821 Emerald Ct Willowbrook, IL 60527

Estimated Value: $644,000 - $774,000

3

Beds

4

Baths

2,619

Sq Ft

$272/Sq Ft

Est. Value

About This Home

This home is located at 821 Emerald Ct, Willowbrook, IL 60527 and is currently estimated at $713,279, approximately $272 per square foot. 821 Emerald Ct is a home located in DuPage County with nearby schools including Gower West Elementary School, Gower Middle School, and Hinsdale Central High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 23, 2023

Sold by

Gasparac Mary Ann

Bought by

Mary Ann Gasparac Declaration Of Trust

Current Estimated Value

Purchase Details

Closed on

Oct 21, 2020

Sold by

Chicago Title Land Trust

Bought by

Gasparac Phil and Gasparac Mary Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,710

Interest Rate

2.99%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 5, 2000

Sold by

Palos Bank & Trust Company

Bought by

Harris Bank Hinsdale and Trust #L-3102

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Interest Rate

8%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mary Ann Gasparac Declaration Of Trust | -- | -- | |

| Gasparac Phil | -- | Fidelity National Title | |

| Harris Bank Hinsdale | $412,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gasparac Phil | $171,710 | |

| Previous Owner | Harris Bank Hinsdale | $250,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,896 | $201,885 | $75,787 | $126,098 |

| 2023 | $8,491 | $185,590 | $69,670 | $115,920 |

| 2022 | $8,394 | $181,630 | $68,900 | $112,730 |

| 2021 | $8,064 | $179,570 | $68,120 | $111,450 |

| 2020 | $7,955 | $176,010 | $66,770 | $109,240 |

| 2019 | $7,650 | $168,890 | $64,070 | $104,820 |

| 2018 | $7,427 | $169,880 | $63,770 | $106,110 |

| 2017 | $7,353 | $163,470 | $61,360 | $102,110 |

| 2016 | $7,166 | $156,010 | $58,560 | $97,450 |

| 2015 | $7,049 | $146,770 | $55,090 | $91,680 |

| 2014 | $7,790 | $158,430 | $53,560 | $104,870 |

| 2013 | $7,589 | $157,690 | $53,310 | $104,380 |

Source: Public Records

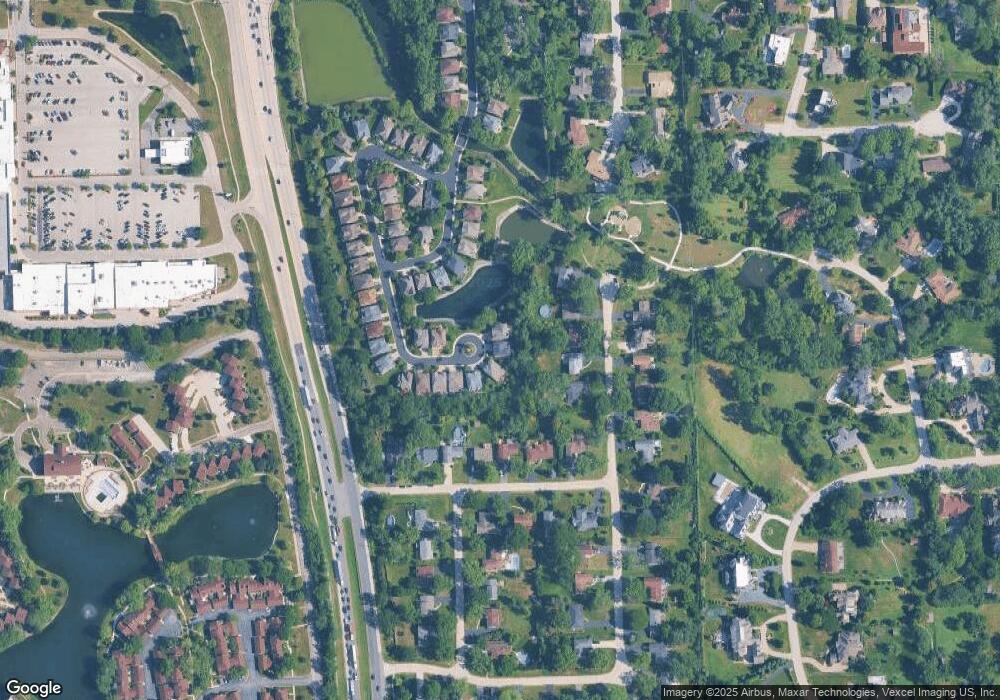

Map

Nearby Homes

- 77 Lake Hinsdale Dr Unit 207

- 520 Ridgemoor Dr

- 354 63rd St

- 101 Lake Hinsdale Dr Unit 205

- 740 67th Place

- 6420 Thurlow St

- 19 Portwine Rd

- 701 Lake Hinsdale Dr Unit 306

- 6340 Americana Dr Unit 904

- 6340 Americana Dr Unit 701

- 601 Lake Hinsdale Dr Unit 101

- 601 Lake Hinsdale Dr Unit 112

- 301 Lake Hinsdale Dr Unit 108

- 301 Lake Hinsdale Dr Unit 404

- 6503 Clarendon Hills Rd

- 200 Brookside Ln Unit A

- 230 Windsor Ln Unit A

- 447 Stratford Ln

- 6648 Weather Hill Dr

- 318 Arabian Cir

- 827 Emerald Ct

- 833 Emerald Ct

- 839 Emerald Ct

- 6436 S Quincy St

- 6444 S Quincy St

- 850 Emerald Ct

- 6426 S Quincy St

- 845 Emerald Ct

- 6450 S Quincy St

- 851 Emerald Ct

- 856 Emerald Ct

- 816 Ridgemoor Dr W

- 6418 S Quincy St

- 824 Ridgemoor Dr W

- 808 Ridgemoor Dr W

- 832 Ridgemoor Dr W

- 857 Emerald Ct

- 6433 Breton Lakes Dr

- 849 Breton Lakes Dr

- 843 Breton Lakes Dr

Your Personal Tour Guide

Ask me questions while you tour the home.