821 SW 10th St Pendleton, OR 97801

Estimated Value: $217,000 - $241,902

2

Beds

1

Bath

942

Sq Ft

$245/Sq Ft

Est. Value

About This Home

This home is located at 821 SW 10th St, Pendleton, OR 97801 and is currently estimated at $230,726, approximately $244 per square foot. 821 SW 10th St is a home located in Umatilla County with nearby schools including Sunridge Middle School, Pendleton High School, and Pendleton Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 7, 2016

Sold by

Talboy Robert Gregg and Talboy Jacque Lynn

Bought by

Chapman Phillip A and Chapman Robert G

Current Estimated Value

Purchase Details

Closed on

Dec 4, 2012

Sold by

Breshers Steven W

Bought by

Talboy Robert Gregg and Talboy Jacque Lynn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$94,627

Interest Rate

3.36%

Mortgage Type

FHA

Purchase Details

Closed on

May 30, 2008

Sold by

Barclay A Jason

Bought by

Breshears Steven W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$98,356

Interest Rate

5.87%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chapman Phillip A | $102,000 | Amerititle | |

| Talboy Robert Gregg | $108,000 | Amerititle | |

| Breshears Steven W | $99,900 | Amerititle |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Talboy Robert Gregg | $94,627 | |

| Previous Owner | Breshears Steven W | $98,356 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2022 | $1,986 | $109,780 | $0 | $0 |

| 2021 | $1,997 | $106,590 | $23,533 | $83,057 |

| 2020 | $1,789 | $95,960 | $21,760 | $74,200 |

| 2018 | $1,738 | $90,460 | $20,510 | $69,950 |

| 2017 | $1,660 | $87,830 | $19,910 | $67,920 |

| 2016 | $1,558 | $85,280 | $19,330 | $65,950 |

| 2015 | $1,551 | $78,050 | $17,690 | $60,360 |

| 2014 | $1,463 | $78,050 | $17,690 | $60,360 |

Source: Public Records

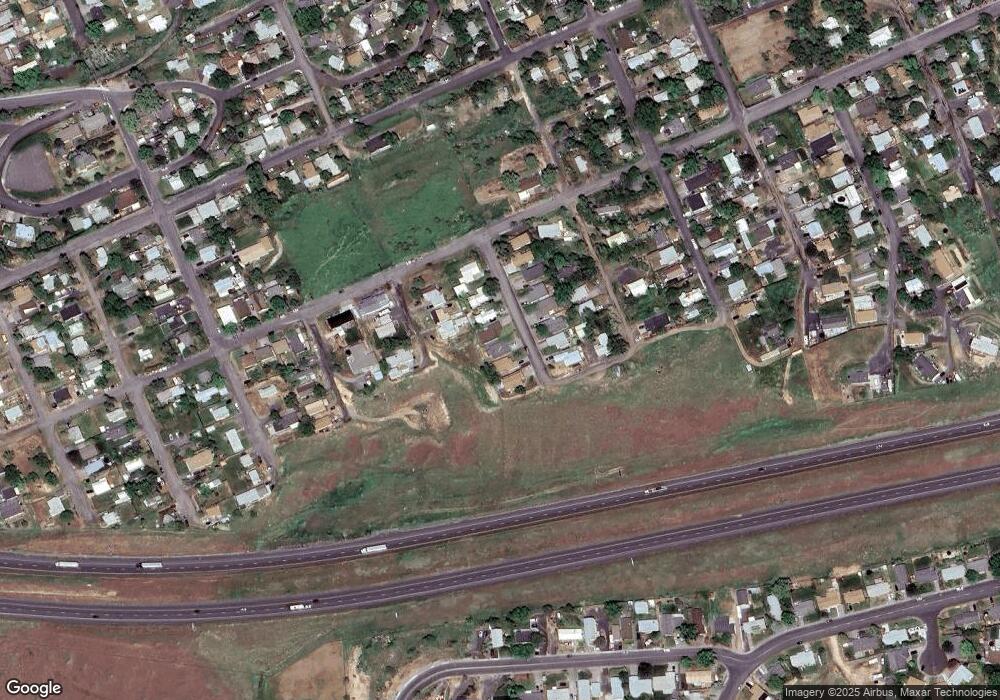

Map

Nearby Homes

- 524 SW 12th St

- 0 SW 9th St

- 514 SW 13th St

- 615 SW 5th St

- 415 SW 7th St

- 606 SW 3rd St

- 611 SW 3rd St

- 0 Tbd Sw 17th St

- 607 SW 2nd St

- 425 SW 17th St

- 606 SW 2nd St

- 1109 SW Nye Ave

- 922 S Main St

- 27 SE Kirk Place

- 3 Tutuilla Rd

- 3 NW 9th St

- 1 SW Tutuilla Creek Rd

- 2 SW Tutuilla Creek Rd

- 401 NW Bailey Ave

- 1003 NW Carden Ave

- 825 SW 10th St

- 817 SW 10th St

- 809 SW 10th St

- 831 SW 10th St

- 814 SW 11th St

- 807 SW 10th St

- 822 SW 10th St

- 826 SW 10th St

- 810 SW 11th St

- 814 SW 10th St

- 828 SW 10th St

- 810 SW 10th St

- 1004 SW Isaac Ave

- 806 SW 10th St

- 819 SW 9th St

- 821 SW 9th St

- 831 SW 9th St

- 809 SW 11th St

- 802 SW 10th St

- 916 SW Isaac Ave

Your Personal Tour Guide

Ask me questions while you tour the home.