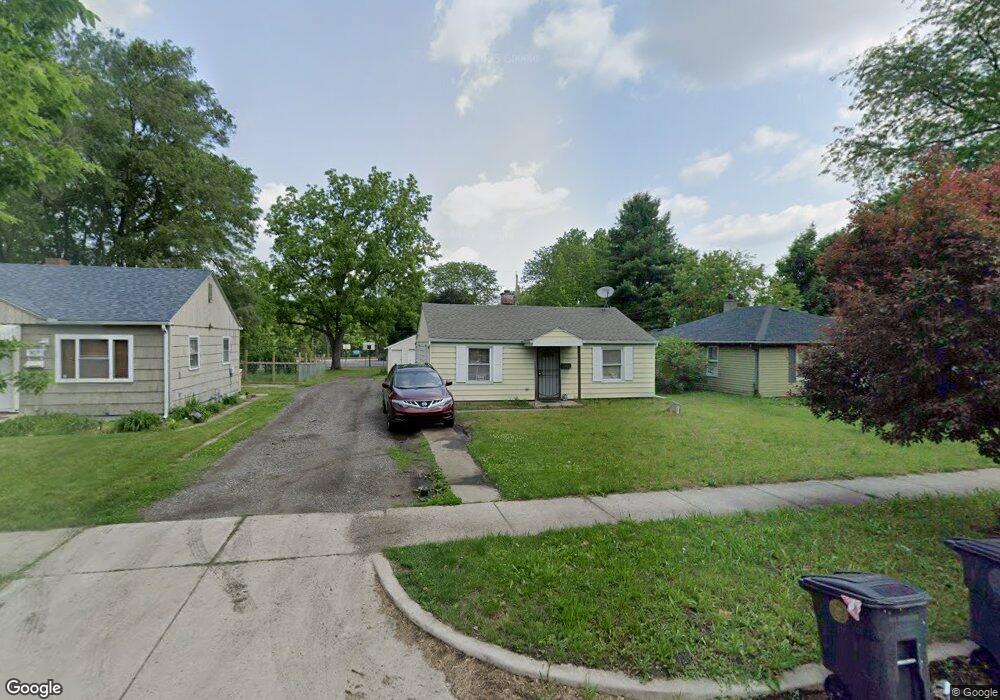

813 W Bryan St South Bend, IN 46616

Keller Park NeighborhoodEstimated Value: $81,173 - $116,000

2

Beds

1

Bath

720

Sq Ft

$134/Sq Ft

Est. Value

About This Home

This home is located at 813 W Bryan St, South Bend, IN 46616 and is currently estimated at $96,293, approximately $133 per square foot. 813 W Bryan St is a home located in St. Joseph County with nearby schools including Muessel Primary Center, Clay Intermediate Center, and Jefferson Intermediate Traditional School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 30, 2020

Sold by

Preferred Trust Company

Bought by

Preferred Trust Company and Larry Bradburn 414300365

Current Estimated Value

Purchase Details

Closed on

Feb 21, 2020

Sold by

Preferred Trust Company

Bought by

Preferred Trust Company and Larry Bradburn 414300365

Purchase Details

Closed on

Mar 26, 2014

Sold by

Bradley Management Llc

Bought by

Preferred Trust Co

Purchase Details

Closed on

Apr 14, 2013

Sold by

Dhf Properties Llc

Bought by

Bradley Management Llc

Purchase Details

Closed on

Nov 24, 2009

Sold by

Woolley Daniel J and Woolley Clara V

Bought by

Dhf Properties Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Preferred Trust Company | -- | None Listed On Document | |

| Preferred Trust Company | -- | -- | |

| Preferred Trust Co | -- | Fidelity National Title | |

| Bradley Management Llc | -- | -- | |

| Dhf Properties Llc | -- | None Available |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,009 | $40,300 | $5,800 | $34,500 |

| 2023 | $605 | $40,500 | $5,800 | $34,700 |

| 2022 | $605 | $25,200 | $5,800 | $19,400 |

| 2021 | $679 | $26,500 | $8,900 | $17,600 |

| 2020 | $679 | $26,500 | $8,900 | $17,600 |

| 2019 | $561 | $25,900 | $8,300 | $17,600 |

| 2018 | $688 | $27,000 | $8,300 | $18,700 |

| 2017 | $712 | $26,900 | $8,300 | $18,600 |

| 2016 | $727 | $26,900 | $8,300 | $18,600 |

| 2014 | $1,043 | $39,900 | $8,300 | $31,600 |

| 2013 | $1,045 | $39,900 | $8,300 | $31,600 |

Source: Public Records

Map

Nearby Homes

- 1815 Sherman Ave

- 248 W Beale St

- 1029 W Bryan St

- 1113 Beale St

- 1105 Queen St

- 1428 Marigold Way Unit 111

- 1922 Berkley Place

- 2106 Hollywood Place

- 1308 Kinyon St

- 1958 Berkley Place

- 2210 Inglewood Place

- 1253 Diamond Ave

- 2237 Hollywood Place

- 1201 Allen St

- 1649 N Adams St

- 1645 N Adams St

- 1710 College St

- 1116 Allen St

- 1838 N Brookfield St

- 1069 Riverside Dr