823 8th Ln Unit 823 Palm Beach Gardens, FL 33418

Estimated Value: $375,466 - $399,000

2

Beds

3

Baths

1,596

Sq Ft

$245/Sq Ft

Est. Value

About This Home

This home is located at 823 8th Ln Unit 823, Palm Beach Gardens, FL 33418 and is currently estimated at $390,367, approximately $244 per square foot. 823 8th Ln Unit 823 is a home located in Palm Beach County with nearby schools including Timber Trace Elementary School, Watson B. Duncan Middle School, and Palm Beach Gardens Community High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 21, 2024

Sold by

Martin Carl L

Bought by

Vander Waal Cornelius Hugo

Current Estimated Value

Purchase Details

Closed on

Feb 21, 2020

Sold by

Rojas John A

Bought by

Martin Carl L and Martin Linda L

Purchase Details

Closed on

Aug 10, 2015

Sold by

Fannie Mae

Bought by

Rojas John

Purchase Details

Closed on

Jul 11, 2013

Sold by

Thompson Mindy L M

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Aug 27, 1998

Sold by

Harrison Ann T and Harrison Craig S

Bought by

Thompson Mindy L M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,700

Interest Rate

6.92%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vander Waal Cornelius Hugo | -- | None Listed On Document | |

| Martin Carl L | $255,000 | Omnl Title Llc | |

| Rojas John | $157,000 | Attorney | |

| Federal National Mortgage Association | -- | None Available | |

| Thompson Mindy L M | $85,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Thompson Mindy L M | $80,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,419 | $274,878 | -- | -- |

| 2023 | $5,231 | $249,889 | $0 | $0 |

| 2022 | $4,589 | $227,172 | $0 | $0 |

| 2021 | $4,152 | $206,520 | $0 | $206,520 |

| 2020 | $3,945 | $194,520 | $0 | $194,520 |

| 2019 | $3,812 | $185,520 | $0 | $185,520 |

| 2018 | $3,718 | $185,427 | $0 | $185,427 |

| 2017 | $3,490 | $170,427 | $0 | $0 |

| 2016 | $3,370 | $160,427 | $0 | $0 |

| 2015 | $2,911 | $126,970 | $0 | $0 |

| 2014 | $2,577 | $115,427 | $0 | $0 |

Source: Public Records

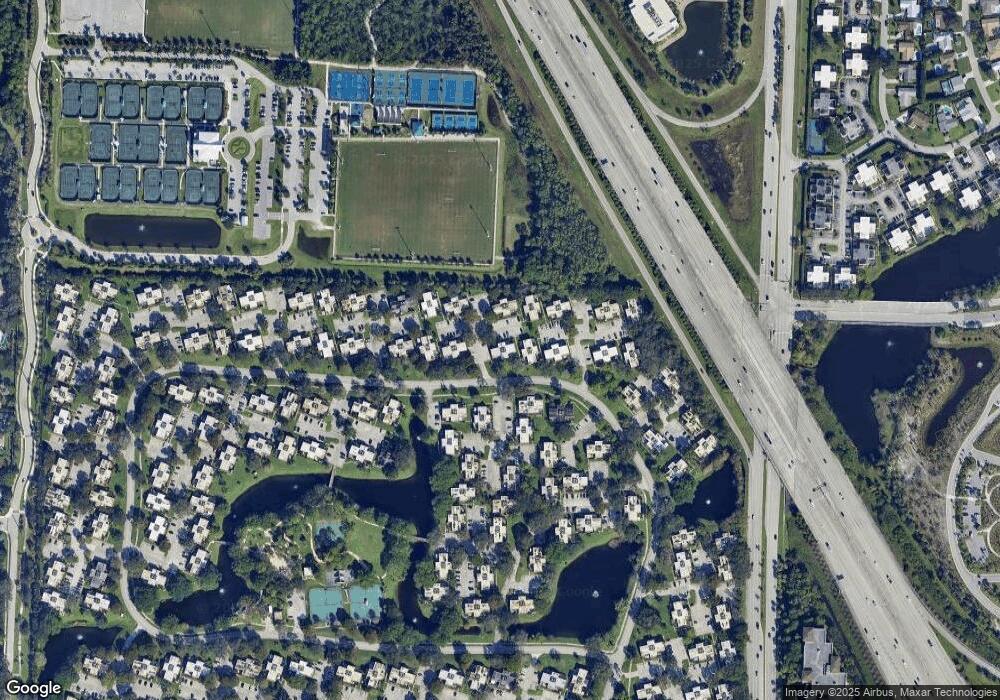

Map

Nearby Homes

- 819 8th Ln

- 730 7th Ln

- 1304 13th Ln

- 1308 13th Ln

- 303 3rd Ln

- 1621 16th Ln

- 1518 15th Ln

- 1715 17th Ln

- 11551 Winchester Dr

- 11554 Winchester Dr

- 1914 19th Ln

- 2256 Quail Ridge N

- 4903 Midtown Ln Unit 3321

- 4903 Midtown Ln Unit 3415

- 4903 Midtown Ln Unit 3404

- 4903 Midtown Ln Unit 3114

- 4903 Midtown Ln Unit 3102

- 4903 Midtown Ln Unit 3110

- 4905 Midtown 2405 Ln Unit 2405

- 4883 Pga Blvd Unit 305