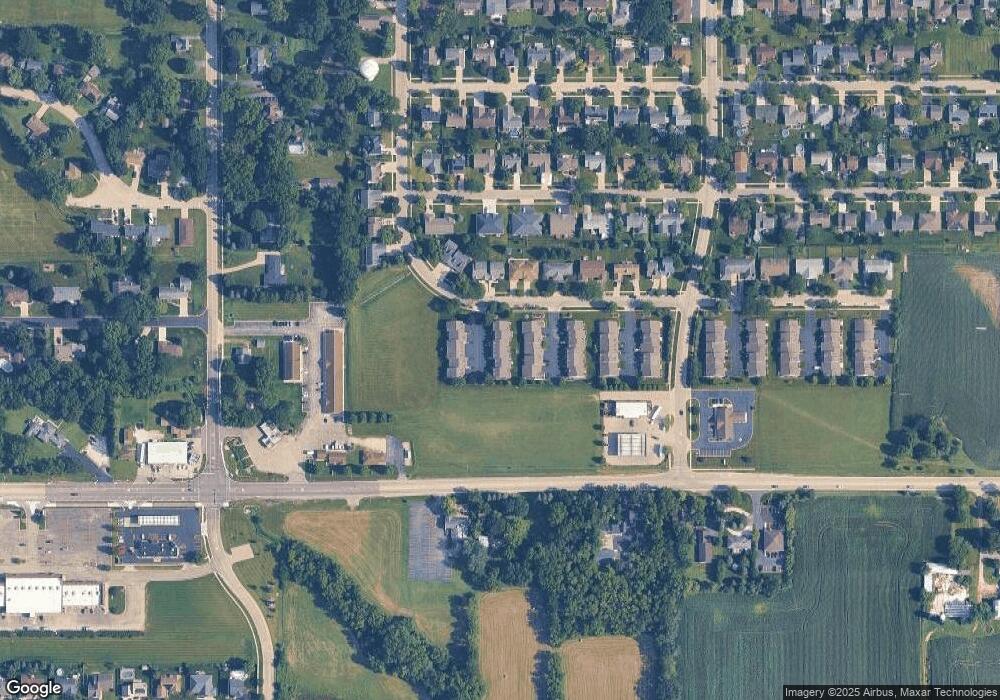

819 Casey Ln Hampshire, IL 60140

Estimated Value: $258,000 - $278,846

3

Beds

2

Baths

1,736

Sq Ft

$157/Sq Ft

Est. Value

About This Home

This home is located at 819 Casey Ln, Hampshire, IL 60140 and is currently estimated at $271,962, approximately $156 per square foot. 819 Casey Ln is a home located in Kane County with nearby schools including Hampshire Elementary School, Hampshire Middle School, and Hampshire High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 16, 2004

Sold by

Oak Brook Bank

Bought by

Spanos Christopher J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$77,500

Outstanding Balance

$38,316

Interest Rate

6.17%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$233,646

Purchase Details

Closed on

Oct 20, 1995

Sold by

Palazzolo Giuseppe and Palazzolo Annette M

Bought by

Oak Brook Bank

Purchase Details

Closed on

Aug 15, 1995

Sold by

Algonquin State Bank

Bought by

Palazzolo Guiseppe and Palazzolo Annette

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$30,000

Interest Rate

7.64%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Spanos Christopher J | $187,500 | 1St American Title | |

| Oak Brook Bank | -- | -- | |

| Palazzolo Guiseppe | $121,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Spanos Christopher J | $77,500 | |

| Previous Owner | Palazzolo Guiseppe | $30,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,451 | $76,724 | $16,723 | $60,001 |

| 2023 | $4,152 | $69,015 | $15,043 | $53,972 |

| 2022 | $4,211 | $63,427 | $13,825 | $49,602 |

| 2021 | $4,349 | $64,547 | $13,041 | $51,506 |

| 2020 | $3,447 | $62,336 | $12,685 | $49,651 |

| 2019 | $3,530 | $60,298 | $12,270 | $48,028 |

| 2018 | $3,662 | $55,081 | $10,648 | $44,433 |

| 2017 | $3,709 | $52,902 | $10,227 | $42,675 |

| 2016 | $4,062 | $49,730 | $9,614 | $40,116 |

| 2015 | -- | $46,222 | $8,936 | $37,286 |

| 2014 | -- | $44,697 | $8,641 | $36,056 |

| 2013 | -- | $47,555 | $9,193 | $38,362 |

Source: Public Records

Map

Nearby Homes

- 895 S State St

- 318 Old Mill Ln

- 704 S State St

- 120 Jack Dylan Dr

- 190 Grove Ave

- 263 E Jackson Ave

- LOT 37 W Oak Knoll Dr

- 730 Bruce Dr

- 862 Briar Glen Ct

- 804 Briar Glen Ct

- 820 Briar Glen Ct

- 602 Woodside Terrace

- 431 Patricia Ln

- 1655 Windsor Rd

- 808 James Dr

- 125 Mill Ave

- 720 James Dr

- 14N693 Getzelman Rd

- Lot 0 N State St

- 1053 Marcello Dr