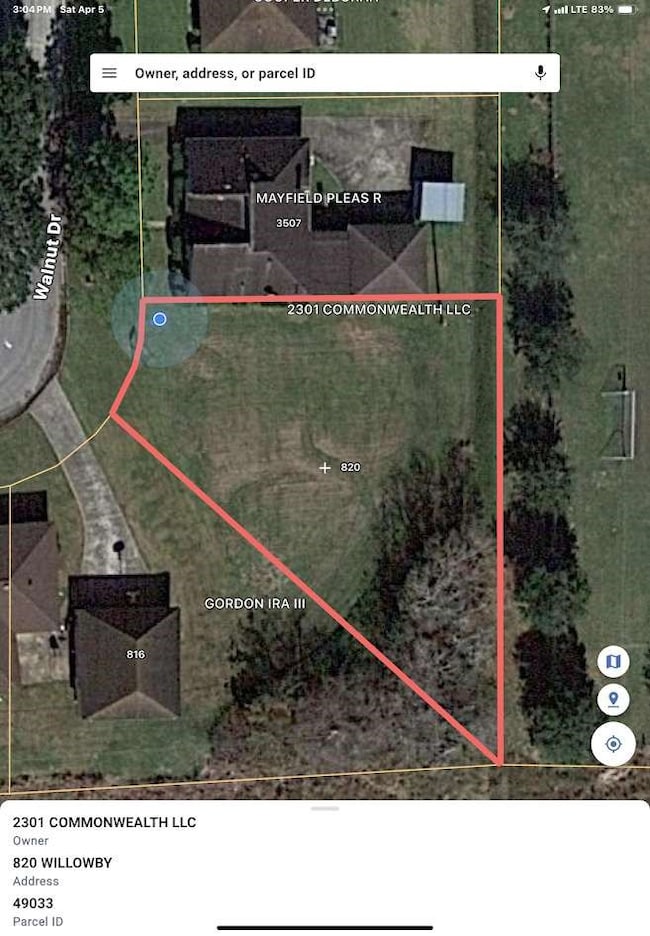

820 Willowby St Bay City, TX 77414

Estimated payment $182/month

About This Lot

ALMOST A HALF ACRE! This 0.45-acre land lot at 820 Willowby St. in Bay City, TX 77414, provides a prime opportunity to build a dream home in a community known for its welcoming atmosphere and rich cultural heritage. Situated in a serene neighborhood, this property combines the charm of small-town living with the convenience of access to Bay City's vibrant downtown, renowned for its local eateries, shopping, and entertainment options. Bay City, nestled in the heart of Matagorda County, offers residents a unique lifestyle enriched by its proximity to the beautiful Texas Gulf Coast, providing ample opportunities for fishing, boating, and beach activities. WE MAKE IT EASY TO OWN. This is a great opportunity! Don't wait, call us today to get more information on the owner's easy terms and smooth process that may be able to put the deed in your name and make this your dream property,

Property Details

Property Type

- Land

Est. Annual Taxes

- $589

Lot Details

- 0.46 Acre Lot

Schools

- Roberts Elementary School

- Bay City Junior High School

- Bay City High School

Community Details

- Whitson Heights Sub Subdivision

Map

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5 | $21,930 | $21,930 | $0 |

| 2023 | $366 | $15,690 | $15,690 | $0 |

| 2022 | $169 | $6,330 | $6,330 | $0 |

| 2021 | $186 | $6,330 | $6,330 | $0 |

| 2020 | $193 | $6,330 | $6,330 | $0 |

| 2019 | $193 | $6,330 | $6,330 | $0 |

| 2018 | $186 | $6,330 | $6,330 | $0 |

| 2017 | $177 | $6,330 | $6,330 | $0 |

| 2016 | $177 | $6,330 | $6,330 | $0 |

| 2015 | -- | $6,330 | $6,330 | $0 |

| 2014 | -- | $6,330 | $6,330 | $0 |

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 11/17/2025 11/17/25 | For Sale | $25,219 | -- | -- |

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Sheriffs Deed | $1,234 | None Listed On Document | |

| Trustee Deed | $2,800 | None Listed On Document | |

| Vendors Lien | -- | None Available |

Mortgage History

| Date | Status | Loan Amount | Loan Type |

|---|---|---|---|

| Previous Owner | $4,400 | New Conventional |

Source: Houston Association of REALTORS®

MLS Number: 11982133

APN: 49033

- 913 Whitson St

- 3216 Moore Ave

- 3200 Moore Ave

- 3511 Roberts Rd

- 1316 Rampart St

- 2919 Letulle Ave

- 3000 J P Davis Ave

- 2802 Park Ave

- 2809 Moore Ave

- 1408 Austin St

- 2912 Avenue C

- 1200 Rugeley St

- 1717 Marguerite St

- 3320 Brooks Ave

- 3021 Avenue F

- 4105 Mockingbird Ln

- 3120 Avenue H

- 1609 Rugeley St

- 1712 Matthews St

- 2710 Avenue F

- 815 Rugeley St

- 1700 Baywood Dr

- 4408 Hiram Brandon Dr

- 2710 Avenue F

- 2818 Avenue G Unit 2818

- 1404 6th St

- 1901 Palm Village Blvd

- 2305 Linwood Ln

- 5001 Avenue F

- 4901 Misty Ln

- 3021 Sycamore Ave Unit 1

- 3021 Sycamore Ave

- 3021 Sycamore Ave Unit 4

- 3021 Sycamore Ave Unit 10

- 2115 Avenue L Unit Downstairs

- 5212 Oak Manor Blvd

- 1700 Avenue H

- 2307 Elm Ave Unit 2307

- 2303 Elm Ave Unit 2

- 2218 Holly Lane Apartments Dr