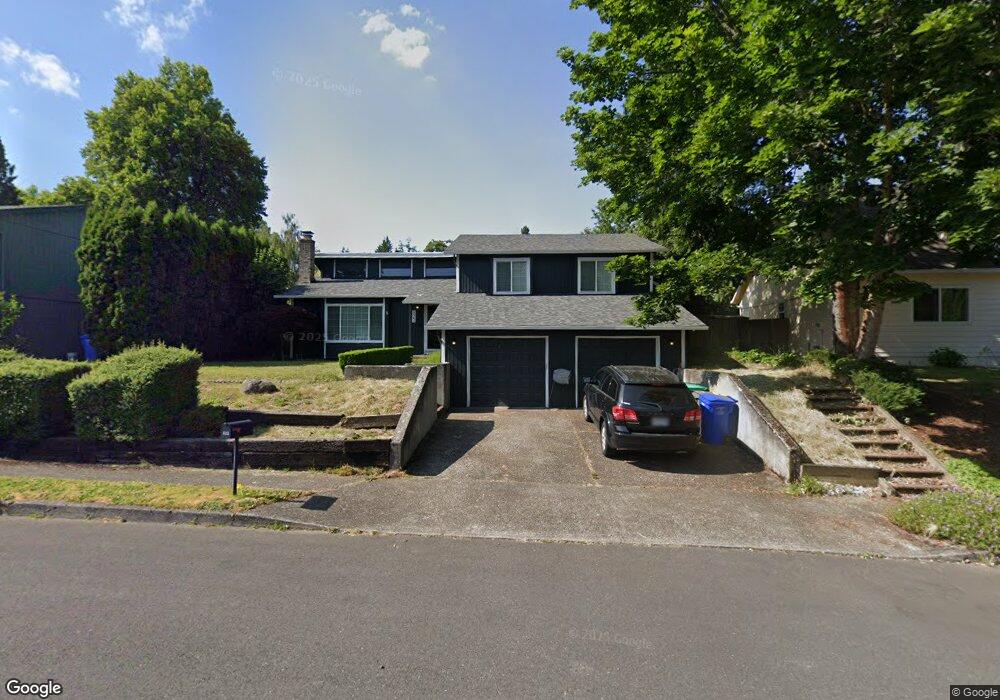

823 SE 8th St Gresham, OR 97080

Historic Southeast NeighborhoodEstimated Value: $496,000 - $549,000

3

Beds

3

Baths

2,131

Sq Ft

$241/Sq Ft

Est. Value

About This Home

This home is located at 823 SE 8th St, Gresham, OR 97080 and is currently estimated at $512,525, approximately $240 per square foot. 823 SE 8th St is a home located in Multnomah County with nearby schools including East Gresham Elementary School, Dexter McCarty Middle School, and Gresham High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 29, 2016

Sold by

Abernathy Grady D

Bought by

Johnston Betnanne R and Johnston Justin S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$314,204

Outstanding Balance

$248,774

Interest Rate

3.66%

Mortgage Type

FHA

Estimated Equity

$263,751

Purchase Details

Closed on

Dec 16, 1999

Sold by

Pate Amy L

Bought by

Abernathy Grady D and Abernathy Diana R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$148,400

Interest Rate

7.69%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 25, 1997

Sold by

Haugen Steven

Bought by

Haugen Amy

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Johnston Betnanne R | $320,000 | First American | |

| Abernathy Grady D | $164,900 | First American Title Co | |

| Haugen Amy | -- | Fidelity National Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Johnston Betnanne R | $314,204 | |

| Previous Owner | Abernathy Grady D | $148,400 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,343 | $262,560 | -- | -- |

| 2024 | $5,115 | $254,920 | -- | -- |

| 2023 | $4,660 | $247,500 | $0 | $0 |

| 2022 | $4,530 | $240,300 | $0 | $0 |

| 2021 | $4,416 | $233,310 | $0 | $0 |

| 2020 | $4,155 | $226,520 | $0 | $0 |

| 2019 | $4,046 | $219,930 | $0 | $0 |

| 2018 | $3,858 | $213,530 | $0 | $0 |

| 2017 | $3,702 | $207,320 | $0 | $0 |

| 2016 | $3,264 | $201,290 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 420 SE Linden Ave

- 417 SE Roberts Ave

- 511 SE 15th St

- 1495 SE Evelyn Ct

- 625 SW Miller Ct

- 4733 SE 2nd St

- 4667 SE 2nd St

- 55 SW Lovhar Dr

- 1407 SE Beech Place

- 955 SE Hogan Rd

- 450 SE Hogan Rd

- 0 SW Miller Ct Unit 470855683

- 1949 SE Palmquist Rd Unit 51

- 1949 SE Palmquist Rd Unit 91

- 1949 SE Palmquist Rd Unit 7

- 1949 SE Palmquist Rd Unit 121

- 1691 SE Cedar Creek Place

- 318 NE Roberts Ave Unit 308

- 491 NE Elliott Ave

- 1918 SE Regner Rd

Your Personal Tour Guide

Ask me questions while you tour the home.