816 Draper Heights Way Draper, UT 84020

Estimated Value: $1,621,000 - $1,797,425

5

Beds

6

Baths

4,427

Sq Ft

$388/Sq Ft

Est. Value

About This Home

This home is located at 816 Draper Heights Way, Draper, UT 84020 and is currently estimated at $1,719,142, approximately $388 per square foot. 816 Draper Heights Way is a home located in Salt Lake County with nearby schools including Oak Hollow School, Draper Park Middle School, and Corner Canyon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 26, 2014

Sold by

Bank Of The West

Bought by

Jenkins Charles M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$550,000

Outstanding Balance

$408,330

Interest Rate

3.5%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$1,310,812

Purchase Details

Closed on

Dec 3, 2013

Sold by

Etitle Insurance Agency

Bought by

Bank Of The West

Purchase Details

Closed on

Apr 12, 2013

Sold by

Sparks Rachel F and Sparks Richard L

Bought by

Sparks Richard L

Purchase Details

Closed on

Feb 28, 2008

Sold by

Sparks Richard L and Sparks Rachel F

Bought by

Sparks Rachel F and Sparks Richard L

Purchase Details

Closed on

Apr 26, 2005

Sold by

Remco Draper Heights 41 Lc

Bought by

Sparks Richard Leroy and Sparks Rachel Faye

Purchase Details

Closed on

Sep 13, 2001

Sold by

Remco Management Lc

Bought by

Remco Draper Heights 40 Lc

Purchase Details

Closed on

Aug 5, 1998

Sold by

U S General Inc

Bought by

Remco Management L C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jenkins Charles M | -- | Metro National Title | |

| Bank Of The West | $746,226 | Etitle Insurance Agency | |

| Sparks Richard L | -- | First American Title | |

| Sparks Rachel F | -- | None Available | |

| Sparks Richard Leroy | -- | First American Title | |

| Remco Draper Heights 40 Lc | -- | -- | |

| Remco Management L C | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jenkins Charles M | $550,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $1,404,700 | $428,400 | $976,300 |

| 2024 | -- | $1,315,400 | $416,100 | $899,300 |

| 2023 | $6,721 | $1,274,500 | $409,500 | $865,000 |

| 2022 | $6,952 | $1,273,300 | $401,400 | $871,900 |

| 2021 | $6,873 | $1,075,400 | $321,400 | $754,000 |

| 2020 | $6,595 | $978,100 | $298,900 | $679,200 |

| 2019 | $6,655 | $964,400 | $293,200 | $671,200 |

| 2018 | $0 | $960,800 | $293,200 | $667,600 |

| 2017 | $5,328 | $756,000 | $279,700 | $476,300 |

| 2016 | $5,270 | $726,600 | $279,700 | $446,900 |

| 2015 | $6,116 | $780,900 | $248,600 | $532,300 |

| 2014 | $5,868 | $731,900 | $262,400 | $469,500 |

Source: Public Records

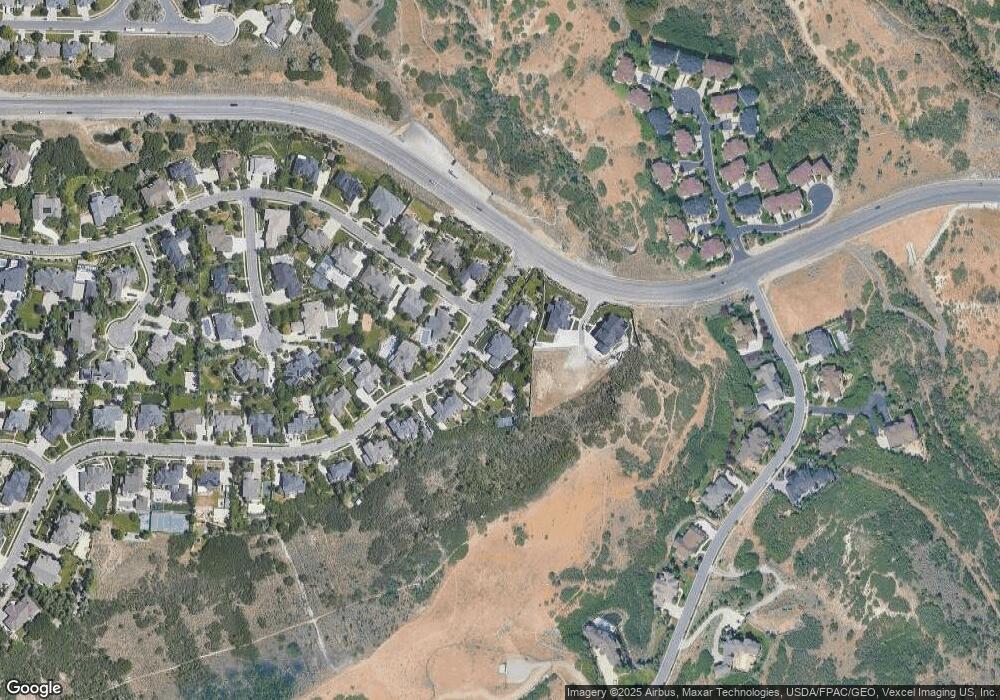

Map

Nearby Homes

- 909 E Rosebud Ct

- 898 E Tendoy Ct

- 14687 S Nestled Cove

- 492 W Maidengrass Way

- 14669 S Faulkridge Ct Unit 106

- 14793 S Vintage View Ln Unit 14

- 13164 S City Point Cove Unit 1

- 1314 E Victor Ln

- 13189 S City Point Cove E Unit 4

- 1349 E Elk Unit 33

- 581 E Draper Woods Way

- 14659 S Culross Ln

- 427 E Parowan Way

- 928 E Rocky Mouth Ln

- 455 E Rocky Mouth Ln

- 919 E Rocky Mouth Ln

- 413 Steep Mountain Dr

- 913 E Spiers Ln

- 1263 E Wild Maple Ct

- 14345 Lapis Dr

- 816 E Draper Heights Way

- 806 Draper Heights Way

- 822 E Draper Heights Way Unit 40,4

- 822 E Draper Heights Way

- 804 E Draper View Rd Unit 103

- 804 E Draper View Rd

- 804 Draper View Rd

- 822 Draper Heights Way

- 14726 S Aulani Cove

- 798 E Draper Heights Way

- 809 E Draper View Rd

- 809 Draper View Rd

- 798 Draper Heights Way

- 792 E Draper View Rd Unit 102

- 792 E Draper View Rd

- 792 Draper View Rd

- 791 Draper Heights Way

- 14731 S Aulani Cove

- 799 E Draper View Rd

- 799 Draper View Rd