8434

- 8444 Waterleaf Ln Unit 8444

- 7606 Providence Woods Ct

- 4543 Spikerush Ln Unit 4543

- 5571 Whitetail Cir

- 8336 Park Place

- 8123 Timbertree Way

- 8125 Timbertree Way Unit 2

- 8127 Timbertree Way Unit 1

- 8111 Timbertree Way Unit 1

- 8137 Timbertree Way Unit 4

- 8120 Timbertree Way

- 8126 Timbertree Way Unit 74

- 8131 Timbertree Way Unit 1

- 8115 Timbertree Way Unit 3

- 8124 Timbertree Way Unit 3

- 8133 Timbertree Way

- 8117 Timbertree Way

- 8110 Timbertree Way

- 8112 Timbertree Way Unit 3

- 8114 Timbertree Way Unit 2

- 8024 Timbertree Way

- 8026 Timbertree Way

- 8022 Timbertree Way Unit 2

- 8020 Timbertree Way Unit 1

- 8103 Timbertree Way