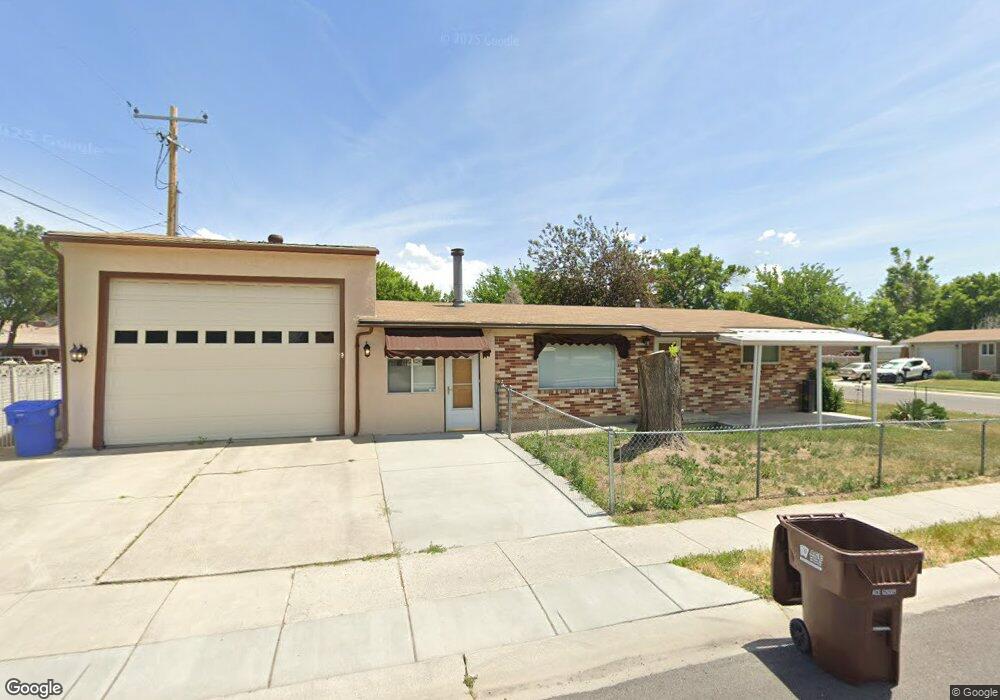

8143 Allen St Midvale, UT 84047

Estimated Value: $450,000 - $492,000

3

Beds

2

Baths

1,150

Sq Ft

$409/Sq Ft

Est. Value

About This Home

This home is located at 8143 Allen St, Midvale, UT 84047 and is currently estimated at $470,161, approximately $408 per square foot. 8143 Allen St is a home located in Salt Lake County with nearby schools including Midvale Elementary School, Midvale Middle School, and Hillcrest High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 20, 2022

Sold by

Mel Saunders Family Trust

Bought by

Fick Darrin and Ruark Danielle

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$440,867

Outstanding Balance

$413,010

Interest Rate

4.16%

Mortgage Type

FHA

Estimated Equity

$57,151

Purchase Details

Closed on

Oct 18, 2021

Sold by

Saunders Melvin J

Bought by

Mel Saunders Family Trust

Purchase Details

Closed on

Oct 11, 2021

Sold by

Saunders Melvin Jackson and Estate Of Ella Junne Saunders

Bought by

Saunders Melvin J

Purchase Details

Closed on

Aug 25, 2009

Sold by

Saunders Junne Charon

Bought by

Charon Rocky Jay

Purchase Details

Closed on

Oct 28, 1997

Sold by

Charon Junne H and Peck Michelle C

Bought by

Charon Junne H

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fick Darrin | -- | Inwest Title | |

| Mel Saunders Family Trust | -- | Ellis Law | |

| Saunders Melvin J | -- | None Available | |

| Charon Rocky Jay | -- | None Available | |

| Charon Junne H | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fick Darrin | $440,867 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,487 | $444,300 | $119,500 | $324,800 |

| 2024 | $2,487 | $424,100 | $113,100 | $311,000 |

| 2023 | $2,429 | $411,500 | $107,500 | $304,000 |

| 2022 | $2,331 | $385,600 | $105,400 | $280,200 |

| 2021 | $2,136 | $303,100 | $96,600 | $206,500 |

| 2020 | $1,826 | $245,600 | $70,200 | $175,400 |

| 2019 | $1,649 | $216,400 | $65,900 | $150,500 |

| 2016 | $1,544 | $192,500 | $65,900 | $126,600 |

Source: Public Records

Map

Nearby Homes

- 652 W Gardenia Dr

- 611 W Beynon Ct

- 7923 S Main St Unit 8

- 8255 S Adams St

- 718 W Blue Magic Ln Unit S201

- 736 W Blue Magic Ln Unit R303

- 736 W Blue Magic Ln Unit R204

- 736 W Blue Magic Ln Unit R202

- 736 W Blue Magic Ln Unit R304

- 736 W Blue Magic Ln Unit R203

- 8345 S Iris Lumi Ln Unit I-304

- 7874 S Main St

- 8362 S Iris Lumi Ln Unit P303

- 7852 Holden St

- 775 Lennox St

- 775 W Lennox St

- 8362 S Iris Lumi Ln Unit P303

- Building Three – Plan Four at Jordan Heights at View 78 - Midvale Jordan Heights

- Building Three – Plan Five at Jordan Heights at View 78 - Midvale Jordan Heights

- Building One – Plan Three at Jordan Heights at View 78 - Midvale Jordan Heights