8201 Hill Ave Holland, OH 43528

Estimated Value: $246,000 - $394,000

3

Beds

2

Baths

1,830

Sq Ft

$176/Sq Ft

Est. Value

About This Home

This home is located at 8201 Hill Ave, Holland, OH 43528 and is currently estimated at $322,754, approximately $176 per square foot. 8201 Hill Ave is a home located in Lucas County with nearby schools including Dorr Street Elementary School, Springfield Middle School, and Springfield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 22, 2022

Sold by

Sloan Kathy Michelle and Sloan Sharon Denise

Bought by

Sloan Calvin C and Sloan Elexis

Current Estimated Value

Purchase Details

Closed on

Dec 10, 2021

Sold by

Martha B Sloan Revocable Trust and Gray Ximena

Bought by

Sloan Calvin C and Sloan Elexis A

Purchase Details

Closed on

Jul 24, 2020

Sold by

Sloan Martha B and Gray Ximena

Bought by

Gray Ximena

Purchase Details

Closed on

Nov 15, 2019

Sold by

Sloan Linda Ethel

Bought by

Clark Fredrick L

Purchase Details

Closed on

Jun 7, 2016

Sold by

Sloan Martha B

Bought by

Sloan Martha B and Martha B Solan Revocable Trust

Purchase Details

Closed on

Aug 20, 2003

Sold by

Estate Of Calvin C Sloansr

Bought by

Sloan Calvin C and Sloan Linda Ethel

Purchase Details

Closed on

Aug 24, 1992

Sold by

Moore Martha B

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sloan Calvin C | $155,000 | None Listed On Document | |

| Sloan Calvin C | $155,000 | Midland Title | |

| Gray Ximena | -- | None Available | |

| Clark Fredrick L | -- | None Available | |

| Sloan Martha B | -- | None Available | |

| Sloan Calvin C | -- | -- | |

| -- | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,316 | $109,795 | $47,670 | $62,125 |

| 2023 | $6,421 | $92,995 | $41,965 | $51,030 |

| 2022 | $6,422 | $92,995 | $41,965 | $51,030 |

| 2021 | $5,479 | $92,995 | $41,965 | $51,030 |

| 2020 | $5,146 | $80,500 | $35,210 | $45,290 |

| 2019 | $5,026 | $80,500 | $35,210 | $45,290 |

| 2018 | $4,951 | $80,500 | $35,210 | $45,290 |

| 2017 | $5,258 | $78,400 | $35,385 | $43,015 |

| 2016 | $5,307 | $224,000 | $101,100 | $122,900 |

| 2015 | $5,297 | $224,000 | $101,100 | $122,900 |

| 2014 | $4,731 | $75,390 | $34,020 | $41,370 |

| 2013 | $4,731 | $75,390 | $34,020 | $41,370 |

Source: Public Records

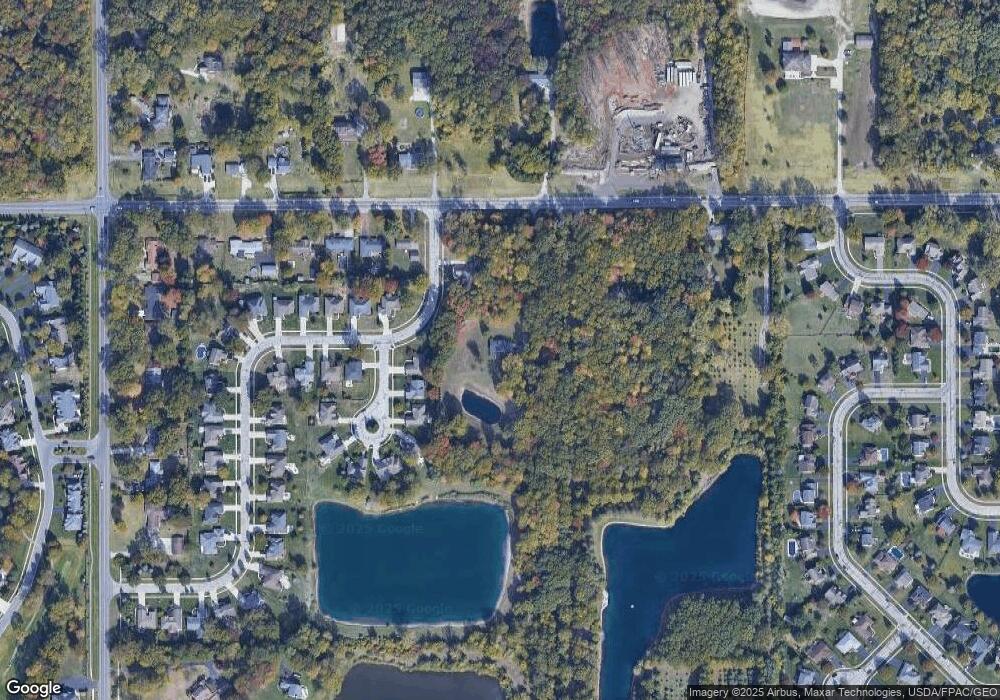

Map

Nearby Homes

- 68 Hidden Meadow Dr

- 126 Hidden Meadow Dr

- 8046 Lea Ct

- 7944 Hill Ave

- 8006 Cove Harbour Dr N

- 7909 Hill Ave

- 44 Treetop Place

- 215 Stone Oak Ct

- 8553 Stone Oak Dr

- 7920 N Shoreline Dr

- 8435 Willow Glen Ct

- 8617 Ponte Vedra Ct

- 8670 Augusta Ln

- 540 S Centennial Rd

- 612 S Centennial Rd

- 7709 Fountain Dr

- 7 Tremore Way

- 8760 Nebraska Ave

- 8945 Oak Valley Rd

- 8733 Saint George Dr

- 43 Beachfront Ct

- 8215 Water Park Dr

- 51 Beachfront Ct

- 59 Beachfront Ct

- 8155 Hill Ave

- 8240 Water Park Dr

- 8241 Hill Ave

- 67 Beachfront Ct

- 48 Beachfront Ct

- 8251 Hill Ave

- 8262 Water Park Dr

- 75 Beachfront Ct

- 8265 Water Park Dr

- 58 Beachfront Ct

- 8261 Hill Ave

- 8270 Water Park Dr

- 8140 Hill Ave

- 74 Beachfront Ct

- 8273 Water Park Dr

- 66 Beachfront Ct