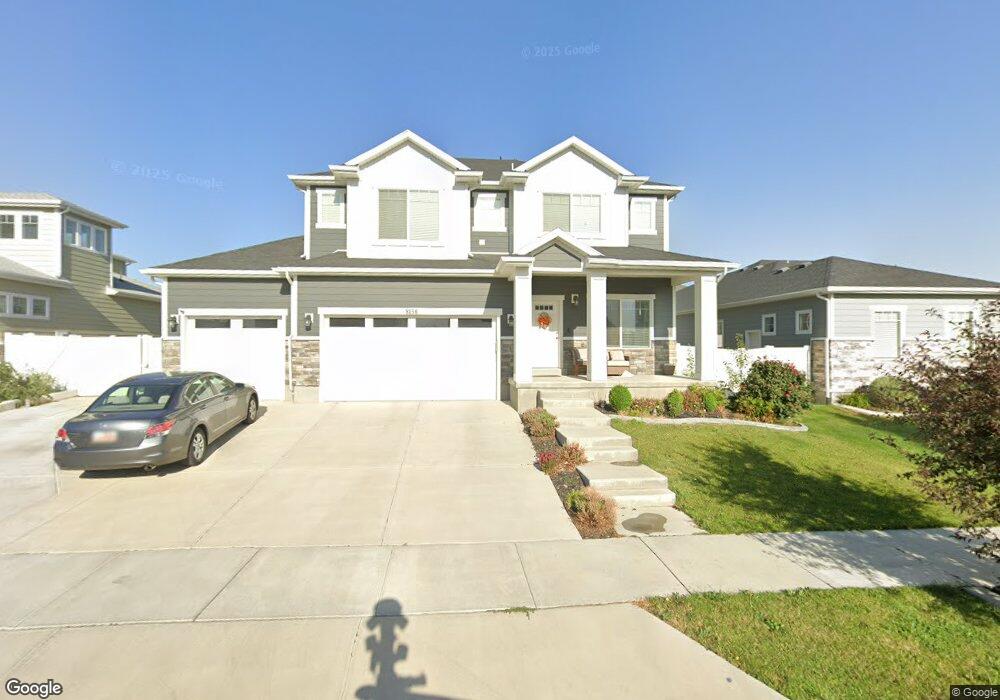

8156 S 6430 W Unit 120 West Jordan, UT 84081

Jordan Hills NeighborhoodEstimated Value: $693,000 - $890,000

3

Beds

3

Baths

3,021

Sq Ft

$252/Sq Ft

Est. Value

About This Home

This home is located at 8156 S 6430 W Unit 120, West Jordan, UT 84081 and is currently estimated at $761,592, approximately $252 per square foot. 8156 S 6430 W Unit 120 is a home located in Salt Lake County with nearby schools including Oakcrest Elementary School, Sunset Ridge Middle School, and Copper Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 29, 2022

Sold by

Child Brent A

Bought by

Rose Donald Dale and Dao Rose Kim

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,000

Outstanding Balance

$111,715

Interest Rate

3.63%

Mortgage Type

New Conventional

Estimated Equity

$649,877

Purchase Details

Closed on

Dec 4, 2017

Sold by

Fieldstone Highlands Llc

Bought by

Child Brent A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$328,772

Interest Rate

3.88%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rose Donald Dale | -- | Cottonwood Title | |

| Child Brent A | -- | Bartlett Title Ins Agcy |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rose Donald Dale | $160,000 | |

| Previous Owner | Child Brent A | $328,772 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,354 | $666,400 | $187,000 | $479,400 |

| 2024 | $3,354 | $645,400 | $181,600 | $463,800 |

| 2023 | $3,413 | $618,800 | $174,600 | $444,200 |

| 2022 | $3,431 | $612,000 | $171,200 | $440,800 |

| 2021 | $2,878 | $467,400 | $134,800 | $332,600 |

| 2020 | $2,728 | $415,800 | $134,800 | $281,000 |

| 2019 | $2,737 | $409,000 | $134,800 | $274,200 |

| 2018 | $2,600 | $385,400 | $132,700 | $252,700 |

| 2017 | $1,494 | $121,300 | $121,300 | $0 |

Source: Public Records

Map

Nearby Homes

- 6466 W Pin Oak Dr

- 8246 S Oak Acorn Ct

- 8269 S 6555 W

- 8043 S Ambrosia Ln

- 8329 S 6430 W

- 7991 S Ambrosia Ln

- 6543 W Oak Bridge Dr

- 8356 S Four Elm Cir

- 6343 W 7900 S

- 7622 Iron Canyon Unit 343

- 7628 S Clipper Hill Rd W Unit 303

- 7068 W Terrain Rd Unit 163

- 6819 S Clever Peak Dr Unit 272

- 6039 W Garnet Grove Way S Unit 221

- 6033 W Garnet Grove Way Unit 223

- 8953 S Smoky Hollow Rd

- 5973 W Hal Row Unit 112

- 8368 S Oak Gate Dr

- 8457 S 6430 W

- 6621 W Braeburn Way

- 8156 S 6430 W

- 8136 S 6430 W Unit 121

- 8136 S 6430 W

- 8166 S 6430 W Unit 119

- 8153 S 6470 W Unit 204

- 8153 S 6470 W

- 8128 S 6430 W

- 8147 S 6430 W

- 8157 S 6430 W

- 8163 S 6470 W

- 8133 S 6470 W

- 8169 S 6430 W

- 8117 S 6470 W Unit 202

- 8117 S 6470 W

- 6447 W 8170 S

- 6437 Lone Wash Way

- 6433 W 8170 S Unit 107

- 8173 S 6430 W

- 6431 W 8170 S Unit 106

- 8123 S 6430 W