8204 277th St E Unit Lot8 Graham, WA 98338

Estimated Value: $966,393 - $1,030,000

4

Beds

3

Baths

3,607

Sq Ft

$280/Sq Ft

Est. Value

About This Home

This home is located at 8204 277th St E Unit Lot8, Graham, WA 98338 and is currently estimated at $1,011,598, approximately $280 per square foot. 8204 277th St E Unit Lot8 is a home located in Pierce County with nearby schools including Rocky Ridge Elementary School, Cougar Mountain Middle School, and Bethel High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 8, 2015

Sold by

Noble Carolyn and Noble Alexander

Bought by

Cooper Amber L

Current Estimated Value

Purchase Details

Closed on

Apr 28, 2008

Sold by

Builtwell Structures Inc

Bought by

Noble Carolyn and Noble Alexander

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

5.81%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 10, 2006

Sold by

Sunwood Estates Llc

Bought by

Builtwell Structures Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$4,706,400

Interest Rate

6.66%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cooper Amber L | $464,719 | First American Title Ins Co | |

| Noble Carolyn | $575,000 | Puget Sound Title Company | |

| Builtwell Structures Inc | $1,945,000 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Noble Carolyn | $200,000 | |

| Previous Owner | Builtwell Structures Inc | $4,706,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,687 | $944,000 | $244,400 | $699,600 |

| 2024 | $9,687 | $917,200 | $240,000 | $677,200 |

| 2023 | $9,687 | $849,700 | $210,000 | $639,700 |

| 2022 | $9,630 | $864,200 | $226,000 | $638,200 |

| 2021 | $8,973 | $658,200 | $170,900 | $487,300 |

| 2019 | $7,381 | $622,700 | $145,600 | $477,100 |

| 2018 | $8,402 | $590,800 | $126,500 | $464,300 |

| 2017 | $7,465 | $538,600 | $109,400 | $429,200 |

| 2016 | -- | $423,300 | $74,700 | $348,600 |

| 2014 | $5,972 | $397,200 | $79,100 | $318,100 |

| 2013 | $5,972 | $385,400 | $76,200 | $309,200 |

Source: Public Records

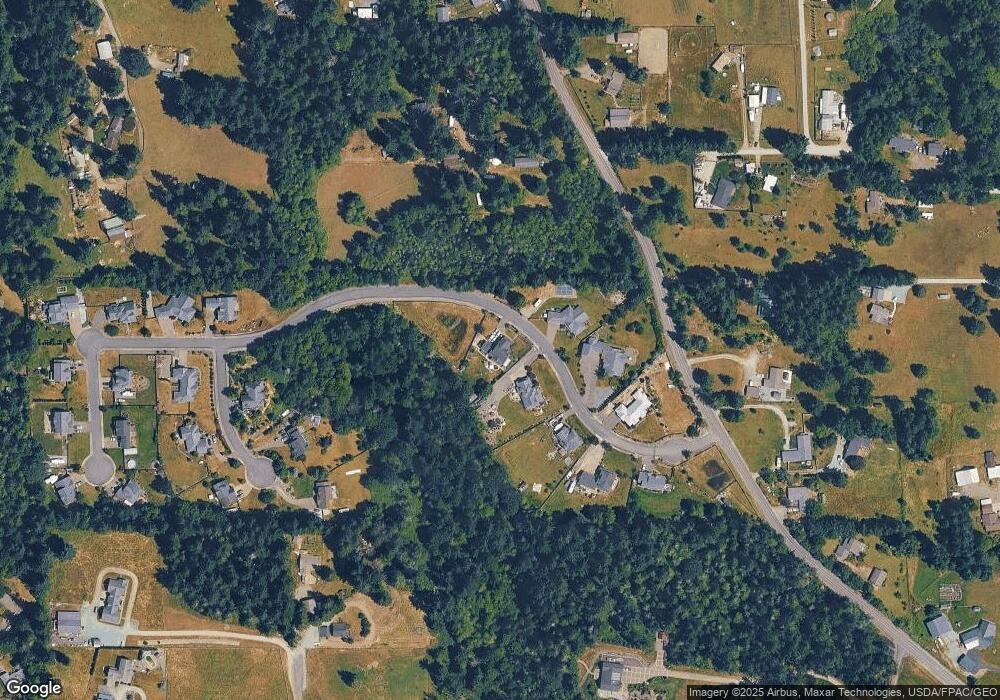

Map

Nearby Homes

- 27507 72nd Ave E

- 28205 73rd Ave E

- 8112 266th St E

- 28905 71st Ave E

- 27721 Webster Rd E

- 0 Meridian St E Unit NWM2315911

- 25713 64th Avenue Ct E Unit 6

- 25608 68th Ave E

- 25712 64th Avenue Ct E Unit 5

- 11518 264th St E

- 25623 64th Avenue Ct E Unit 9

- 6908 254th St E

- 25704 64th Avenue Ct E Unit 3

- 25701 E E 99th Ave E

- 25611 64th Avenue Ct E Unit 10

- 25707 61st Avenue Ct E

- 10410 260th St E

- 25811 59th Avenue Ct E

- 5804 258th Street Ct E

- 30314 91st Ave E

- 8204 277th St E

- 8208 277th St E

- 8205 277th St E Unit Lot 3

- 8205 277th St E

- 8212 277th St E

- 8209 277th St E Unit Lot 2

- 8209 277th St E

- 8215 277th St E

- 8216 277th St E

- 8220 277th St E

- 27713 79th E Unit Lot23

- 27717 79th Avenue Ct E

- 27713 79th Avenue Ct E

- 27709 79th Avenue Ct E

- 27611 Webster Rd E

- 7903 277th St E

- 27512 Webster Rd E

- 27601 Webster Rd E

- 8312 275th St E

- 27811 80th Ave E