8173 Dripping Springs Rd Denison, TX 75021

Estimated Value: $835,000 - $907,370

4

Beds

4

Baths

3,988

Sq Ft

$218/Sq Ft

Est. Value

About This Home

This home is located at 8173 Dripping Springs Rd, Denison, TX 75021 and is currently estimated at $871,185, approximately $218 per square foot. 8173 Dripping Springs Rd is a home located in Grayson County with nearby schools including Lamar Elementary School, Scott Middle School, and Denison High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 27, 2019

Sold by

Lamance Jade D and Lamance Tiffany

Bought by

Murphy David and Murphy Heather R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$435,000

Outstanding Balance

$385,079

Interest Rate

3.7%

Mortgage Type

New Conventional

Estimated Equity

$486,106

Purchase Details

Closed on

Dec 1, 2011

Sold by

Alcoholic Services Of Texoma Inc

Bought by

Lamance Jade D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

4.13%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 22, 2007

Sold by

Darr Mitchell and Darr Ellen

Bought by

Lamance Jade D and Lamance Tiffany

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,500

Interest Rate

6.21%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Murphy David | -- | Red River Title Co | |

| Lamance Jade D | -- | Red River Title Co | |

| Lamance Jade D | -- | Grayson County Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Murphy David | $435,000 | |

| Previous Owner | Lamance Jade D | $100,000 | |

| Previous Owner | Lamance Jade D | $40,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,413 | $859,686 | $274,968 | $584,718 |

| 2024 | $13,067 | $809,088 | $220,094 | $588,994 |

| 2023 | $10,793 | $770,506 | $0 | $0 |

| 2022 | $12,103 | $700,460 | $165,910 | $534,550 |

| 2021 | $12,168 | $649,017 | $149,499 | $499,518 |

| 2020 | $11,234 | $564,286 | $109,550 | $454,736 |

| 2019 | $10,491 | $504,510 | $109,550 | $394,960 |

| 2018 | $9,640 | $468,694 | $104,624 | $364,070 |

| 2017 | $9,752 | $451,396 | $94,674 | $356,722 |

| 2016 | $9,065 | $371,144 | $64,853 | $306,291 |

| 2015 | $8,137 | $373,603 | $65,117 | $308,486 |

| 2014 | $7,827 | $359,370 | $54,924 | $304,446 |

Source: Public Records

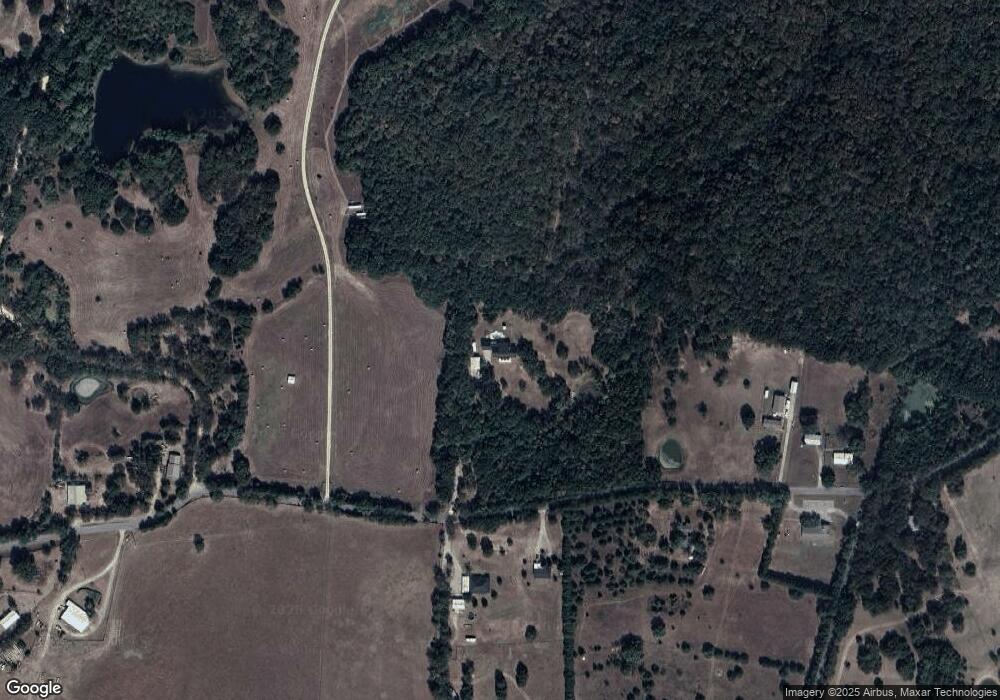

Map

Nearby Homes

- TBD 2 Dripping Springs Ridge

- 9425 Dripping Springs Rd

- 1805 Arthur Rd

- 312 Magnus Rd

- 9591 Dripping Springs Rd

- 9771 Dripping Spring Rd

- 249 Martin Dr

- 235 Magnus Rd

- 3557 US Highway 69

- 153 Kelsey Rd

- 4942 Us Highway 69

- 9426 Dripping Spring Rd

- 9436 Dripping Spring Rd

- 9408 Dripping Spring Rd

- 9386 Dripping Spring Rd

- 66 Shady Woods Ln

- 3105 U S 69

- 811 Russell Ln

- TBD Cross Timber Estates Dr

- 492 Russell Ln

- 8393 Dripping Springs Rd

- 8342B Dripping Springs Rd

- 8342A Dripping Springs Rd

- 8172 Dripping Springs Rd

- 9741 Dripping Spring Rd

- 8437 Dripping Springs Rd

- 7950 Dripping Springs Rd

- 1747 Calf Creek Ln

- 1735 Calf Creek Ln

- 1745 Calf Creek Ln

- 8916 Dripping Springs Rd

- 7555 Dripping Springs Rd

- 7555 Dripping Springs Rd

- 7555 Dripping Springs Rd

- 723 Jim Lamb Rd

- 1529 Calf Creek Ln

- 1489 Calf Creek Ln

- 7358 Dripping Springs Rd

- 908 Trail Rd

- 818 Trail Rd