815 S 100 W Unit 127 Willard, UT 84340

Estimated Value: $579,000 - $660,299

--

Bed

--

Bath

--

Sq Ft

10,019

Sq Ft Lot

About This Home

This home is located at 815 S 100 W Unit 127, Willard, UT 84340 and is currently estimated at $629,825. 815 S 100 W Unit 127 is a home located in Box Elder County with nearby schools including Three Mile Creek School, Adele C. Young Intermediate School, and Box Elder Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 22, 2023

Sold by

Rw Custom Inc

Bought by

Hollenbeck Bryce J and Hollenbeck Laura M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$332,000

Outstanding Balance

$324,959

Interest Rate

6.96%

Mortgage Type

New Conventional

Estimated Equity

$304,866

Purchase Details

Closed on

Apr 20, 2022

Sold by

Rw Custom Inc

Bought by

White Rock Partn Rs Llc

Purchase Details

Closed on

Mar 17, 2022

Sold by

Adams Susan R

Bought by

Rw Custom Inc

Purchase Details

Closed on

Jun 4, 2021

Sold by

Land Marketing Inc

Bought by

Rw Custom Inc

Purchase Details

Closed on

May 20, 2021

Sold by

Land Marketing Inc

Bought by

Rw Custom Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hollenbeck Bryce J | -- | Old Republic Title | |

| White Rock Partn Rs Llc | -- | None Listed On Document | |

| Rw Custom Inc | -- | Backman Title Services | |

| Rw Custom Inc | -- | Mountain View Title Ogden | |

| Rw Custom Inc | -- | Mountain View Title Ogden |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hollenbeck Bryce J | $332,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,143 | $625,717 | $158,000 | $467,717 |

| 2024 | $3,143 | $631,359 | $158,000 | $473,359 |

| 2023 | $3,284 | $669,482 | $165,000 | $504,482 |

| 2022 | $1,283 | $135,000 | $135,000 | $0 |

| 2021 | $0 | $0 | $0 | $0 |

Source: Public Records

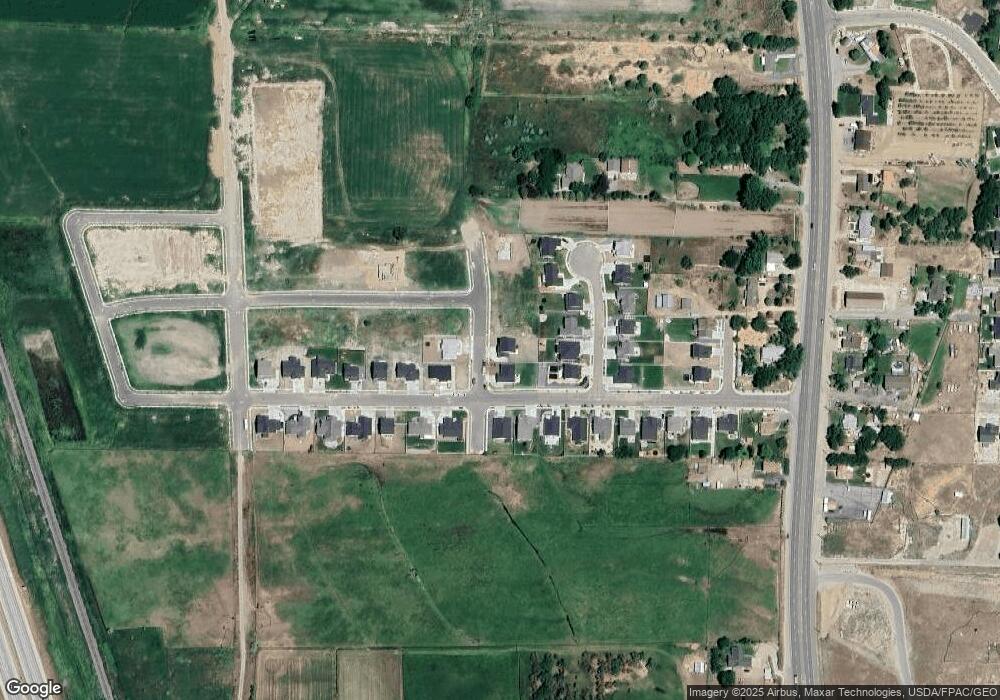

Map

Nearby Homes

- Leighton Plan at Deer Run At Willard Bay - Deer Run

- Foxhill Plan at Deer Run At Willard Bay - Deer Run

- Norfolk Plan at Deer Run At Willard Bay - Deer Run

- Northfield Plan at Deer Run At Willard Bay - Deer Run

- Denford Plan at Deer Run At Willard Bay - Deer Run

- Clearpoint Plan at Deer Run At Willard Bay - Deer Run

- Cambria Plan at Deer Run At Willard Bay - Deer Run

- Berrington Plan at Deer Run At Willard Bay - Deer Run

- Ashland Plan at Deer Run At Willard Bay - Deer Run

- Whitman Plan at Deer Run At Willard Bay - Deer Run

- Ponderosa Plan at Deer Run At Willard Bay - Deer Run

- Twain Plan at Deer Run At Willard Bay - Deer Run

- Hemingway Plan at Deer Run At Willard Bay - Deer Run

- 223 W 800 S Unit 344

- 223 W 800 S

- 228 W 800 S

- 243 W 800 S Unit 346

- 242 W 825 S

- 242 W 825 S Unit 348

- 203 W 800 S

- 815 S 100 W

- 821 S 100 W

- 812 S 100 W Unit 128

- 824 S 100 W Unit 129

- 93 W 825 S

- 93 W 825 S Unit 125

- 804 S 55 W Unit 111

- 804 S 55 W

- 83 W 825 S

- 83 W 825 S Unit 124

- 797 S 100 W Unit 144

- 107 W 825 S Unit 142

- 816 S 55 W Unit 110

- 73 W 825 S Unit 108

- 822 S 55 W Unit 109

- 128 W 825 S Unit 130

- 794 S 55 W Unit 112

- 784 S 55 W Unit 113

- 121 W 825 S

- 121 W 825 S Unit 141