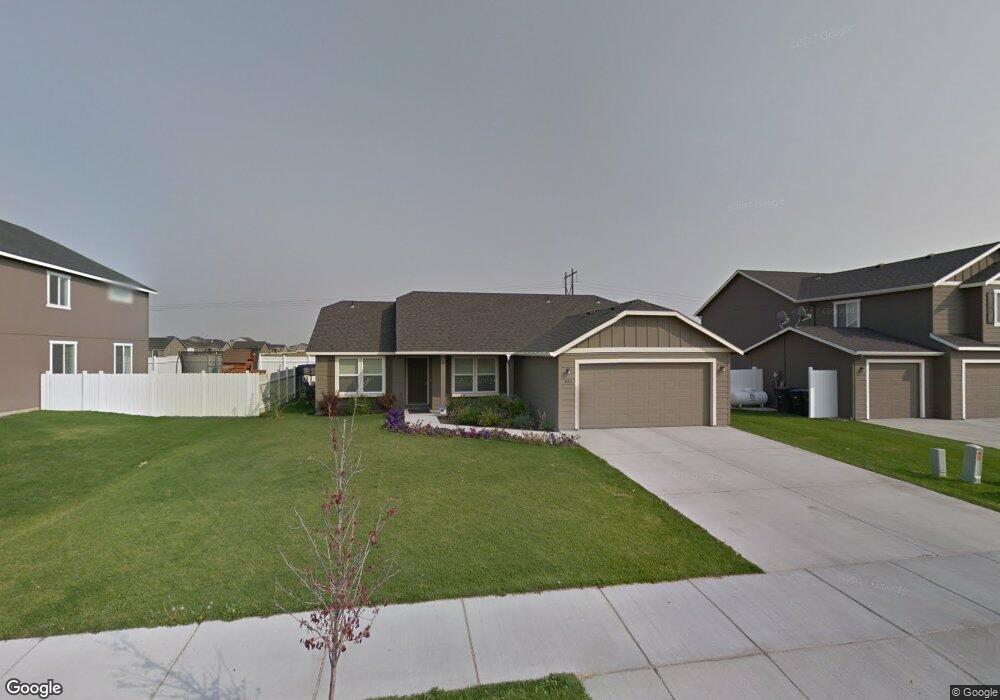

823 S Rees St Moses Lake, WA 98837

Estimated Value: $342,520 - $370,000

3

Beds

2

Baths

1,506

Sq Ft

$240/Sq Ft

Est. Value

About This Home

This home is located at 823 S Rees St, Moses Lake, WA 98837 and is currently estimated at $361,130, approximately $239 per square foot. 823 S Rees St is a home located in Grant County with nearby schools including Lakeview Terrace Elementary School, Columbia Middle School, and Moses Lake High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 28, 2020

Sold by

Friehe Carla

Bought by

Bcw Homes Llc

Current Estimated Value

Purchase Details

Closed on

May 15, 2017

Sold by

Friehe Rainis Katharina

Bought by

Friehe Carla

Purchase Details

Closed on

Jan 11, 2012

Sold by

Bowen Catherine Freda and Bowen Maxon Keene

Bought by

Friehe Katharina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,500

Interest Rate

3.93%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 31, 2008

Sold by

Hayden Homes Llc

Bought by

Junvik Catherine Freda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$147,255

Interest Rate

5.77%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bcw Homes Llc | -- | None Available | |

| Friehe Carla | $154,000 | None Available | |

| Friehe Katharina | $154,000 | Grant County Title | |

| Junvik Catherine Freda | -- | Grant County Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Friehe Katharina | $115,500 | |

| Previous Owner | Junvik Catherine Freda | $147,255 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,445 | $305,370 | $44,500 | $260,870 |

| 2023 | $2,781 | $219,155 | $32,500 | $186,655 |

| 2022 | $2,623 | $219,155 | $32,500 | $186,655 |

| 2021 | $2,404 | $219,155 | $32,500 | $186,655 |

| 2020 | $2,355 | $193,640 | $32,500 | $161,140 |

| 2019 | $2,295 | $168,495 | $30,000 | $138,495 |

| 2018 | $2,549 | $162,005 | $30,000 | $132,005 |

| 2017 | $2,235 | $152,765 | $30,000 | $122,765 |

| 2016 | $2,150 | $146,420 | $30,000 | $116,420 |

| 2013 | -- | $135,835 | $30,000 | $105,835 |

Source: Public Records

Map

Nearby Homes

- 814 S Blessing St

- 736 S Rees St

- 805 S Hamilton Rd

- 732 N Widgeon St

- 720 N Widgeon St

- 716 N Widgeon St

- 724 N Widgeon

- 728 N Widgeon St

- 700 N Widgeon

- 704 N Widgeon

- 712 N Widgeon

- 1346 Greens Loop

- 800 S Hamilton Rd

- 1055 July Ct

- 1059 July Ct

- 1701 E Burr Ave Unit 51

- 1701 E Burr Ave Unit 67

- 1701 E Burr Ave Unit 12

- 1042 S Lakeland Dr

- 1346 E Oasis Cir