8164 Marcy Rd NW Lancaster, OH 43130

Bloom NeighborhoodEstimated Value: $623,000 - $743,145

5

Beds

2

Baths

3,462

Sq Ft

$197/Sq Ft

Est. Value

About This Home

This home is located at 8164 Marcy Rd NW, Lancaster, OH 43130 and is currently estimated at $683,286, approximately $197 per square foot. 8164 Marcy Rd NW is a home located in Fairfield County with nearby schools including Bloom Carroll Primary School, Bloom Carroll Intermediate School, and Bloom-Carroll Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 15, 2017

Sold by

Kasson Gregory M and Kasson Theresa J

Bought by

Winkler Bartholomew O and Winkler Emily A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,000

Outstanding Balance

$143,027

Interest Rate

4.19%

Mortgage Type

Future Advance Clause Open End Mortgage

Estimated Equity

$540,259

Purchase Details

Closed on

Oct 5, 2007

Sold by

Kiger Robert L and Barry Beverlee E

Bought by

Kasson Gregory M and Kasson Theresa J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$232,000

Interest Rate

6.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 1, 1989

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Winkler Bartholomew O | $350,000 | Valmer Land Title Agency | |

| Kasson Gregory M | $290,000 | Title First Agency Inc | |

| -- | $130,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Winkler Bartholomew O | $280,000 | |

| Closed | Kasson Gregory M | $232,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $15,659 | $190,040 | $53,110 | $136,930 |

| 2023 | $8,084 | $190,040 | $53,110 | $136,930 |

| 2022 | $8,146 | $190,040 | $53,110 | $136,930 |

| 2021 | $6,623 | $139,580 | $42,490 | $97,090 |

| 2020 | $6,695 | $139,580 | $42,490 | $97,090 |

| 2019 | $6,716 | $139,580 | $42,490 | $97,090 |

| 2018 | $4,538 | $80,130 | $35,690 | $44,440 |

| 2017 | $3,527 | $78,430 | $33,990 | $44,440 |

| 2016 | $3,475 | $78,430 | $33,990 | $44,440 |

| 2015 | $3,422 | $75,070 | $33,990 | $41,080 |

| 2014 | $3,285 | $75,070 | $33,990 | $41,080 |

| 2013 | $3,285 | $75,070 | $33,990 | $41,080 |

Source: Public Records

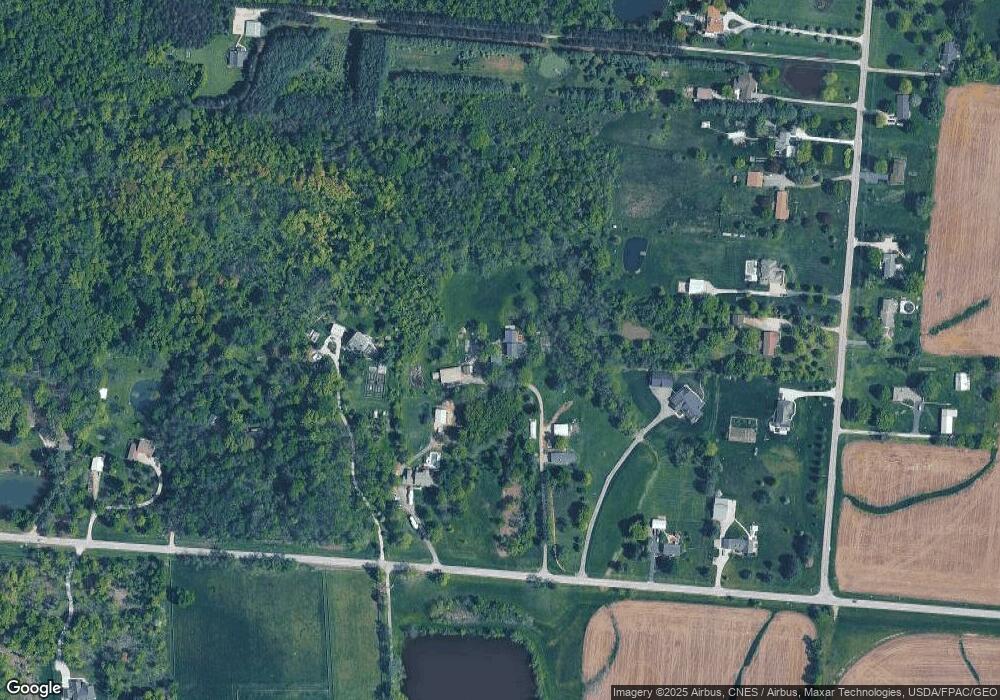

Map

Nearby Homes

- 7835 E Ohio State Ln NW

- 839 Rockmill Rd NW

- 7985 Lithopolis Rd NW

- 8642 Water St

- 9605 Royalton Rd SW

- 1975 Lamb Rd NW

- 10 Mount Zion Rd NW

- 8322 Benson Rd

- 2780 Cedar Hill Rd NW

- 10385 Lithopolis Rd NW

- 681 Mount Zion Rd SW

- 4180 Stone Hill Drive East NW

- 1219 W Slate Ridge Dr

- 11394 Cedar Creek Dr NW

- 6920 Winchester Rd NW

- 4900 Pickerington Rd NW

- 8416 Royalton Rd SW

- 8245 Royalton Rd SW

- 8143 Royalton Rd SW

- 2155 Carroll-Southern Rd NW

- 8160 Marcy Rd NW

- 8132 Marcy Rd NW

- 8228 Marcy Rd NW

- 8270 Marcy Rd NW

- 8090 Marcy Rd NW

- 8050 Marcy Rd NW

- 1093 Heister Rd NW

- 1145 Heister Rd NW

- 1195 Heister Rd NW

- 8380 Marcy Rd NW

- 1245 Heister Rd NW

- 1180 Heister Rd NW

- 1331 Heister Rd NW

- 1210 Heister Rd NW

- 1265 Heister Rd NW

- 1100 Heister Rd NW

- 1291 Heister Rd NW

- 1250 Heister Rd NW

- 8430 Marcy Rd NW

- 1345 Heister Rd NW