8211 Peppervine Ct Conroe, TX 77385

Estimated Value: $327,665 - $385,000

3

Beds

2

Baths

1,902

Sq Ft

$188/Sq Ft

Est. Value

About This Home

This home is located at 8211 Peppervine Ct, Conroe, TX 77385 and is currently estimated at $357,416, approximately $187 per square foot. 8211 Peppervine Ct is a home located in Montgomery County with nearby schools including Suchma Elementary School, Irons J High School, and Oak Ridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 18, 2016

Sold by

Gower Ashley Nicole and Gower James Michael

Bought by

Salazar Manuel A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$189,050

Outstanding Balance

$151,774

Interest Rate

3.42%

Mortgage Type

New Conventional

Estimated Equity

$205,642

Purchase Details

Closed on

Oct 7, 2011

Sold by

Mhi Partnership Ltd

Bought by

Gower Ashley Nicole and Gower James Michael

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$186,491

Interest Rate

4.28%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 6, 2011

Sold by

242 Llc

Bought by

Fmr Holdings Llc

Purchase Details

Closed on

Jun 24, 2011

Sold by

Fmr Land Holdings Llc

Bought by

Mhi Partnership Ltd

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Salazar Manuel A | -- | Fidelity National Title | |

| Gower Ashley Nicole | -- | Mellenium Title Co | |

| Fmr Holdings Llc | -- | None Available | |

| Mhi Partnership Ltd | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Salazar Manuel A | $189,050 | |

| Previous Owner | Gower Ashley Nicole | $186,491 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,227 | $273,553 | $35,468 | $238,085 |

| 2024 | $3,197 | $288,202 | $35,468 | $252,734 |

| 2023 | $3,197 | $278,530 | $35,470 | $265,630 |

| 2022 | $7,271 | $253,210 | $35,470 | $240,570 |

| 2021 | $6,926 | $230,190 | $35,470 | $209,290 |

| 2020 | $6,609 | $209,260 | $35,470 | $173,790 |

| 2019 | $6,755 | $206,940 | $35,470 | $171,470 |

| 2018 | $5,871 | $196,130 | $35,470 | $160,660 |

| 2017 | $6,476 | $196,130 | $35,470 | $160,660 |

| 2016 | $7,088 | $214,670 | $35,470 | $179,200 |

| 2015 | $6,647 | $218,320 | $35,470 | $182,850 |

| 2014 | $6,647 | $202,570 | $35,470 | $167,100 |

Source: Public Records

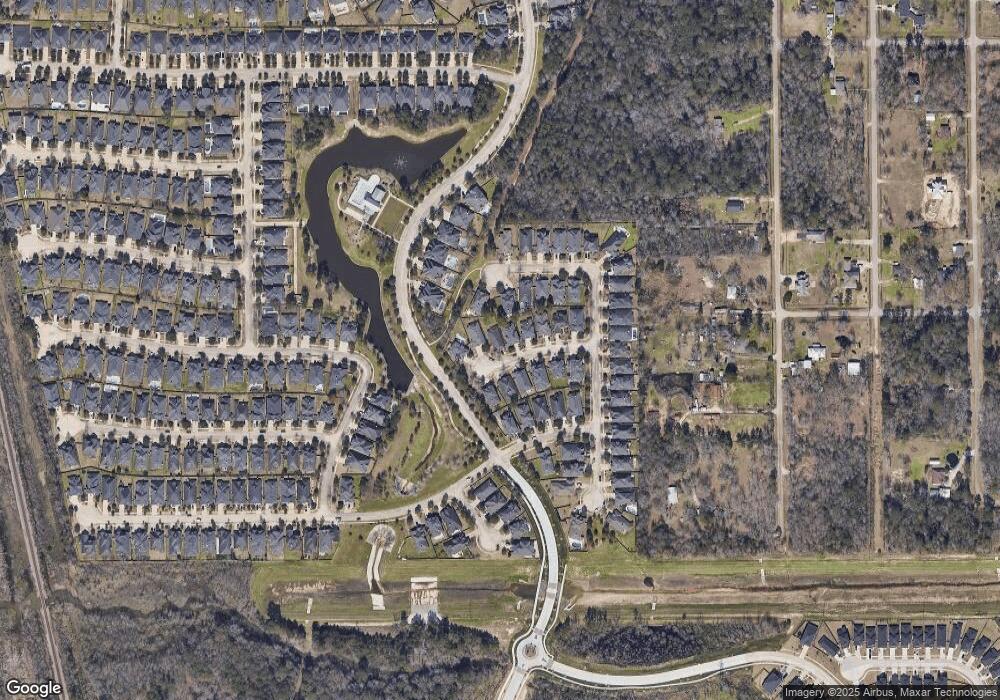

Map

Nearby Homes

- 17254 Rookery Ct

- 8186 Laughing Falcon Trail

- 8231 Horsetail Ct

- 8126 Little Scarlet St

- 8115 Spreadwing St

- 9253 Inland Leather Ln

- 17583 Harper's Way

- 8143 Black Percher St

- 17128 Spindle Oaks Dr

- 17026 Harpers Way

- 8320 Greenleaf Ridge Way

- 9291 Inland Leather Ln

- TBC/ Spindle Oaks

- 17129 Sprawling Oaks Dr

- 17105 Upland Bent Ct

- 9622 Blue Water Hyssop

- 6342 Big Oaks Dr

- 17058 Gleneagle Dr S

- 9863 Swan Ct

- 17610 Rosette Grass Dr

- 8215 Peppervine Ct

- 8207 Peppervine Ct

- 8203 Peppervine Ct

- 8210 Peppervine Ct

- 8219 Peppervine Ct

- 8214 Peppervine Ct

- 8202 Peppervine Ct

- 8218 Peppervine Ct

- 8223 Peppervine Ct

- 8206 Horsetail Ct

- 8210 Horsetail Ct

- 8222 Peppervine Ct

- 8207 Laughing Falcon Trail

- 8227 Peppervine Ct

- 8203 Laughing Falcon Trail

- 8214 Horsetail Ct

- 17207 Harpers Way

- 8215 Laughing Falcon Trail

- 8230 Peppervine Ct

- 8218 Horsetail Ct