8130 A1a S Unit G2 Saint Augustine, FL 32080

Butler and Crescent Beaches NeighborhoodEstimated Value: $386,000 - $416,000

2

Beds

2

Baths

1,115

Sq Ft

$361/Sq Ft

Est. Value

About This Home

This home is located at 8130 A1a S Unit G2, Saint Augustine, FL 32080 and is currently estimated at $401,962, approximately $360 per square foot. 8130 A1a S Unit G2 is a home located in St. Johns County with nearby schools including W. Douglas Hartley Elementary School, Gamble Rogers Middle School, and Pedro Menendez High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 7, 2025

Sold by

Lembcke Andrew Edward and Lembcke April Jane

Bought by

Edenfield Trust and Edenfield

Current Estimated Value

Purchase Details

Closed on

Apr 25, 2006

Sold by

Nugent Jack R and Nugent Drucilla M

Bought by

Torbett Joseph L and Torbett Sara A

Purchase Details

Closed on

Apr 24, 2000

Sold by

Hissong Peggy B

Bought by

Nugent Jack R and Nugent Drucilla M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,400

Interest Rate

8.27%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Edenfield Trust | $399,000 | Land Title Of America | |

| Torbett Joseph L | $325,000 | Olde Towne Title & Escrow | |

| Nugent Jack R | $115,000 | Anastasia Title Services Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Nugent Jack R | $106,400 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,241 | $331,000 | -- | $331,000 |

| 2024 | $4,241 | $375,000 | -- | $375,000 |

| 2023 | $4,241 | $352,470 | $0 | $352,470 |

| 2022 | $3,716 | $289,000 | $0 | $289,000 |

| 2021 | $3,046 | $232,500 | $0 | $0 |

| 2020 | $2,782 | $208,000 | $0 | $0 |

| 2019 | $3,141 | $232,000 | $0 | $0 |

| 2018 | $2,809 | $198,000 | $0 | $0 |

| 2017 | $2,670 | $189,000 | $0 | $0 |

| 2016 | $2,439 | $165,000 | $0 | $0 |

| 2015 | $2,304 | $155,000 | $0 | $0 |

| 2014 | $2,086 | $136,000 | $0 | $0 |

Source: Public Records

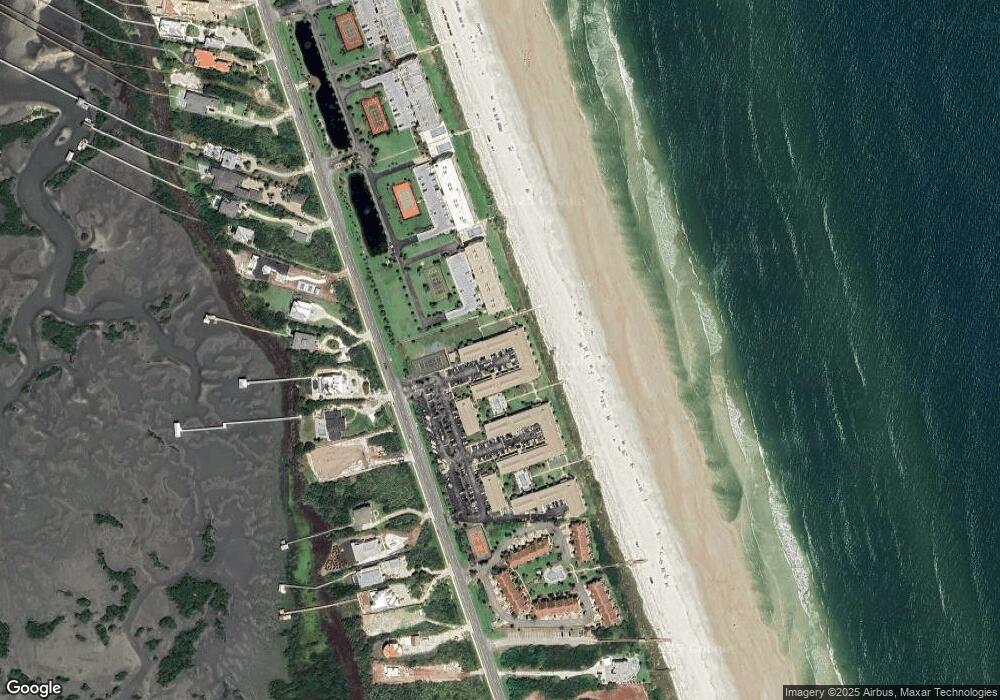

Map

Nearby Homes

- 8130 A1a S Unit H3

- 8130 A1a S Unit B9

- 8130 A1a S Unit H7

- 8130 A1a S Unit J13

- 8130 A1a S Unit J13

- 8130 A1a S Unit H18

- 8090 Jimmy Buffett Memorial Hwy Unit 104

- 8090 A1a S Unit 207

- 8090 A1a S Unit 205

- 8000 A1a S Unit 505

- 8000 A1a S Unit 504

- 8280 A1a S

- 7975 A1a S

- 7950 A1a S Unit 220

- 7950 A1a S

- 7900 A1a S Unit B210

- 7900 A1a S Unit B210

- 7900 A1a S

- 7900 A1a S Unit A214

- 7900 A1a S Unit A214

- 8130 A1a S

- 8130 A1a S Unit F-5

- 8130 A1a S Unit D2

- 8130 A1a S Unit J-3

- 8130 A1a S Unit H-8

- 8130 A1a S Unit J18

- 8130 A1a S

- 8130 A1a S Unit J5

- 8130 A1a S Unit A 6

- 8130 A1a S Unit E14

- 8130 A1a S Unit A10

- 8130 A1a S Unit I11

- 8130 A1a S Unit H10

- 8130 A1a S Unit H8

- 8130 A1a S Unit I12

- 8130 A1a S Unit G7

- 8130 A1a S Unit E11

- 8130 A1a S Unit I13

- 8130 A1a S Unit H-7

- 8130 A1a S Unit F16