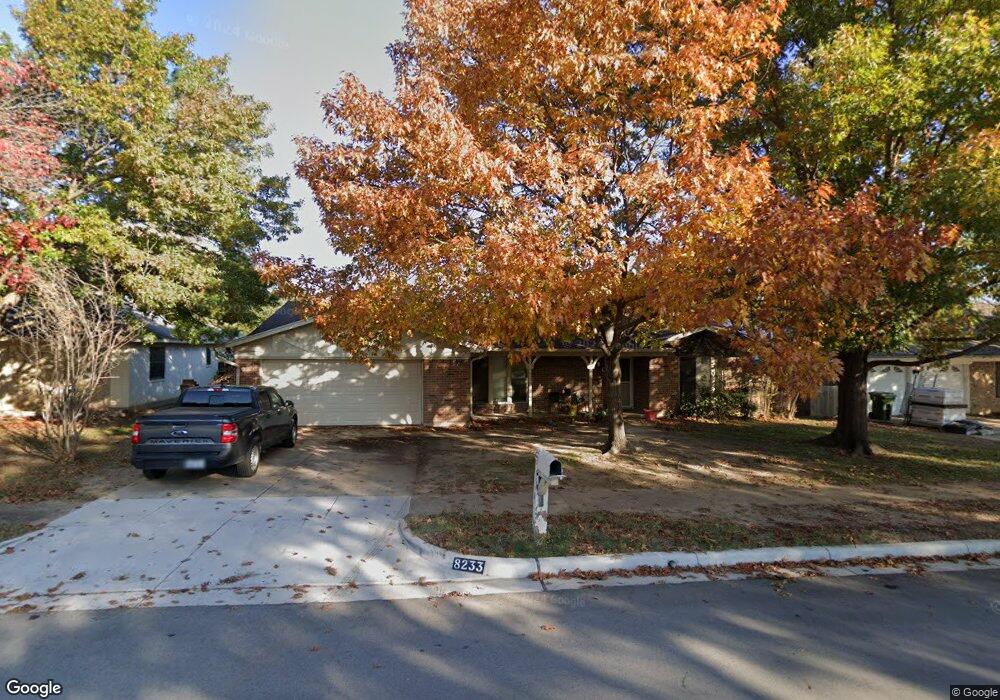

8233 Pearl St North Richland Hills, TX 76180

Estimated Value: $324,745 - $371,000

3

Beds

2

Baths

1,653

Sq Ft

$209/Sq Ft

Est. Value

About This Home

This home is located at 8233 Pearl St, North Richland Hills, TX 76180 and is currently estimated at $344,686, approximately $208 per square foot. 8233 Pearl St is a home located in Tarrant County with nearby schools including Walker Creek Elementary School, Smithfield Middle School, and Birdville High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 17, 2014

Sold by

Nunley Charles Richardson and Riggs Jessica Ann

Bought by

Franklin April D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,329

Outstanding Balance

$107,463

Interest Rate

4.5%

Mortgage Type

FHA

Estimated Equity

$237,223

Purchase Details

Closed on

Aug 29, 2011

Sold by

Zaborac Robyn Matthew and Zaborac Nancy Lee

Bought by

Nunley Charles Richardson and Riggs Jessica Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$122,000

Interest Rate

4.54%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Franklin April D | -- | None Available | |

| Nunley Charles Richardson | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Franklin April D | $139,329 | |

| Previous Owner | Nunley Charles Richardson | $122,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,274 | $243,050 | $60,000 | $183,050 |

| 2024 | $5,274 | $243,050 | $60,000 | $183,050 |

| 2023 | $5,171 | $235,715 | $60,000 | $175,715 |

| 2022 | $4,953 | $205,816 | $35,000 | $170,816 |

| 2021 | $4,377 | $172,022 | $35,000 | $137,022 |

| 2020 | $5,228 | $205,476 | $35,000 | $170,476 |

| 2019 | $5,447 | $206,851 | $35,000 | $171,851 |

| 2018 | $5,009 | $190,208 | $35,000 | $155,208 |

| 2017 | $4,828 | $179,453 | $35,000 | $144,453 |

| 2016 | $4,117 | $153,012 | $15,000 | $138,012 |

| 2015 | $2,571 | $95,700 | $15,000 | $80,700 |

| 2014 | $2,571 | $95,700 | $15,000 | $80,700 |

Source: Public Records

Map

Nearby Homes

- 6250 Shirley Dr

- 6113 Cliffbrook Dr

- 8057 Caladium Dr

- 0 Mid Cities Blvd

- 8240 Bridge St

- 8321 Bridge St

- 6137 Marquita Mews

- 8020 Bridge St

- 6116 Morningside Dr

- 6017 Avalon St

- 8740 Ice House Dr

- 8748 Morris Mews

- 8409 Main St

- 6008 Monterey Mews

- 8765 Bridge St

- 7800 Mockingbird Ln Unit 29

- 7800 Mockingbird Ln Unit 81

- 7800 Mockingbird Ln Unit 73

- 7800 Mockingbird Ln Unit 43

- 7800 Mockingbird Ln Unit 205